Anjuli Davies10:59

Anjuli Davies10:59Good morning all !

FRANCES COPPOLA10:59

FRANCES COPPOLA10:59Morning everyone

Ben Harrington10:59

Ben Harrington10:59Morning!

Good to be back on ML

Anjuli Davies10:59

Anjuli Davies10:59Very excited to be joined today by both Ben Harrington and Frances Coppola

I’m four coffees in already

Anjuli Davies11:00

Anjuli Davies11:00Can find Ben at www.betaville.co.uk (quick shoutout)

So…dare I ask, where do we start?

Only had one coffee this morning – coconut milk Cappuccino

Yeah but my day started at 4.45 this morning

How come Frances?

Anjuli Davies11:00

Anjuli Davies11:00

FRANCES COPPOLA11:01

FRANCES COPPOLA11:01I was on Wake Up to Money at 5.05

@Frances – ah I see …

talking about?

FRANCES COPPOLA11:01

FRANCES COPPOLA11:01Credit Suisse

Ben Harrington11:02

Ben Harrington11:02@Frances – yes this seems to be the main story of the weekend

FRANCES COPPOLA11:02

FRANCES COPPOLA11:02“Is there going to be a 2008-style crisis”

Ben Harrington11:02

Ben Harrington11:02What do you think Frances?

FRANCES COPPOLA11:03

FRANCES COPPOLA11:03I don’t think so. Lehman was a disorderly collapse not an orderly resolution

But the AT1 thing is going to cause some ripples

(Just for the few people who aren’t reading newspapers / wires all weekend – UBS bought Credit Suisse in takeunder Swiss government-backed bail out)

Anjuli Davies11:04

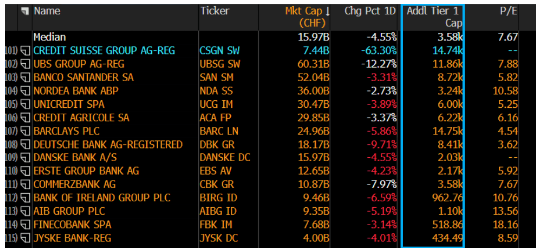

Anjuli Davies11:04

11:04

11:04that’s from: AndreasStenoLarsen

·

Which banks have large AT1 issuances? Barclays, Santander and Deutsche worth mentioning.

Ben Harrington11:04

Ben Harrington11:04(FT led the reporting of the UBS takeover talks with a series of top exclusives)

FRANCES COPPOLA11:04

FRANCES COPPOLA11:04Ok so what went wrong at CS?

I think it was all about credibility

@Frances – wasn’t it the culmination all the screw ups over the last few years? Greensill, Mozambique etc

Anjuli Davies11:06

Anjuli Davies11:06On AT1s fine print

Third, AT1 coupons can be halted by regulators. Under a rule known as the Maximum Distributable Amount, or MDA, regulators can restrict a bank’s distributions (including AT1 coupons) if its CET1 capital ratio falls below a certain level, although just as with AT1 trigger levels, European banks generally maintain large buffers above the individual MDA thresholds they are given. Regulators can also halt distributions to trap capital in the banking system as a prudential measure in times of stress or when losses are building up. However, history has shown regulators prefer to halt other distributions such as share dividends and bonus pools before they resort to halting AT1 coupons, just as they did in response to the COVID crisis in 2020.

What is the Point of Non-Viability?

There is another important regulatory element investors need to consider, which is that a bank’s solvency is ultimately at the discretion of its national regulator (or the European Central Bank for EU banks). If a bank runs into serious trouble, regulators can declare a Point of Non-Viability to try to protect depositors, stem the losses and prevent contagion.

We have seen that European banks generally have CET1 ratios in the mid-teens; we think it is highly unlikely any regulator would let a bad situation carry on long enough for a bank’s CET1 ratio to fall to 7%, let alone 5.125%, so in practice it is likely that a bank’s Point of Non-Viability would occur with capital levels higher than the trigger levels embedded into AT1 securities. This is why it is important for investors to pay attention to the individual capital requirements set by national regulators for each bank, and to scrutinise annual stress tests very carefully.

FRANCES COPPOLA11:07

FRANCES COPPOLA11:07So the regulator can simply opt to wipe AT1s. And FINMA has opted to do exactly that.

Presumably there will now be a repricing of AT1s as a class, with negative effects on bank capitalization.

Anjuli Davies11:08

Anjuli Davies11:08Everyone on Twitter has now become an expert on AT1s

Ben Harrington11:08

Ben Harrington11:08US-based Signature Bank has just been sold to the New York Community Bank

on the tape

(on Friday Bill Ackman of Pershing Square was touting about rumours Bank of America were about to buy Signature Bank).

FRANCES COPPOLA11:10

FRANCES COPPOLA11:10There’s been chatter in crypto circles that Signature Bank was sound and it was seized by regulators as part of a nefarious plot to cut crypto off from dollars

Ben Harrington11:10

Ben Harrington11:10@interesting

FRANCES COPPOLA11:10

FRANCES COPPOLA11:10NYCB has only bought a third of the assets and has refused to take on crypto-related deposits

Ben Harrington11:10

Ben Harrington11:10Sorry meant @Frances – interesting!

Anjuli Davies11:10

Anjuli Davies11:10For those who have missed Izzy’s take :

|

So, was this a failure of regulation?

FRANCES COPPOLA11:11

FRANCES COPPOLA11:11I’d say AT1 investors should read the term sheet

Anjuli Davies11:12

Anjuli Davies11:12It seems absurd, also given the Sunday trading that happened yesterday – was this a bunch of clueless traders?

11:13But given the shock, and the knock-on effect for other banks , how could the regulators not forsee this

Ben Harrington11:14

Ben Harrington11:14(Some interesting lines to come out the FT coverage of the Credit Suisse situation was around BlackRock, who clearly were sniffing around CS. Deutsche Bank also were reported to be interested in bits.)

FRANCES COPPOLA11:14

FRANCES COPPOLA11:14I’m not wholly convinced by the “no-one could have known” argument re AT1s. I suspect it is like the uninsured depositors in the US banks. People didn’t think regulators would actually wipe them.

Anjuli Davies11:16

Anjuli Davies11:16Basically, they can’t believe they did it…

FRANCES COPPOLA11:16

FRANCES COPPOLA11:16Anyway, if AT1s now reprice to take account of the (now known) risk of being wiped, a lot of banks will suddenly have a lot less Tier 1 capital. That strikes me as… not good.

Anjuli Davies11:16

Anjuli Davies11:16Anyone follow Boaz Weinstein ?

Ben Harrington11:17

Ben Harrington11:17Boaz Weinstein

made a ton during the 2020 sell off

FRANCES COPPOLA11:17

FRANCES COPPOLA11:17There’s always a winner

Anjuli Davies11:18

Anjuli Davies11:18·

It may surprise you but I’ve never once invested in AT1 or Perps because I could never figure out what they’re worth. When you see other bank AT1’s down tomorrow my two cents are to not be tempted to buy. If you must, buy half senior and half actual equity for a better profile.

That’s Boaz from Saba Capital Management

Anjuli Davies11:20

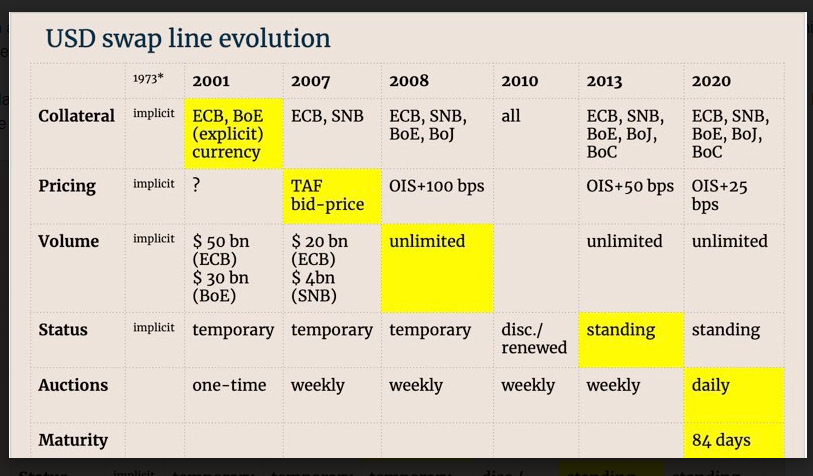

Anjuli Davies11:20SO, Frances – how significant is the mass coordinated use of dollar swap lines ?

FRANCES COPPOLA11:21

FRANCES COPPOLA11:21It seems to be a precautionary measure, and the value is (as ever with central bank precautionary actions) in the signalling. Sends an important message that the Fed has the back of the global financial system.

Anjuli Davies11:21

Anjuli Davies11:21But even that doesn’t seem to have been enough

FRANCES COPPOLA11:22

FRANCES COPPOLA11:22It’s the old problem – liquidity doesn’t solve solvency problems.

We may see a shakeout among banks whose capital is, shall we say, on the fictional side.

Anjuli Davies11:23

Anjuli Davies11:23I like that Frances “fictional side”

Ben Harrington11:23

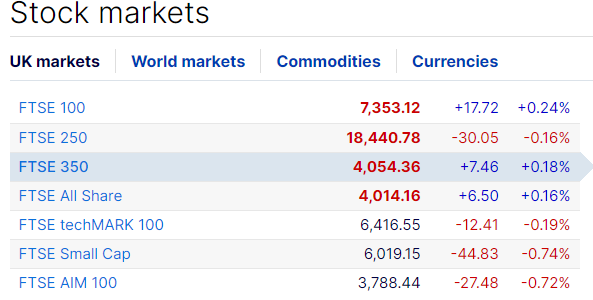

Ben Harrington11:23@Frances – so who do you think might be next?

There is already talk about a French and/or Italian banks potentially running into “issues”

All the European bank stocks are getting pummelled this morning

and the insurers

11:25Standard Chartered is one of the worst performing shares this morning

Assume the Abu Dhabi lot are pleased they had to park their £20 billion takeover bid (as revealed by Bloomberg)

Anjuli Davies11:27

Anjuli Davies11:27Isn’t it the insurers and pension funds chasing yield in negative interest rate environment

and private wealth managers

We’ve got SNB and FED decisions this week

FRANCES COPPOLA11:28

FRANCES COPPOLA11:28Fed has already said it is considering a pause

Fed may pause but inflation won’t…

FRANCES COPPOLA11:30

FRANCES COPPOLA11:30But if banks tighten credit conditions then that is the equivalent of raising rates, Ben

Anjuli Davies11:30

Anjuli Davies11:30this is interesting

FRANCES COPPOLA11:30

FRANCES COPPOLA11:30So central banks need to take into account passive tightening from nervous banks

Anjuli Davies11:30

Anjuli Davies11:30Is it true that only CS and UBS have this permanent writedown mechanism?

Ben Harrington11:30

Ben Harrington11:30@Frances – perhaps you are correct … didn’t think about it like that

11:32Amazing the shift in sentiment … it was just a couple of weeks ago that markets were pricing in 50 basis point hike

FRANCES COPPOLA11:32

FRANCES COPPOLA11:32Ahem.

Anjuli Davies11:33

Anjuli Davies11:33There’s a bloodbath for macro hedge funds

FRANCES COPPOLA11:33

FRANCES COPPOLA11:33

Anjuli Davies11:36

Anjuli Davies11:36Shall we move to Credit Suisse’s investment bank?

FRANCES COPPOLA11:36

FRANCES COPPOLA11:36Is it going to survive?

Anjuli Davies11:36

Anjuli Davies11:36What is Michael Klein going to do next?

He was paid massive amounts to take on the resurrected First Boston brand

Reuters was plush with stories about how it forecast revenues of $3.5 billion

But then came stories about how it was struggling to find investors…

Ben Harrington11:37

Ben Harrington11:37@Frances – you have to assume the best people are going to leave the investment bank if they haven’t already

Anjuli Davies11:38

Anjuli Davies11:38Colm Kelleher was asked on the press conference about the IB and he clearly stated it was not a priority, even for UBS

11:40And yet I read that CS would honour their bonus payments…

Ben Harrington11:40

Ben Harrington11:40@Helmholtz – re Dubai … what are you suggesting?

Credit Suisse staff will still be paid their bonuses despite its £2.7bn takeover by rival UBS in a deal designed to avert a global banking crisis.

Workers were reassured in an internal memo that there would be no changes to payroll arrangements and bonuses would still be paid on March 24.

@Helmholtz – yeah but the Saudis just seen their recent “investment” in CS get almost wiped out

FRANCES COPPOLA11:42

FRANCES COPPOLA11:42Pay their bonuses then lay them off?

CS was already slated for 9,000 job losses and there are now surely going to be whole lot more.

Ben Harrington11:42

Ben Harrington11:42@Helmholtz – wonder what the Saudis think of Klein now?

Anjuli Davies11:43

Anjuli Davies11:43Is there anything worth selling in the IB ? Could it be picked apart

Ben Harrington11:43

Ben Harrington11:43@Helmholtz – I concur

Anjuli Davies11:44

Anjuli Davies11:44Ok, so we have 15 minutes left and Ben has some UNCOOKED news for us

What else was around in the Sunday newspapers Ben?

Ben Harrington11:44

Ben Harrington11:44Well, you might have noticed over the weekend I teamed up with friends at The Sunday Times to write a story about Sparta Capital building a stake in THG, formerly known as The Hut Group.

Any THG followers among the rabble?

Anjuli Davies11:45

Anjuli Davies11:45Ah, interesting

tell us more

Who is Sparta Capital ?

Ben Harrington11:46

Ben Harrington11:46They are a relatively new activist fund set up by Franck Tuil, a former senior PM at Elliott Advisers.

Recently took a stake in Wood Group and argued last year it should be buying back shares or it will become a takeover target

An activist hedge fund, founded by a former executive of the fearsome US firm Elliott Advisors, has taken a stake in THG, leaving the troubled online retailer contending with two activists on its shareholder register.

Ben Harrington11:48

Ben Harrington11:48and then … Wood Group actually became a takeover target … receiving an indicative offer from Apollo at a 60pc premium

Anjuli Davies11:48

Anjuli Davies11:48So what’s the angle here for Sparta?

Ben Harrington11:49

Ben Harrington11:49From my understanding there a lot of angry and annoyed traditional shareholders in THG. So the fact that Sparta have turned up alongside Kelso is interesting. One assumes they are attempting to be the catalyst for some serious change at THG. And who knows … perhaps that change might involve corporate activity.

Anjuli Davies11:50

Anjuli Davies11:50Isn’t Moulding supposed to be giving up his golden share this summer?

Ben Harrington11:51

Ben Harrington11:51Yes Matt Moulding, the founder of THG, has previously made noises about doing that so the company can get onto the main market

but whether he will now that there are two activists on the register…?

let’s see

Anjuli Davies11:51

Anjuli Davies11:51Anything going on in the water sector Ben?

Ben Harrington11:52

Ben Harrington11:52yes there was an Ofwat announcement

about owners of water companies

The regulators said this morning it will take new powers to prevent the payment of dividends to shareholders if there is a risk to the company’s “financial resilience”, and to take enforcement action against companies that don’t link payments to performance. See the link:

https://www.ofwat.gov.uk/ofwat-announces-new-regulatory-controls-on-water-company-dividends/

Anyway, this comes amid rumours about an infrastructure fund weighing an offer for Pennon

Whether this announcement puts the kibosh on that potential deal remains to be seen …

Anjuli Davies11:54

Anjuli Davies11:54

A share price in the green !

Ben Harrington11:55

Ben Harrington11:55Yes but I suspect that’s because there is a flight to safety this morning … all the other water companies are up, too.

Anjuli Davies11:55

Anjuli Davies11:55True, the miners as well

Any other small cap news?

Ben Harrington11:55

Ben Harrington11:55Premier African Minerals might be worth keeping an eye on. There could be some news soon about the mine in Zimbabwe producing serious amounts Lithium.

Anjuli Davies11:56

Anjuli Davies11:56Interesting… any decent UNCOOKED rumours about European companies?

Ben Harrington11:56

Ben Harrington11:56there has been talk around a couple of Italian companies. One UNCOOKED bid rumour involves Saras S.p.A, an Italian oil refining group controlled by the Moratti family. The rumour is a Gulf-based company, possibly from Qatar, is looking to buy the Moratti family’s shareholding with a view to then buying the rest of the company

Anjuli Davies11:57

Anjuli Davies11:57oooh that’s a bit left field

The ever ongoing issue of Italian families ceding control

Ben Harrington11:57

Ben Harrington11:57And there is also some UNCOOKED gossip about a Infrastructure Wireless Italiane, the Italian wireless network operator. The rumour is the group behind Vantage Towers, which includes KKR and Global Infrastructure Partners are looking to buying the remainder of the company they don’t own.

Anjuli Davies11:57

Anjuli Davies11:57Ok, wwe’ve got 3 more minutes, what have you got for us?

Ben Harrington11:58

Ben Harrington11:58Yes!

Last but not least

There is some UNCOOKED takeover talk around DFDS, a shipping and logistics company.

Anjuli Davies11:59

Anjuli Davies11:59Ah, ferries

Ben Harrington11:59

Ben Harrington11:59The mutter is that a trade buyer could be interested in merging with / buying DFDS.

Sharp suited types also suggest private equity firms have been studying the business.

Anjuli Davies11:59

Anjuli Davies11:59That’s great Ben, don’t forget he’s over at www.betaville.co.uk

that’s a wrap from us, but Frances will be here all week !

and I am sure we will be talking about banks all week…

No doubt

I’m sure you will!

Au revoir mes amis… time for dejeuner…

FRANCES COPPOLA12:01

FRANCES COPPOLA12:01A domani, rabble!