With the world finally waking up to the challenges of valuing any cryptocurrency token properly, here at the Blind Spot — having called the crypto complex right — we’re moving on to pastures new. Notably, how to value a media subscription.

In the broad media spectrum that’s far from an easy process. Too much news is centred (quite rightly!) on simply telling interesting stories. But for us journalists focused on financial markets, some sort of track record is probably quantifiable in dollar terms.

It was Nassim Taleb who famously argued that journalists are rarely accountable for their hot takes, since there’s not much downside for them if they’re wrong. The cryptocurrency crowd has often echoed this point when challenging journalistic sceptics like myself. “Have fun being poor!” “You should be ashamed of how much money you have lost people who listened to your advice!”

My usual retort is that journalistic skin in the game is tied to reputation and credibility. Unlike most of Twitter, journalists link their real-world identities and names to their positions. If they get stuff wrong people know about it. The alternative — a scenario where journalists are trading on the back of their own tips — is arguably even more conflicting and corrupting. Hence disclosures are necessary.

But in recent days, me crowing about my successes in calling the blockchain and crypto markets right, has driven some of my nearest and dearest (who happen to be traders) mad. Their view is that just “calling” something is meaningless unless you also clearly call the exits. Yes, billions of mal-investment may have been avoided if people listened to you. But that, in their opinion, is no good way to value a call.

There are other factors to consider too they say: like the cost of wearing the position until it comes good. You may be right in the end but if you’re stopped out a million times before you get there what good is that?

Having thought about it I’ve decided they have a point. Jim Cramer, after all, persists as a phenomenon regardless of his appalling track record. Also, it’s somewhat clear that journalists have a habit of selectively remembering the stuff they got right but never the stuff they got wrong.

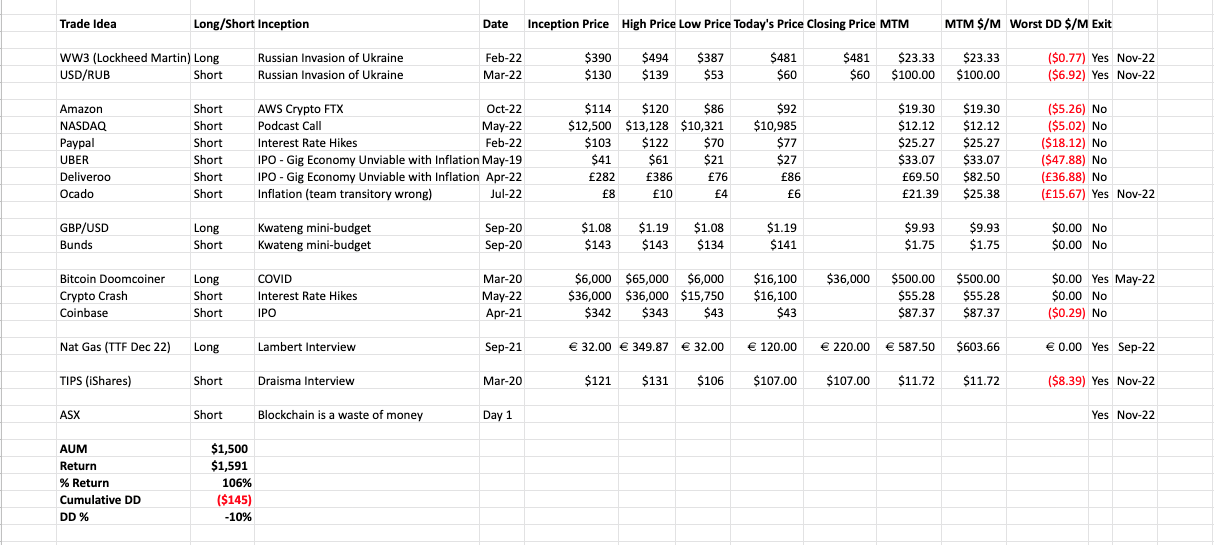

In the interests of transparency, I’ve decided to give my trading relation the opportunity to assess my long-term performance. He’s applied the harshest criteria and we’ve had many arguments about the scope and nature of my exits (since I’ve never been used to making them). They weren’t convinced, for example, that I could add $2 trillion in lost market cap in the cryptocurrency realm as a positive mark on my pnl. So we had to compromise on a few matters. He’s also dubious about the RUB trade, since you couldn’t execute it in reality.

Anyway, here’s the rap sheet. And yes, there’s a quantifiable URL link, Tweet or email for every entry/exit. [Excuse the typos, though, the spreadsheet was compiled by a trader.] A theoretical $100m was applied to each trade.

Warning: there may have been some selective bias on my part in recalling the full range of my calls, and yes you just have to take my word for the objectivity of the auditor. None of this is financial advice, etc etc. 🙂

Hindsight Capital LLC

3 Responses

Hi Izabella – with all due respect to your husband, I think he is talking nonsense.The test of a financial journalist is whether of not he or she tells the truth, the whole truth and nothing but the truth. When there is a debacle, such as what is happening in FTX, that should be the standard to judge those who reported on it. That is all.

Thanks! I will tell him 🙂