Anjuli Davies10:57

Anjuli Davies10:57…

Good morning and welcome to Spot Markets Live, the weekly round robin of micro and macro news. Today I’m excited to be joined by @Macrokurd. A portfolio manager at a multi-billion dollar hedge fund running an emerging markets macro business.

He previously spent time at an investment bank running a trading desk and at a global asset management firm

Morning

MacroKurd10:59

MacroKurd10:59Good morning!

Anjuli Davies10:59

Anjuli Davies10:59Do you want to tell us a bit about yourself to start off with

MacroKurd10:59

MacroKurd10:59Sure..

Anjuli Davies11:01

Anjuli Davies11:01I’m sure we are all going to have a lot of questions !

MacroKurd11:02

MacroKurd11:02I started at an investment bank trading EM local currency products for the CEMEA region…mainly countries like Israel, Poland, Czech Rep, Hungary, Romania, Turkey etc…and risk taking in global EM. I spent 7 years there and then moved to become a co-pm on an EM macro fund at a dedicated EM hedge fund, where we started with AUMof 330m USD, built that to a peak of 1.7bn USD in 2017, but end up closing down the fund in 2019. I was brought in to a large US asset manager to bring a new HF style absolute return focus on their EM local business. I spent 2 years there, pretty much during the Covid years. But I decided to leave start of last year and to go back to absolute return/ HF style strategy portfolio management. I currently work at a multi strat Hedge funds, running an EM macro business, involved in global EM.

So my career has been pretty much all macro and EM dedicated

all the Emerging Markets is often also submerging markets 🙂

although*

Anjuli Davies11:03

Anjuli Davies11:03So hard or soft landing – what does that mean for EM?

MacroKurd11:05

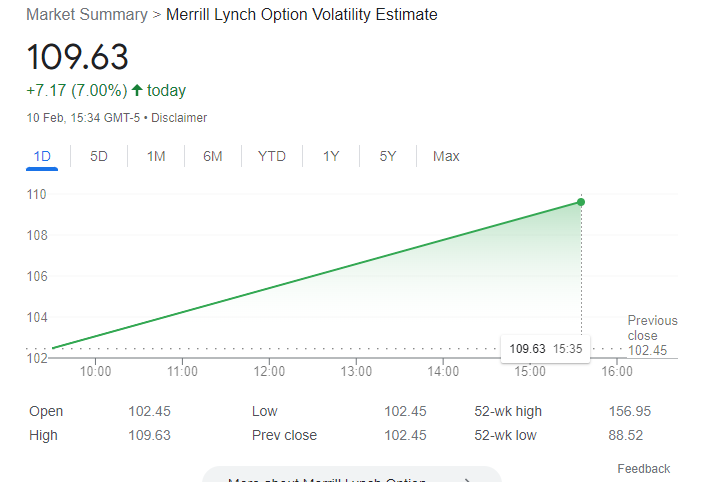

MacroKurd11:05Good q….EM likes one thing above all else….or rather hates one thing above all else…and that is volatility. High vol environments don’t bode well for EM risk. As we saw last year with the US rate vol market, the MOVE Index hitting recent highs, EM fared very poorly. A soft landing will bode better for EM risk than Hard landing. However Hard landing will mean more differentiated EM risk, likely favouring EM fixed income which can do ok if the fed is cutting, vs EM equities.

Anjuli Davies11:07

Anjuli Davies11:07Looking at EM rates and what happened in the DM world last year if inflation is sticky do you think they are better placed with their monetary policy and consumer balance sheets to sustain globally higher inflation for longer?

here’s that MOVE index

Thanks @Clement and @Richard for the questions

MacroKurd11:12

MacroKurd11:12It’s a little complex. And very differentiated. You look at Brazil and Mexico for example. Mexico surprise hiked by 50bps last week vs expect unanimously at 25bps. They took base rate to 11%. Inflation is on a 8 handle and expected to continue drifting lower to 4-5%. That is very high real rates. Brazil also has their rate just under 14%, with inflation already on a 5 handle. So they have decent rate policy in real terms. This differs with others like India that are reluctant and running negative real rates. So some will do better than others especially as they have shown credibility. But, that’s too simple. Higher for longer, with changes in governments that are worried about growth means fiscal may be prone to easing to offset. And EM risk takers wont be comfortable. So in sort there are winners and lowers…or rather losers and v bad losers, but overall, EM wont fare well with a very sticky for very long inflation outlook in the DM world

But in don’t believe we get that in DM world…but that’s just my views

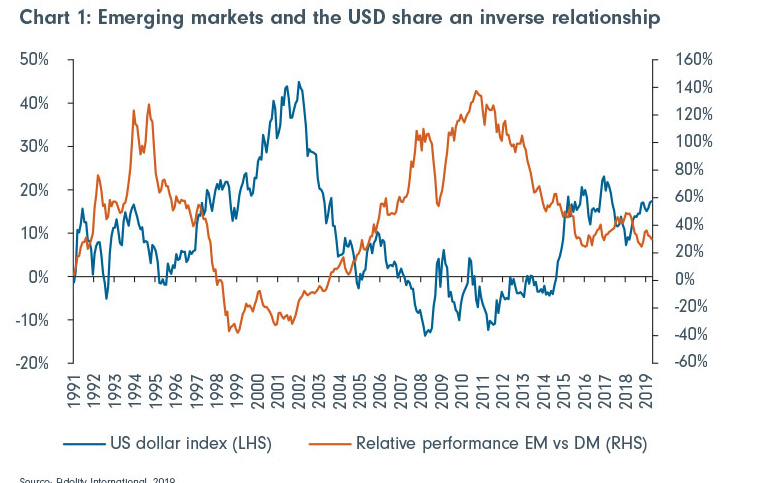

Clement…EM as levered dollar…again differentiated, but we have seen interesting price action for example of recent year, EUR/EM has gone a lot lower

basically useful to think not of just dollar but an EM vs DM outlook

last year was the year EM was more DM like and DM was more EM like

where DM blocs expanded fiscal and kept rates much lower than needed

EM didn’t overall ease fiscally during covid as much

and was v proactive in tightening rates in the inflation cycle

So vs dollar, it wont be immune, but EM can still do v well vs likes of EUR, GBP, CAD, etc..

Re China

It’s just a market of its own. Really

Its all v tightly controlled by gov and PBOC

to take China risk is to take a view on what the authorities goals are

rest is all just constant speculation

@Richard both options same?

@Clement, exactly….China authorities changed goal on covid opening….that was the trade

Anjuli Davies11:18

Anjuli Davies11:18Looking at some of the big EM country drivers… it’s a big week for Brazil with talk of resetting their inflation target. What’s your view on this and what will be the outcome for Brazilian rates and currency?

MacroKurd11:18

MacroKurd11:18@Graham, deglobalisation is not as real as people make out. Its headlines more than reality. Reality is more restructuring globalisation. The onshoring away form China is real, but it will take many years to pan out. Mexico is a main beneficiary and can see that already happening

Re Brazil

Anjuli Davies11:21

Anjuli Davies11:21What did you make of talk of a currency union a few weeks back?

Brazil and Argentina will this week announce that they are starting preparatory work on a common currency, in a move which could eventually create the world’s second-largest currency bloc.

MacroKurd11:23

MacroKurd11:23The currency union was way over blown. First its been discussed previously during the Bolsonaro administration. It’s not new. Secondly, these things tend to take a long time to plan out and implement. And thirdly, this is a currency union discussed not a single currency as most thought, like the euro. Its mainly a recognition politically of their trade ties. They are their biggest trading partner after all.

Anjuli Davies11:23

Anjuli Davies11:23@user007 we will get on to India

MacroKurd11:23

MacroKurd11:23India…

Anjuli Davies11:25

Anjuli Davies11:25

MacroKurd11:25

MacroKurd11:25Its a story many investors like mainly as the ‘new China’. Which is a valid case but its a long process. In the meantime some concerns on how Modi is running things, the ties with Russia on energy and the ‘image’ portrayed as put some people off. The INR has been a very consensus big long for EM investors already, and that has started to get reduced a bit. Monetary policy is relatively low for the environment so its betting on a turnaround in inflation domestically and globally, but its rates don’t act as much buffer if things are sticky as mentioned as a risk

Anjuli Davies11:26

Anjuli Davies11:26So, what do you think are the big trades this year ?

MacroKurd11:30

MacroKurd11:30As a macro pm, people miss the point tat risk taking is about assessing probability adjusted weight of scenarios. So its not a clear picture where we are headed in the global context. We have moved from soft vs hard landing to more weight now on soft vs no landing which had v little weight before. we have talks of inflation will surprise higher then go down then that will prove transitory and will resurge. Basically that tells you everything about the markets. They don’t know, and they are speculating loudly from all corners.

So you are going to have a conviction to get the direction right overall. So risk taking for now for me is a relative value game. Pick your longs and shorts, winners and losers. But if asked my bias view, I think its under-priced that we could well see every central bank cutting or preparing to cut rates by year end. I see inflationary as coming down materially and surprising the markets over the course of the year. And during this year, EM fixed income will be a big winner.

Anjuli Davies11:32

Anjuli Davies11:32Moving from South America to South Africa….how will the Eskom crisis affect South African markets?

South Africa’s president has declared a state of disaster to try and deal with a crippling and unprecedented energy crisis. South Africans have been facing blackouts every day, which have badly affected homes and businesses, but what difference will this emergency measure make, if any?

MacroKurd11:36

MacroKurd11:36Its all about the budget this week. There is potential for a positive reaction as a lot of bearishness is priced in. We could see potentially a primary surplus this quarter with some revenue overshoot on the underspending. 0.4% ish perhaps vs -0.2% treasury outlook. This will help on the debt transfers to Eskom.

But the market wont really care too much about the token measures announced on the solar power projects etc until there is a credible plan of action. So short term the markets may get some relief, but long term, South Africa will constantly price risk premia in its markets as Eskom is a lingering risk without any credible solution yet. Plastering over the cracks never really works in the long term for EM.

Anjuli Davies11:38

Anjuli Davies11:38What other countries are on your watch right now?

MacroKurd11:42

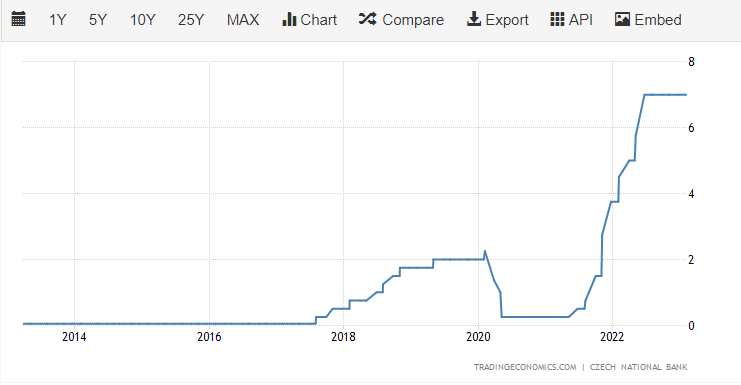

MacroKurd11:42Well have an eye on all really. In terms of what looks interesting. I think the EM places that could indicate a start of cutting cycle. I think this is grossly underappreciated to global markets. These central banks gave us an insight into where central banking was going during 2021/22. They were actually leading indicators for DM central bank policy making. I think we can see the same on the way down and the DM world may well take notice. The key countries to watch (apart form Brazil) are Czech Republic first then Chile.

Czech Republic has one of if not the best reputation in policy making credibility. When they signal a cutting cycle is to begin, its worth taking note. Chile was expected by markets to begin cutting in April but this is now pushed out to June. But basically watching the language from EM central banks is key here, likely over coming couple of months if indeed we get a clearer downtrend in inflation and inf expectations.

Anjuli Davies11:42

Anjuli Davies11:42So you don’t buy the thesis it’s a false dip in inflation ?

Interesting re Czech Republic I hadn’t realised they had such a reputation

Czech interest rates

MacroKurd11:48

MacroKurd11:48No I don’t. I think its taken longer then other cycles, but we are massively tightening money supply globally. So you have a huge amount of moving parts in the US, that can take a day of debate! But simply I think it has lags after the built up savings we have seen there and many places.

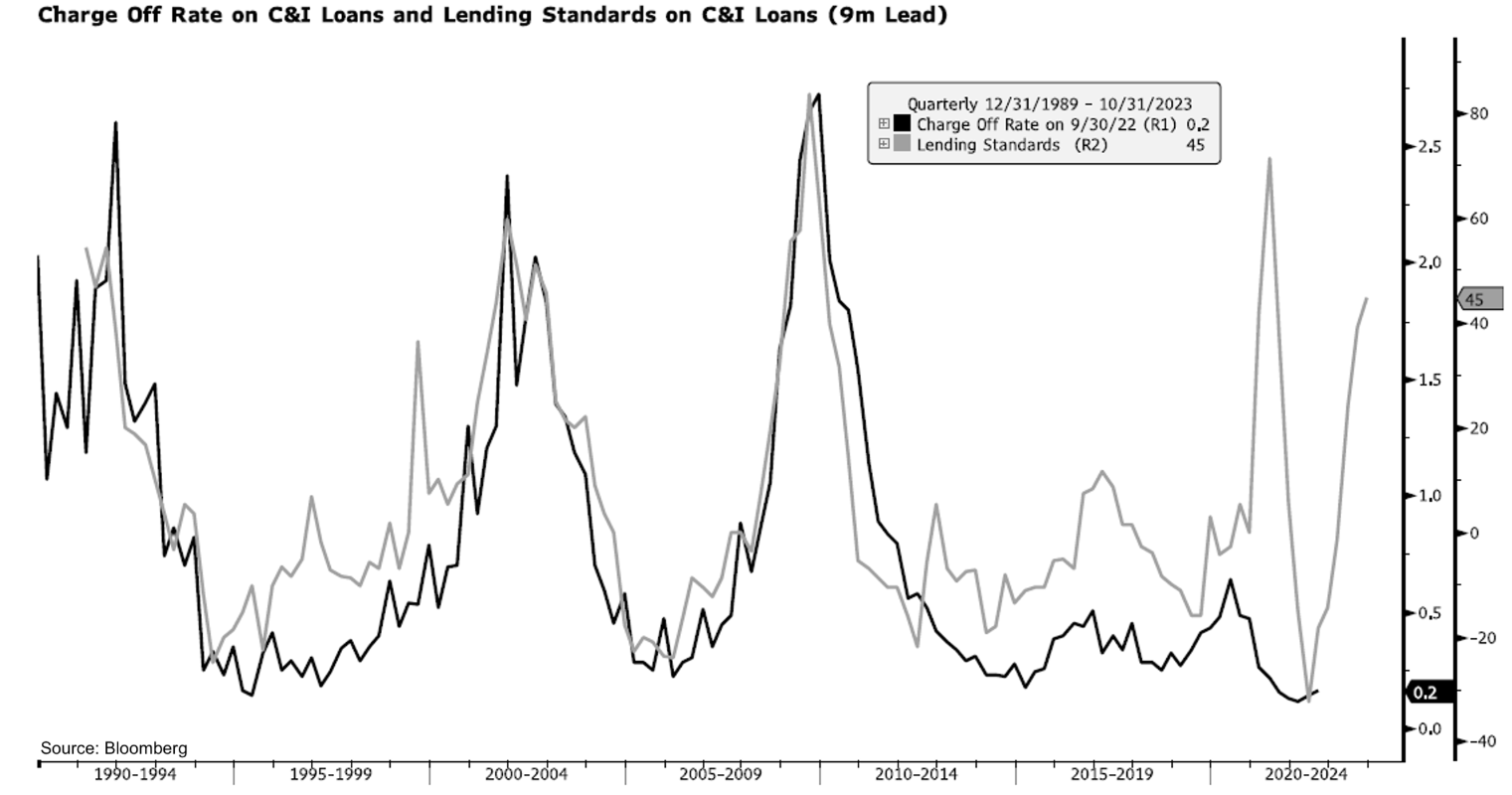

But I think the Fed data published last week on tightening of lending standards was a very important set of data. Its quite reliable historically as a leading indicator for where the economy is heading. It points to recession. I know employment has been the constant surprise, but people forget that employment is almost always v strong right at the beginning of recessions. I think this time will be even more so. Ultimately, in very basic terms, covid meant people were laid off and then was hard to get them back. So businesses were scarred and have been reluctant to let anyone go. That changes when your making a loss and revenues are weak. You hold on to labour at expense of capex and investments, until you cant any longer.

The main drivers that pushed inflation up are in reverse. I cant see how we get a resurgent inflation picture. But, one has to be humble about risks and I cant be dead certain in the view. Energy remains a major risk for sure. But the cycle is showing v traditional signs of cycles. Housing goes first, and ends with employment.

But think this too

China reopening

is a different risk

Anjuli Davies11:51

Anjuli Davies11:51

MacroKurd11:52

MacroKurd11:52I like that chart a lot. It’s v simple and telling

And its not just the US where that is happening

I also think of this

Anjuli Davies11:52

Anjuli Davies11:52IS all the stuff about Chinese spy balloons (and now UFOs) significant ?

MacroKurd11:54

MacroKurd11:54Investment banks don’t/didn’t have same extent of labour shortage. Unfortunately, everyone still wants to work at an investment bank out of uni (:-)). The labour supply hasn’t been as constrained. But the banks also tend to be v good forecasters of cycles. And the big rounds of cutting we have seen since last few months tell me the banks see a gloomy picture ahead

Anjuli Davies11:56

Anjuli Davies11:56@Clement that might be a good question to finish up on

MacroKurd11:59

MacroKurd11:59Yea. So EM won’t rally if inflation remains high and sticky in DM world. This is an important note to mention. What has changed structurally in the world? Essentially during the last 25 year or so, since China entered the WTO, we created a world of current account deficits vs surpluses. The US current account deficit rose while China created a current account surplus economy, essentially driven by selling products to the rest of the world cheaply using cheaper labour. The poverty rate in 1981 in China was 88%, today it stands at 0.7%. It created a massive middle income in China. It also rose other boats. It helped bolster the Asia bloc, and countries like Taiwan and Korea rose with big current account surpluses too

This all also benefitted Europe. The Asian bloc was buying Gucci bags, and BMWs and all the goods Europeans were making

So we had a world where there was big current account surpluses in Asia and Europe, vs a deficit in the US

Now that meant when they had current account surpluses, their savings exceeded their investments. And there was a limited scope of saving products for them at home

Sow e saw big flows form Taiwan lifers, Korean pension funds, European institutions abroad, to the US mainly

It helped run the big S&P rally over the last decade(s)

It helped bring down treasury yields and global rates (r*)

it trickled down the risk spectrum to US credit bonds, Ig then HY, and then at the bottom there, was EM

And that was a big benefit for risk assets and EM

So one can look at the world today and say well we are likely structurally changing. We have higher deficit spending in Asian blocs, we have Europeans that need to spend a lot more domestically on energy supply investments, green energy, defence etc

So debt will need to be issued and bought domestically

this comes at the detriment ultimately for the emerging markets that have relied on foreign flows funding their deficits

Anjuli Davies12:03

Anjuli Davies12:03So the last question as we are at full time – your twitter profile says Kurdistan, Wales and Trinidad – which one would you invest in?!

MacroKurd12:03

MacroKurd12:03so risk premia in emerging markets will be structurally higher, meaning more sensitive to cycles

hahaha great question…I mean I think I cant imagine 3 worse places to invest haha

But gun to head…Wales…

Anjuli Davies12:04

Anjuli Davies12:04That says it all…….

MacroKurd12:04

MacroKurd12:04In anticipation of a stop loss on Brexit few years down the line 🙂

Anjuli Davies12:04

Anjuli Davies12:04Well, it’s been fascinating, thank you so much for coming on and come back soon !

MacroKurd12:05

MacroKurd12:05Pleasure

thanks for having me!

Anjuli Davies12:05

Anjuli Davies12:05Bye everyone, until next week !

MacroKurd12:05

MacroKurd12:05bye

One Response