Hi everyone!

Today’s Spot Markets live session is with Marc Ostwald, Chief Economist and Global Strategist at ADM Investor Services International, previously of Monument Securities. Marc is a fixed income specialist, who conducts his consensus-challenging forecasting and analysis of macro and microeconomic trends and central bank policies on a broad range of asset classes.

Comments from Izabella and Marc that address audience questions have been put in bold.

Spot Markets Live – 27/06/22

Izabella Kaminska11:58

Izabella Kaminska11:58Hello everyone

Is there anybody there

It’s like a seance.

Oh great hello, we have our first watcher

Hello and welcome to Spot Markets Live, the real-time markets chat that takes you on a whirlwind tour of the markets. Happening every Monday at 11 for now, with a limited controlled live audience until we get the tech up to scratch.

But, soon enough, we will roll things out further.

Those reading this, if you fancy a login to help us expand the test over the weeks to come please email [email protected].

Today, I’m joined by Marc Ostwald from ADM Investor services, previously of Monument Securities. Marc is a fixed income specialist, who has been watching the market for longer than most crypto traders have been able to read. So it’s very fortunate to have him on the day that Russia is defaulting.

Hello Marc!

Hi, good to join you and happy Monday

Izabella Kaminska 12:00

Izabella Kaminska 12:00Nice to have you here

Marc may end up doing the heavy lifting today as I am still recovering from a Polish wedding at the weekend. Ha!

The big news today of course is the Russian default. Does it matter? Was it priced in? Is it LTCM all over again?

I don’t know! But it’s a shame the new stuff isn’t as ornate as the old defaulted stuff which is still trading in the vintage market. You can get your hands on one of these for about $300.

But before we get to the repercussions, let’s have a look at how the markets are taking the news more broadly. Seemingly well.

It’s an up day for the FTSE today.

Rolls Royce is leading the pack on the FTSE, followed by the miners. Aberdeen Asset Management and Ocado are the laggards

But before I get to the weekend news, Marc what has caught your eye? Other than the Russian default.

more countries dealing with power crises … France calling for restraint from consumers, Japan facing power rationing, Peruvian truckers striking due to high diesel prices….

Izabella Kaminska12:04

Izabella Kaminska12:04Yeah looks like the power story is really gearing up. Sri Lanka is also on its last legs.

The expectation is that this will create a demand destruction effect eventually, but I keep hearing from commodity guys that this is quite different to a conventional recession. Because if the thing that is causing the demand destruction is the commodity shortage, the substitution effects don’t necessarily move too much demand away from the commodities.

This is especially the case with power.

How on earth can the government seriously ration it?

Especially nowadays when we all have fridge freezers.

France’s situation is going to be very telling.

- French energy giants urge consumers to cut energy use

French Finance Minister Le Maire backs calls for consumers to cut energy use

Izabella Kaminska 12:07

Izabella Kaminska 12:07Yeah this is the big story in France today

I can offer some insight as my dirty secret is that I am in France.

Currently, the power is still on.

Here’s the Telegraph on what’s going on:

France’s top three energy suppliers have called households and businesses to prepare to ration electricity and gas as Russia’s invasion of Ukraine fuels fears of shortages this winter.

In an unusual intervention, the bosses of Engie, EDF and TotalEnergies, appealed to French households and businesses to limit consumption of energy, electricity, gas and oil products.

Catherine MacGregor, chief executive of Engie; Jean-Bernard Lévy, who heads up EDF; and Patrick Pouyanné, chairman of TotalEnergies; made the plea in French newspaper Le Journal du Dimanche.

The miners are down no doubt on news copper prices have hit new lows.

“Copper prices hit 16-month lows on Thursday as traders dumped the metal. They’ve dropped more than 11% in two weeks.

The metal is used in many construction materials, including electrical wires and water pipes. That means it’s often viewed as a proxy for economic activity, since demand tends to heat up when the economy is expanding and cool when it’s contracting. It’s affectionately referred to as “Dr. Copper” among traders because of its alleged talent for prognostication.

Russia accounts for 4% of global copper output and almost 7% of nickel output, according to S&P Global. Traders were nervous that supply could run short just as the economic recovery from the pandemic was ramping up, and they started hoarding aggressively.

“Once that stockpiling impulse ended, then global commodity demand started to reconnect with global growth,” Ghali said.”

But now for what we have been waiting for

Marc, what’s your take on the Russian default then?

Does the default make much difference? Yes, from the aspect that this is a default forced on Russia due to sanctions as a result of its invasion of Ukraine, and that is unprecedented. It’s long been priced with Russia’s debt trading at 20 cents in the dollar for the past 3 months. Will bondholders rush to a resolution of the default? Highly unlikely, the claims remain valid for 3 years, and they will wait to see if sanctions get loosened or lifted.

Izabella Kaminska 12:10

Izabella Kaminska 12:10So does that mean in a weird way we are in new territory in the bond precedent-setting world?

Certainly, forced default when an entity can pay has not been seen before, and it seems this is another part of a fracturing global payments system

Izabella Kaminska 12:11

Izabella Kaminska 12:11Newsflash from Japan: Japan urges 37m people to switch off lights.

(we’ll get back to that)

The fracturing payments system is one of our areas of interest here at the Blind Spot.

I sense that the core market still is in a bit of denial about what this means for global markets.

What do you think?

Definitely in denial…. not recognizing that it impairs liquidity, trade finance availability, and in the long run, questions US dollar hegemony, and encourages more barter trade

Izabella Kaminska 12:14

Izabella Kaminska 12:14Yeah, i agree. And I don’t personally think the ECB is going to be able to keep it together in this context.

What do you think the Japanese energy shortages are going to mean for Japanese rates and bonds?

Because obviously, the funding trade is still on for now.

And a lot of market entities that would otherwise suffer from higher rates, have gone into the swap market to get take advantage of the discrepancy.

I kind of feel, personally, that the prospect of the return of heavily positive Japanese rates is the widowmaker of them all – if it were to happen.

But am I being over the top?

The BoJ will argue that Japanese inflation is still all about energy and that this won’t last. Markets may think it is time to test the BoJ 10-yr JGB yield target….. as you say a long established widowmaker, but pressure on the JPY may be a different story

A weak JPY n the long run is much more of a challenge…

Izabella Kaminska 12:18

Izabella Kaminska 12:18Also, given the fractured payment system, how is that going to impact japan given its position as a major provider of dollar liquidity?

That is a big aspect as Japan provides much of the dollar credit in Asia, above all for trade finance

Izabella Kaminska 12:19

Izabella Kaminska 12:19@RF saying there is still no substitute for the dollar. Which is the usual reassurance narrative. But I still think this underestimates fragmentation.

There might not be a substitute. We just go to a multipolar world, which is generally less liquid and less efficient at matching and supporting international trade.

If international trade is all about competitive advantage and division of labour, that just means more onshoring, and a return to varying standards in international trade.

It also begs the question is all those trillions of FX reserves accumulated since 1997/98, what’s the point if they are not needed for trade?

Izabella Kaminska 12:21

Izabella Kaminska 12:21Yes, this is the big “float” question.

Ironically also where the whole thing intersects with our recent learnings from crypto implosions.

I had a small thread about this matter on Twitter this morning that has generated some interest.

and if the FX reserves are not needed, then all the USD bonds are not needed either.

It applies also to EUR debt, as the second biggest reserve currency.

It makes the Japanese look very smart in actively discouraging other central banks from holding JPY as a major part of their reserves.

Izabella Kaminska 12:25

Izabella Kaminska 12:25Yes, this is the key point. And what I was trying to explain last week about how the move to the euro itself created an existential crisis for all the dollars that were floating about in the system operating as a bridging currency. When the euro was born, this float suddenly became less needed. And the result was a dollar bid that went looking for other low-risk stuff to fund — potentially fuelling the subprime debacle.

Renaissance-era trade norms should be coined as an official term

ha

FYI that was my tweet

The other thing it does is create even more fracturing of commodity pricing, above and beyond the regional differences that have always existed (best seen in NatGas prices over the past year).

Izabella Kaminska 12:27

Izabella Kaminska 12:27yes – definitely.

(regarding state-backed hacker groups being the new privateers)

I also think people underestimate the way hackers are the direct competition for taxing authorities. It’s the way the market has always kind of had to deal with either being (from the libertarian standpoint) pressed by the government for tax or by some alternative local mafia.

Hackers are just another rent-extracting element we now have to deal with, it’s just they use their own currency of choice — i.e. crypto.

And that creates the same underlying demand for the currency as tax does for fiat.

Because if you have to get your hands on bitcoin to pay a hacker ransom, the hacks are de facto supporting the price of bitcoin.

And perhaps it was always so.

But moving back to immediate matters.

what’s going to happen to the holders of Russian debt at this stage?

For the time being, they just sit and wait, and waive income, but the key point is Russia does not have a lot of external debt

Izabella Kaminska 12:30

Izabella Kaminska 12:30So the contagion will likely be low then?

it’s not a Greece situation

low contagion effect, until risk premia adjust for the fact that seizing or blocking assets is the new normal

Izabella Kaminska 12:31

Izabella Kaminska 12:31that is a good point.

not good news for EM commodity exports

Izabella Kaminska 12:32

Izabella Kaminska 12:32And isn’t this the point that Putin himself is leveraging in his domestic propaganda?

That the liberal west can no longer be relied on? So a default on their side is kind of meaningless?

and per se trying to force the issue for EM, southern hemisphere, who they want to go with, NATo/G7 or SCO (Shanghai Cooperation Organization) … and whether the IME/World bank institutions have benefitted or harmed then

Izabella Kaminska 12:35

Izabella Kaminska 12:35Interesting times for the IMF

mm… Since you are a bond watcher, Marc, what other more esoteric markets or sovereigns are worth watching — currently underappreciated by the market?

Which sovereigns to keep an eye on other than Russia basically?

EU / eurozone fragmentation does get into the spotlight, but the bigger issue is EU is so dependent on external trade (above all Germany and Italy) , that if the rest of the world (excluding North America) gets itself organized into a different trade bloc, where does that leave the EU?

Izabella Kaminska 12:39

Izabella Kaminska 12:39I guess the really “out there” risk is US bond fragmentation (especially in the aftermath of Roe vs Wade). I mean I’m not usually a buyer of the idea that there will be a civil war split in the US… but I do wonder if the latest could put even more tension on US cohesion. And if there will be some sort of bond buyer ESG strike on local state debt in pro-life states.

Yes – and regarding marc’s point, the question is how much does Asia really need the EU?

Meanwhile, marc is the unofficial informant on all matters “coming up” in finance in the City. What are the big things to watch this week in your opinion?

Any big macro news?

ECB Sintra Forum, (the equivalent of Fed Jackson Hole meeting) – how much humble pie will central bankers eat on getting their economy and inflation outlook so wrong?

Izabella Kaminska 12:42

Izabella Kaminska 12:42Ah ha. And do we expect any more insight into this “antifragmentation instrument”?

it’s still a mystery, right?

good question, ECB seems to be counting on saying its there as a toll, but hoping that it never gets used like OMT was never used – that’s a big gamble

Izabella Kaminska 12:43

Izabella Kaminska 12:43yeah, it’s all about the messaging.

@RF- that is in many ways, not an option, the RBA’s QE programme was relatively small, and only started due to the pandemic, the BoJ’s balance sheet is >100% of Japan’s GDP

and obviously >20 years old

Izabella Kaminska 12:46

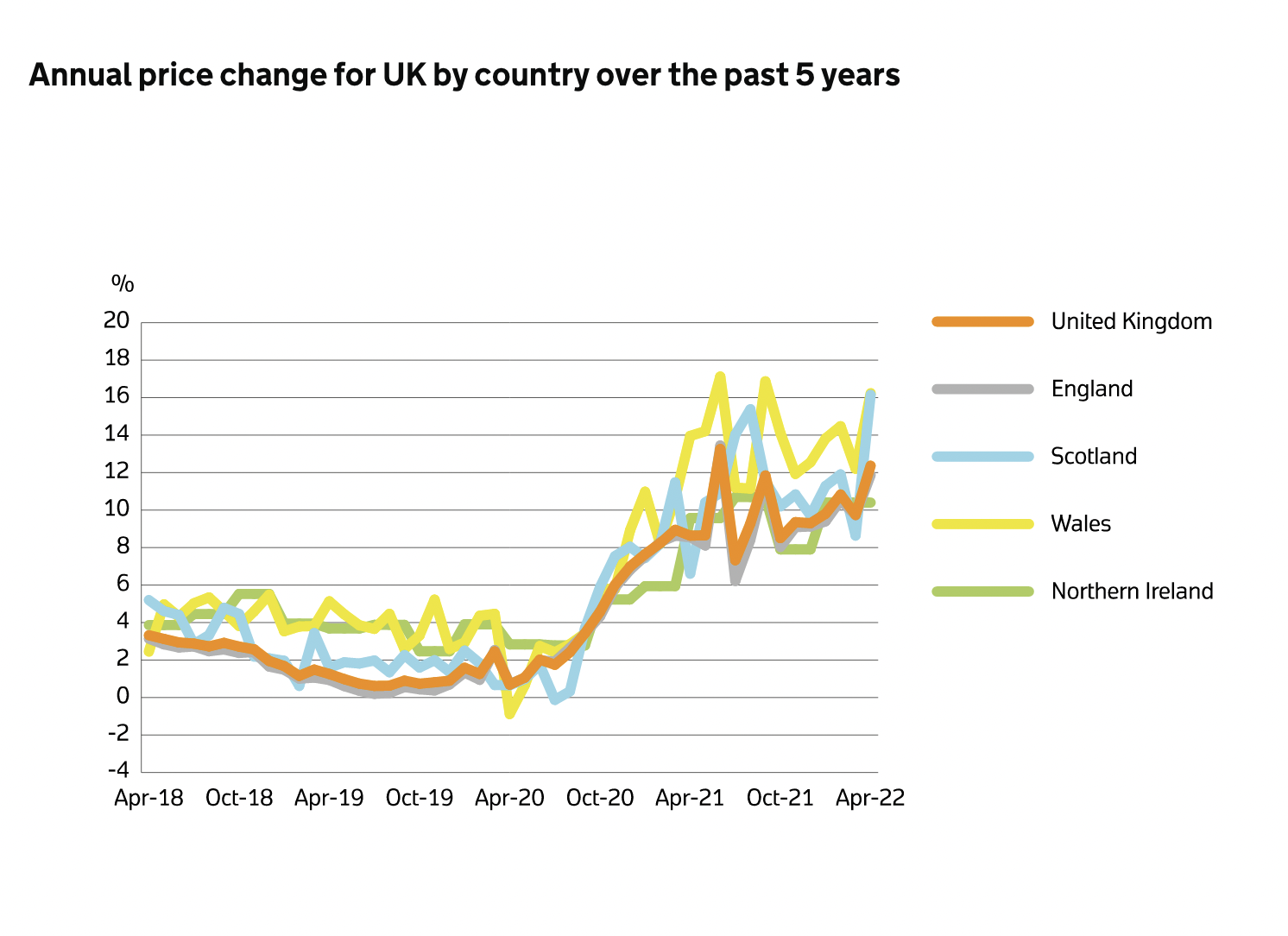

Izabella Kaminska 12:46On UK housing, and housing in general. I mean this is the big question of our time. Have we learnt from 2008? Will the mortgage sector be resilient?

the big gains from Covid and people leaving urban centres are still in play JUST.

I’m not an expert here but so much of the recent action seems to me focused on regional WFH arbitrage.

If the BoJ hold is broken, then the sad conclusion is a debt jubilee may well be the result

Izabella Kaminska 12:47

Izabella Kaminska 12:47oooh – that’s interesting.

Does that basically invite overt nationalisation of assets do you think? A debt jubilee? How does it impact pension funds and all the asset owners?

Surely that makes a contingent liability of the state?

it certainly does, and that applies globally, but the world’s debt mountain and the huge unfunded social security and pensions of most western countries are a topic that keeps on getting swept under the carpet by generations of politicians everywhere

Izabella Kaminska 12:51

Izabella Kaminska 12:51This is a great question though. Because those gunning for debt forgiveness neglect that the debt supports a helluva lot of the no longer in the workforce population. And if payments to them freeze because of a debt jubilee, it seems to me that there is no other way around it but to have the state fund these liabilities through the acquisition of productive assets.

I know this sounds dystopic, but the alternative is basically having to share the income from younger generations, either directly where the young people bail out the old people. or indirectly. A lot of that can be managed, I reckon, through a housing ownership transfer in some shape or form.

but perhaps I’m being a bit naive – It’s a real problem.

I’ve totally taken my eye off the GSEs (freddies and fannies). But it’s worth checking in on that

GSEs are a huge problem, and the fact that US 30-yr mortgage rates have skyrocketed from 3.20% a year ago to 5.82% (way more than Treasuries) says the market is aware of this, especially due to Fed balance sheet reduction

12:57Congress has put re-privatization on the back burner for a long time, doubtless recognizing that this is a Gourdian type knot

take state support away (especially in rising rates environment) and the housing market could crumble in the US

Izabella Kaminska 12:58

Izabella Kaminska 12:58Yeah. Indeed.

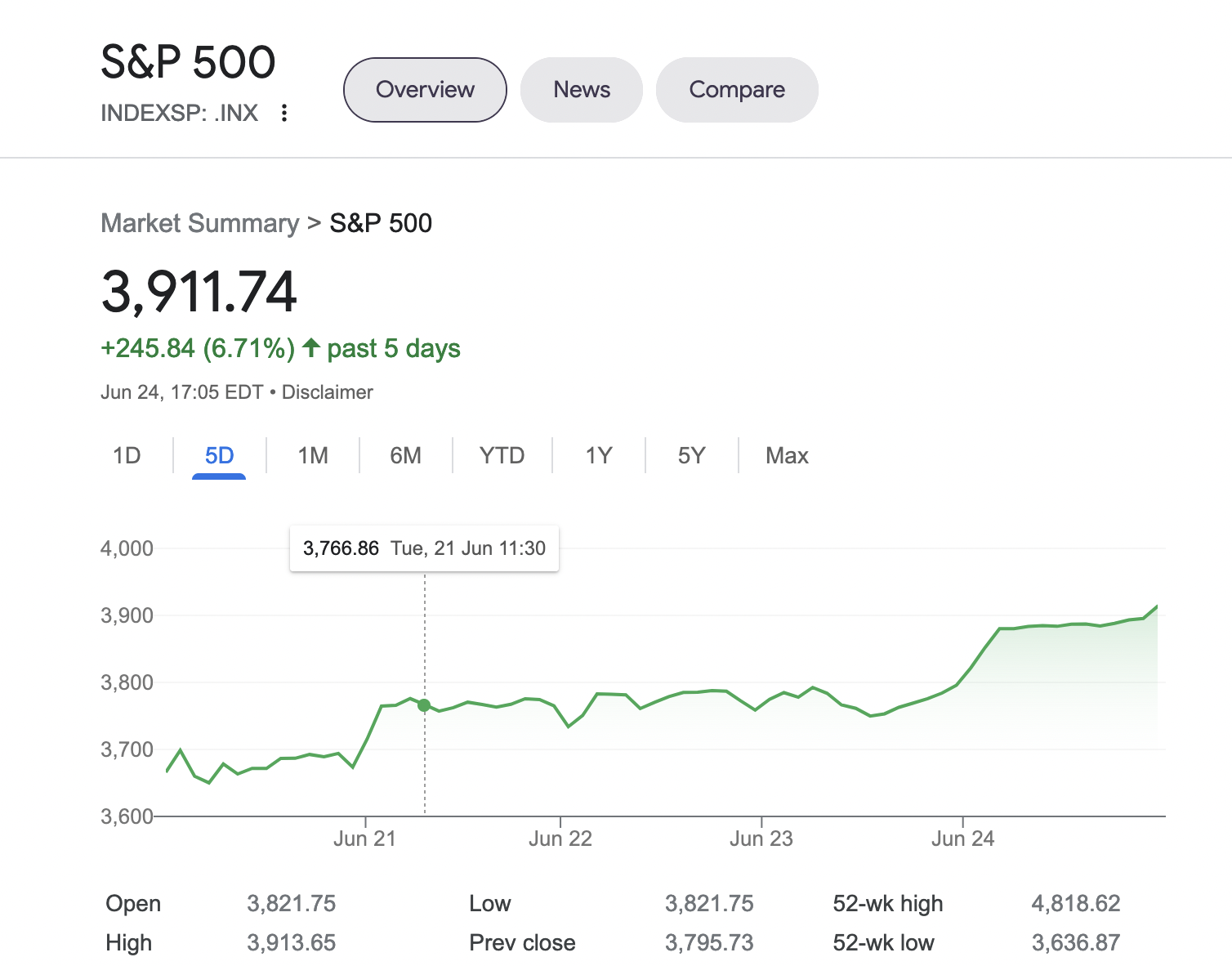

We’ve got five more minutes. It’s worth clocking what happened on Friday. There was a big market meltup.

go figure

End of quarter rebalancing effects, just as we had at end of Q1, but false dawn for risk appetite, just the power flow of money as funds are sitting on mountains of cash.

Izabella Kaminska 12:59

Izabella Kaminska 12:59VIX price spiked from 28.3 to 29.72 in one minute, froze for 4 minutes, and crashed the rest of the day until just before close.

Yeah, the old window dressing malarky right?

yes

Izabella Kaminska 13:00

Izabella Kaminska 13:00And this has an unintended consequence on vol.

One last point to get in here.

There were some quarterly results from electric vehicle makers.

“Quarterly results for the number of electric vehicles built and handed to Tesla customers will be released in roughly a week – considering the shutting of the company’s Shanghai plant for weeks, Tesla’s job cuts including workers who’d joined the country earlier, and his description of the new factories opening near Berlin and Austin as ‘gigantic money furnaces’. Days after the last comments, Reuters reported Musk had sent the email wanting to cut 10% of employees. Doesn’t exactly inspire confidence.”

The Elon comment about how tesla’s factories are just capital-burning furnaces is very interesting and strangely transparent.

but has been flagged by logistic indices and prices, do follow Craig Fuller at Freightwaves and Lars Jensen on Shipping

Izabella Kaminska13:02

Izabella Kaminska13:02Oh, good tips. Reminds me to go check in on that sector.

anyway, on that note it’s 12.02… and I have to get myself back to a more stable electricity supply.

Marc thank you so much for joining us. We will be posting this transcript on the main website. And do now spread the word. We are looking to increase the audience. And also do provide feedback etc.

thanks for having me…. was great fun!

Izabella Kaminska13:04

Izabella Kaminska13:04Last and not least, I will be posting rabble comments this time around. I will use acronyms for the names though for privacy purposes.

Thanks again and bye-bye everyone!

One Response