Izabella Kaminska 10:58

Izabella Kaminska 10:58…

Greetings rabble.

Hello and welcome to Spot Markets Live, the weekly tour of what’s going on in markets and finance. Today I’m joined by Anjuli Davies… Hello Anjuli.

Good morning

From London for a change

Izabella Kaminska 10:59

Izabella Kaminska 10:59Also, it’s a special session, as we are currently holed up face-to-face in the Unherd offices at Westminster –

– part of my little quid pro quo (I write a column for them, they give us some access to their amazing new offices. Which really are cool).

It’s nice to get out of the house.

In a very Christmassy office.

Izabella Kaminska 11:00

Izabella Kaminska 11:00Except, unfortunately, Anjuli’s computer has decided to pack itself in.

iPhone to the rescue …

Izabella Kaminska 11:00

Izabella Kaminska 11:00So, she is slightly immobilised and using her phone

But yes, the office here is really rather lovely. Somewhat Dickensian I would call it.

Can we share a photo you think? Or will Paul Marshall get upset by that?

Full Disclosure: Paul Marshall (of Marsall Wace LLP) is to Unherd what SBF was to Semafor. Or something.

Izabella Kaminska 11:01

Izabella Kaminska 11:01I’m going to sneak in a pic:

The future of media is patronage by rich billionaires, crypto dudes, and hedge fund managers apparently.

Except for you, Izzy

Izabella Kaminska 11:02

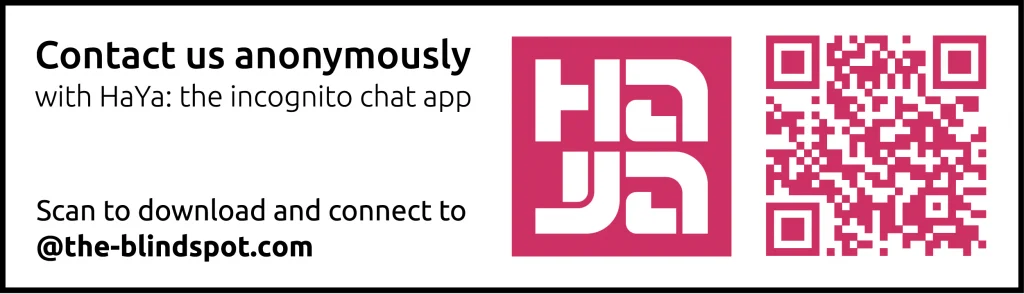

Izabella Kaminska 11:02Disclosure: The Blind Spot remains 100% independent, self-funded and journalist owned. If you want to keep it that way do spread the word. At the moment we are bartering our way to sustainability.

@D – it does feel like they should

So what shall we look at today?

Izabella Kaminska 11:03

Izabella Kaminska 11:03Obviously, the big news comes in the shape of the Chinese covid protests. Matt Hancock coming third in I’m a Celebrity and news that Rishi is launching an energy savings PR campaign.

I have done a couple of Octopus Energy “savings sessions “ and have saved £1.81 so far …

Izabella Kaminska 11:04

Izabella Kaminska 11:04Eeek. I can’t wait for the secret snaps of Rishi decadently using electric heaters in the midst of December.

In his pure cashmere sweaters

Izabella Kaminska 11:04

Izabella Kaminska 11:04Here are the details about the “save energy” propaganda plan, courtesy of the FT

In terms of market news, it’s all a bit boring today

European markets are slightly down. About a percentage.

Last I checked, Centrica was the top gainer no doubt on the Rishi propaganda news.

The pound still going higher.

@P damn right.

She’s in the wrong profession

Izabella Kaminska 11:06

Izabella Kaminska 11:06I did try to mark myself to market.

But the problem is, it’s all very conflicting and dubious. Journalists just can’t make calls the way traders do.

Speaking of which…

What I really want to talk about is the great Elon Semafor confrontation – and how it applies to FTX.

11:08 For those who don’t know, Elon got narky on Friday with Semafor (the SBF-backed media vehicle set up by a former New York Times journalist and a former Bloomberg editor, whose great “new idea” about how to reform media is to unbundle opinion from “fact” in the same article and make the bylines EVEN BIGGER.)

Leaning into the celebrity journalism thing eh?

Izabella Kaminska 11:09

Izabella Kaminska 11:09Exactly, neither is really good practice if you’re trying to save media from its own conflicted self. One of the fundamental rules of good media practice is not blurring opinion writing with news. Another good rule for the truly neutral press used to be not putting bylines on stories. So in Semafor, we have the equivalent of leaning into everything that most people would consider bad. But I digress.

Long story short, Elon flagged in a Twitter spaces chat when all the SBF stuff was unfolding that SBF had approached him to invest, offering between $1-2bn. But – as text messages released in his M&A litigation reveal – he wasn’t entirely convinced SBF had the liquidity. So he took the op to do a small victory lap and note that his bullshit metre was going off immediately.

Izabella Kaminska 11:10

Izabella Kaminska 11:10Right. But the media has since gone a bit bonkers about Elon. The rage is incessant. And there is no tolerance for any positive spin on Elon whatsoever.

To be clear here at the Blind Spot we are not indiscriminate fanboys or haters of Elon.

I’ve written plenty of snarky stuff about Elon in my time, who undoubtedly perfected the great pretend and extend business strategy.

But we’re not so infused with one-sided hatred that we can’t see when occasionally the man is right.

The details are in my thread:

But the key point is that Semafor simply couldn’t handle the idea that Elon might have come out on top in this.

So they wrote a piece on Thursday, Nov 24, implying a secret text showed that actually in the end Elon was hustling SBF for the money and that SBF bought Twitter stock after all.

Here’s the story:

Who do we think is the source of the “secret” text?

Izabella Kaminska 11:12

Izabella Kaminska 11:12Well quite. Clearly SBF himself.

Elon then tweeted that the story was inaccurate as he didn’t roll into the investment. Which sent everyone on the internet crazy, accusing him of lying because once a liar, always a liar.

But as I pointed out there was zero provable evidence of their assertion provided. And it was entirely reasonable to take Elon’s word for it. Then Ben Smith, Semafor co-founded, finally coughed up the evidence. It was the following text message from SBF:

This of course proves absolutely nothing.

Sorry, who are you? Lol.

Izabella Kaminska 11:13

Izabella Kaminska 11:13Alphaville’s new hire Louis Ashworth, who had previously gone through FTX’s filings of assets and found a listing of $43m worth of illiquid Twitter shares, even agrees in his most recent assessment that the reference to the Twitter stock in SBF’s accounts doesn’t necessarily prove anything, since the chaos of SBF’s accounting was such, nobody can be sure if he rolled or didn’t.

My point is that whether he rolled or not is entirely irrelevant. Nor does it prove that Elon was wrong or hypocritical to point out that his bullshit metre was going off. Either scenario is a total non-story.

BUT THERE IS SOMETHING THE TEXT MESSAGE DOES PROVE!!!

DEAR SMLers:

****– this is a world-exclusive insight coming up here —*****

What the text message inadvertently reveals – and what no media has seemingly picked up on — is that whatever SBF’s liquidity position was in March when he first started hustling Elon for an op to invest, it may have been entirely vanquished by May 5.

May 5 being when SBF sent that text message

Any ideas why that is particularly relevant?!

No. What is it that happened on May 5 that is so meaningful?

Izabella Kaminska 11:16

Izabella Kaminska 11:16May 5, of course, is two days before the Terra Luna collapse occurred. It is pretty much established now that SBF’s troubles probably began around then, and he was playing whack-a-mole keeping everything contained ever since.

For a clue to the real catalyst for the unwind let’s check in on the front page of Coindesk on the day:

Basically, I’d say it’s bleeding obvious.

SBF’s empire began collapsing the day after the Federal Reserve first raised rates on May 4.

It was the Fed that done it. In the billiard room. With the Terra Luna.

What’s more, it was just after the fed hike that the Terra Luna foundation started buying more bitcoin for its reserves.

This is a new take on Agatha Christie.

Izabella Kaminska 11:17

Izabella Kaminska 11:17Hehe. It really is.

Maybe it’s more Sherlock Holmes given our Dickensian surroundings.

On that note, it’s worth revisiting what was happening in crypto between May 4-5

Either way, this is a rich strand to pursue. How exactly would a rise in the cost of dollar funding have percolated through the system to impact SBF?

If anyone has any ideas let us know. But this is the key to how the kingdom collapsed. And it implies LEVERAGE.

But I think we will leave it there for now.

@diggens – no? Link?

Speaking of liquidity, the USD swap lines are still being tapped

Izabella Kaminska 11:20

Izabella Kaminska 11:20But what about China and the yuan?

Good question

Well, on the yuan liquidity front, it’s getting interesting, Bill Ackman’s put a short position on the Hong Kong dollar, but it’s worth remembering the PBOC initiated loads of swap lines between itself and its belt and road counterparts.

The whole arrangement is different tho. Much more like an export-financing loop. China lends hard-up countries the yuan it needs to buy exports from them.

So the question is how sustainable is it really? Probably about as much as SBF’s empire.

The analogies don’t stop there. Remember when China launched its reserve pool with the BIS?

China’s central bank will create a reserve pool with the Bank for International Settlements, along with five other central banks, to provide liquidity for participating economies in times of market stress. The People’s Bank of China said on June 25 it signed an agreement to launch the new Renminbi Liquidity Arrangement (RMBLA) during the BIS annual meetings, held over the weekend. Developed by the BIS and the PBoC, the new arrangement will allow participating central banks to obtain pooled

This is not dissimilar to what Binance is now doing with its recovery fund.

The recovery fund would be used to buy distressed crypto assets and support the industry. The crypto market has seen a massive decline since the start of the year, leading to several crypto firms going out of business.

The crypto market continues to be under pressure, with bitcoin (BTC) trading 1.6% lower during the day, hovering at around $16,400 at the time of writing.

So a cross between an IMF fund, and a European Troika-inspired recovery fund to save the euro.

It’s all the same stuff. Just in different flavours.

None of which is supporting the price of bitcoin:

But let’s move to China proper.

What does the rabble think? Is this the beginning of the end? Or just another Hong Kong situation?

Tom, my former colleague who is now the FT’s Shanghai correspondent, was at the protests all of yesterday.

He filed this story:

He thinks it’s “very very significant”.

@rabble – Speaking of the Chinese army, I did not know that Chairman Mao’s grandson is an important and senior general in the army.

I found this video by Matthew Tye quite amusing

Basically, he doesn’t seem too suitable for the role.

Some might say the whole arrangement is indicative of how corruption and nepotism have skewed and undermined the Chinese system.

Also worth noting the Chinese officials are now banning the sale of white paper to stop protestors using the sheets as a signal of censorship during protests.

I have to say, the subversive genius of the Chinese is second to none – when they actually go for it.

@B – yes I tend to agree. But the question if China topples, what happens elsewhere?

Btw has anyone seen Jack Ma lately?

I saw an interesting comment over the weekend noting that the motivations for China introducing a CBDC are entirely different from those of the West. Notably, the issue was the likes of Ant’s financial potentially muscling in on PBOC turf and undermining currency control.

But whether the PBOC takes control or not, doesn’t change the fact that the model comes unstuck unless they can keep convincing investors that investment for further growth is essential. Here’s a story from Reuters that suggests the PBOC is not ready to give up on pretend and extend just yet.

HONG KONG/SHANGHAI, Nov 25 (Reuters) – China’s central bank will offer cheap loans to financial firms for buying bonds issued by property developers, four people with direct knowledge of the matter said, the strongest policy support yet for the crisis-hit sector.

The People’s Bank of China (PBOC) hopes the loans will boost market sentiment toward the heavily indebted property sector, which has lurched from crisis to crisis over the past year, and rescue a number of private developers, said the people, who asked not to be named as they were not authorised to speak to the media.

What happens if/when the proliferation of protests causes a surge in Covid infections?

The zero Covid strategy means not many people have had it before.

The healthcare system will buckle.

Izabella Kaminska 11:37

Izabella Kaminska 11:37I guess we will see if their vaccines are effective or not. But as far as i understand the takeup hasn’t been at all that great.

And that applies to all the countries that got Sinovac too.

It’s almost too depressing to think about

Izabella Kaminska 11:39

Izabella Kaminska 11:39Anyway good to check in on how the Global Times are reporting things this morning:

no sign of any protest references

Moving on… I thought it might be worth taking a look at Poland

Not because we’re top of our group in the World Cup.

Woooo hooo

🇵🇱🇵🇱🇵🇱🇵🇱🇵🇱

But because Philip Pilkington put out an interesting Twitter thread, which made the country’s Twittergentsia go absolutely nuts.

Pilkington is an independent economist, formerly GMO. Here’s the thread:

https://twitter.com/philippilk/status/1596180282125737986

Philip is basically making an argument that Poland is about to massively overextend itself by going too large on defence. The gist of the argument is as follows:

“The plan is to increase defence spending by 2.6% of GDP. With $17bn of new contracts with the US and South Korea, they’ve already hit 2.5% of GDP. ALL of that money flows abroad!”

3/ Poland’s current account has collapsed into deficit this year. In the last two quarters it averaged 4% of GDP. That large a deficit is difficult enough to fund for a rich country like Britain or even the United States.

4/ Now add on the 2.5% of GDP being spent on weapons and we get to a 6.5% of GDP current account deficit. In a relatively poor Central European country with its own currency!

5/ But wait, there’s more! Poland’s inflation is close to 20%. 20%! They’re in the same territory as Argentina and Turkey were prior to both entering an inflation-depreciation doom loop.

6/ The zloty has declined 12% this year against USD. That’s nothing in compared to what’s coming. If you think a relatively poor country with an inflation rate over 10% higher than the US and a current account deficit of 6.5% of GDP can survive for long I’ve got a bridge to sell.

7/ Surely then the Polish central bank are raising rates to defend the currency? Nope. Real interest rates in Poland is -11%. -11%!!!

8/ This isn’t simple mismanagement. This is the sort of policy making you see in basket-case economies. If Poland collapses into actual hyperinflation will it remain an EU member state? Not clear.

This analysis has upset the Poles no end. Apparently, they’ve taken to messing with his Wikipedia page.

But I do wonder if he has a point. And it all reminds me of my favourite ever economic/social/civilisation-focused paper.

About the Security/Prosperity paradox:

This basically argues the moment any civilisation has to spend more on defence than on reinvestment in the stuff that creates prosperity, it becomes doomed.

The production of economic surplus, or “prosperity,” was fundamental to financing the rise of pristine civilizations. Yet, prosperity attracts predation, which discourages the investments required for civilization. To the extent that the economic footing of civilization creates existential security threats, civilization is paradoxical. We claim that, in addition to surplus production, civilizations require surplus protection, or “security.” Drawing from archaeology and history, we model the trade-offs facing a society on its path to civilization. We emphasize preinstitutional forces, especially the geographical environment, that shape growth and defense capabilities and derive the conditions under which these capabilities help escape the civilizational paradox. We provide qualitative illustration of the model by analyzing the rise of the first two civilizations, Sumer and Egypt.

And the problem is all the arms companies aren’t Polish, so you’re propping up the Americans and the French and the British …

Izabella Kaminska 11:48

Izabella Kaminska 11:48Exactly. But this reality has upset the poles. Their patriotism combined with their unwavering support for Ukraine has made them potentially ignore some important economic realities.

Hasn’t the war in Ukraine been great for America plc?

Izabella Kaminska 11:50

Izabella Kaminska 11:50It seems so. And the Europeans are beginning to notice.

This from Politico marks a real turning point I think:

Probably a piece that’s worth framing somewhere:

But let’s move on to what everyone wants to talk about: Black Friday.

Anjuli did you go crazy online?

Was waiting for cyber Monday …

Izabella Kaminska 11:55

Izabella Kaminska 11:55Ah, of course! Apparently, retail inventory in Europe is full to the brim because of the warm autumn/winter. So mass discounting is expected to continue well into Xmas.

Dario has summed up the state of affairs.

I’m passing on his notes

News reports that despite the plethora of plummeting economic indicators, this week’s Black Friday online sales have broken records, with Shopify merchants reporting $3.36bn in sales, up 17% over 2021.

Data out of the UK this morning showed retail sales slid

Izabella Kaminska 11:57

Izabella Kaminska 11:57This is from the CBI for November:

- Retail sales declined in the year to November (-19% from +18% in October) with a broadly similar fall expected next month (-21%).

- Sales volumes were seen as average for the time of year (+3% from +20% in October) and are expected to remain broadly in line with seasonal norms in December (-1%).

Izabella Kaminska 11:57

Izabella Kaminska 11:57Yep. Not looking good. So discounting is definitely likely to be on the cards

- Online retail sales contracted in the year to November (-5% from -23% in October). Internet sales have now been flat or falling for 13 months, and an accelerated contraction (-26%) is expected next month.

- Retailers remained notably pessimistic about the business situation over the next three months (-22%), to a similar extent to August (-22%).

- Employment growth in retail slumped in the year to November (-17% from +13% in August) – the first decline in headcount since August 2021. A further fall (-12%) is anticipated next month.

- Retailers expect to reduce investment in the next 12 months compared to the previous 12 (-38% from -31% in August), to the greatest extent since May 2020

Izabella Kaminska 11:58

Izabella Kaminska 11:58And here’s retail week on the inventory situation:

Fashion retailers are grappling with mounting piles of unsold stock as improving supplier delivery times and weakening consumer demand impact inventory levels.

The shortening of lead times from East Asia has left retailers receiving new stock earlier than expected while many are still clearing last year’s delayed stock following supply chain snarl-ups.

The situation has hit a number of fashion chains at a time when consumers are reining in their spend as the cost-of-living crisis bites.

Dario has been following the Redditor take on all this, and they don’t trust the “all-time biggest” Black Friday sales figures either.

Is that more of a take on CNBC?

Izabella Kaminska 11:59

Izabella Kaminska 11:59Quite.

They’re also dubious of the sales figures because they were all buy-now-pay-later or on credit.

But wasn’t it always the case? Not sure that makes sense as an argument.

And aren’t all Black Friday sales fake anyway …?

Izabella Kaminska 12:01

Izabella Kaminska 12:01When did Black Friday even become a thing?

It’s still a relatively new phenomenon in Europe.

But we’re out of time. I think worth finishing on one last snippet that’s been brought to my attention by Dario.

Apparently, Moodys are looking to downgrade Coinbase, pointing to increased volatility and uncertainty in the crypto markets.

And Redditors have pointed out that Coinbase bonds have tumbled to 53 cents on the dollar, falling from about 92 cents in January.

On that cheery note, we are going to head out and have some coffee in the adjacent Unherd Dickensian cafe.

It’s been great doing this face-to-face. Hopefully next time your computer won’t die.

Pa

Izabella Kaminska 12:03

Izabella Kaminska 12:03Good polish skills 🙂

Do widzenia to the rabble. See you next week, hopefully with more stock focused commentary.

Maybe need a new one in the black Friday sales.