Today’s Spot Markets live session is with Dario Garcia, the Blind Spot’s assistant editor, who formerly worked as a corporate investigator for Kroll.

Comments from Izabella and Dario that address audience questions have been put in bold

Spot Markets Live – 08/08/22

Izabella Kaminska 10:58

Izabella Kaminska 10:58Hello there!

Anyone out there?

My usual seance tactic.

Howdy!

All seeing Graham here as well 🙂

good good

So hello and welcome back to Spot Markets Live, the real-time markets chat that takes you on a whirlwind tour of the markets.

We are now back every Monday at 11, with a hope to gear up more sessions around Sept/Oct. We are also hoping to do more impromptu sessions as and when markets bleed.

Those reading this in transcript form, if you fancy a login to help us expand the test over the weeks to come please email [email protected].

Today I’m joined by Blind Spot assistant editor Dario Garcia Giner,

Hello Dario!

Hello Izzy!

Izabella Kaminska 11:01

Izabella Kaminska 11:01Before joining me at the Blind Spot, Dario was a corporate investigator at Kroll. But he has given up on that world for the much less glamorous world of start-up journalism.

Dario is currently a nomad, so the living incarnation of the Work-from-home dream.

But Dario originally hails from Marbella, Spain, and is a fluent Spanish speaker obviously, as well as French and German.

How are you finding the transition to journalism?

The first thing to say is that it’s great to wake up without a knot of anxiety in my chest

Otherwise, I’m finding it both very fascinating and challenging to write for public consumption!

Much better than spending days or weeks on a piece of material for it to disappear into the netherworld of corporate boardroom politics

Izabella Kaminska 11:04

Izabella Kaminska 11:04Yeah, that must be weird. Doing all that work and finding out all those tidbits and intriguing factoids and not being able to publicly share them. Kind of the opposite of journalism.

Definitely.

Izabella Kaminska 11:04

Izabella Kaminska 11:04First a little housekeeping.

Blind Spot subscribers may have noticed the lack of an email this weekend. Unfortunately, I was struck down by a bug on Wednesday (just after interviewing Niall Ferguson) and have only just recovered.

If you haven’t seen the podcast you can view it here:

Niall clarifies the most important point: that his name is pronounced NEIL not N-ial (as in denial).

There’s also a good Trump impression there from him.

But really the takeaway for me is that Niall is structurally long bitcoin and crypto, and is kind of worried about the potential for nuclear weapon deployment.

But back to my absence: These are the perils of a start-up operation I’m afraid, and ironically one of the critiques I made of the Substack model was that people don’t anticipate things like sick leave or time off when they start those things.

Small Blind Spot announcement: I can report that I have now managed to raise a little bit of angel money. Don’t worry, TBS is still fully 100% controlled by me. It’s a 2-year convertible debt note. But it does mean we will be making some investments as of September, including a refresh of the website and hopefully some more people investments.

Can’t wait to see what comes from it!

Izabella Kaminska 11:07

Izabella Kaminska 11:07well, as it happens…

If you know anyone who is interested in joining a start-up journalism operation, do let me know. I am looking for young aspiring writers or maybe those transitioning from careers in the city and keen to have a stab at journalism/analysis. I’m also looking for affordable deals on web design and such the like. Feel free to email me on [email protected].

DO SPREAD THE WORD

We are building this together, and the objective is to maintain a discerning but open minded voice in the market for financial news.

I can also announce that on August 22 SML will be co-hosted by a former M&A reporter who I am hoping to convince to become a permanent fixture at TBS. This will be her trial run to see if it’s for her.

Izabella Kaminska 11:10Let’s proceed – though it’s a bit peak summer. So not the usual amount of quality tidbits. But we still have a few

Izabella Kaminska 11:10Let’s proceed – though it’s a bit peak summer. So not the usual amount of quality tidbits. But we still have a few

FTSE is up about half a percent at 7,470. The top gainer is Hargreaves Lansdown, up 7% – which looks like a relief rally following news on Friday that profits had fallen and business had slowed.

Here’s the story from the FT

Izabella Kaminska 11:12

Izabella Kaminska 11:12Yeah, interesting times for asset managers.

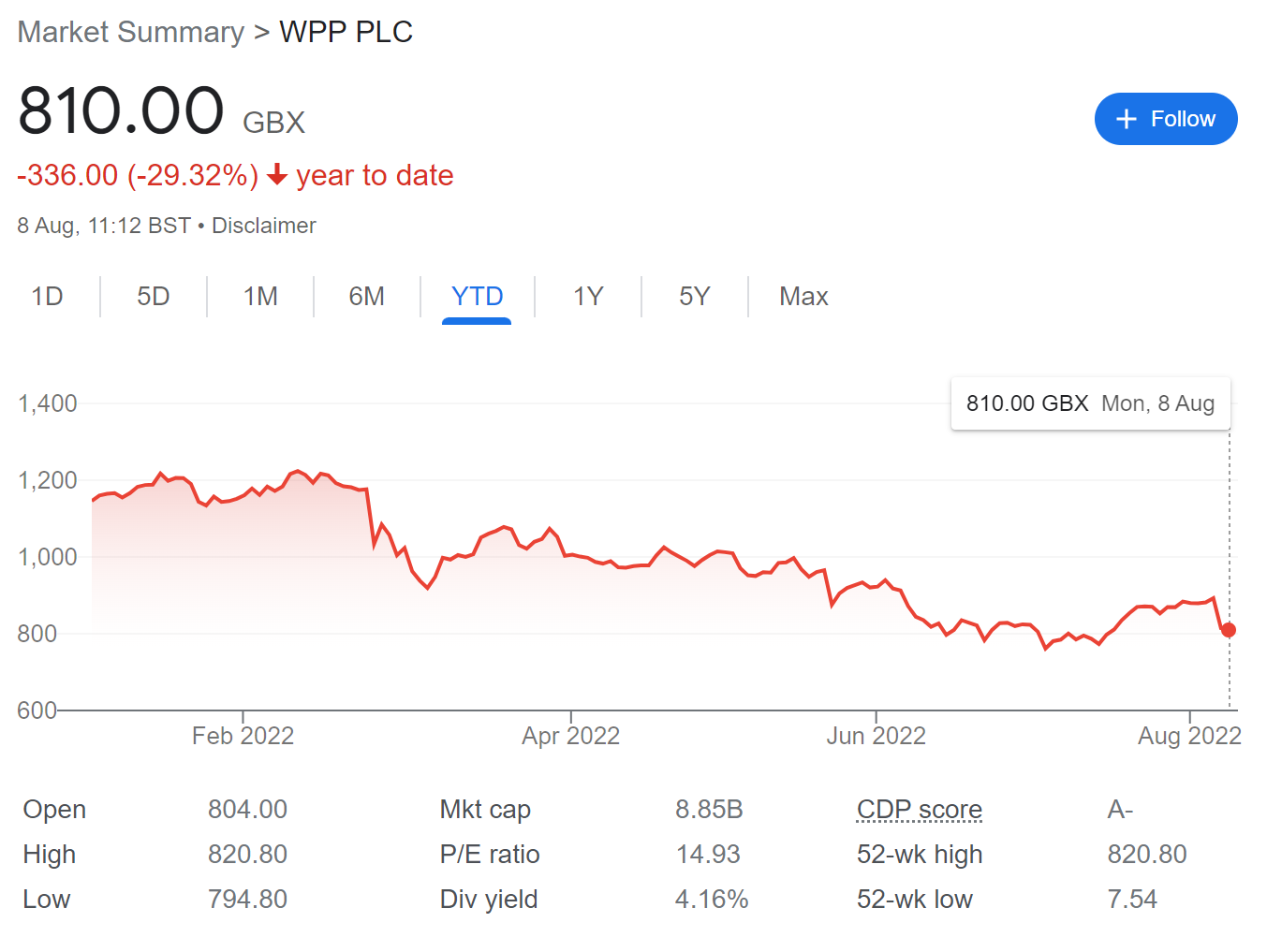

Top loser is WPP on ongoing concerns about the health of the advertising market

And here’s the FT story about that:

Izabella Kaminska 11:13

Izabella Kaminska 11:13Seems we may have chosen the worst time to start a journalism start-up ! Lucky we have subs and are not only ad-dependent.

Though ads would definitely be nice.

But what’s caught your eye this week Dario? You’re well into the memestocks no?

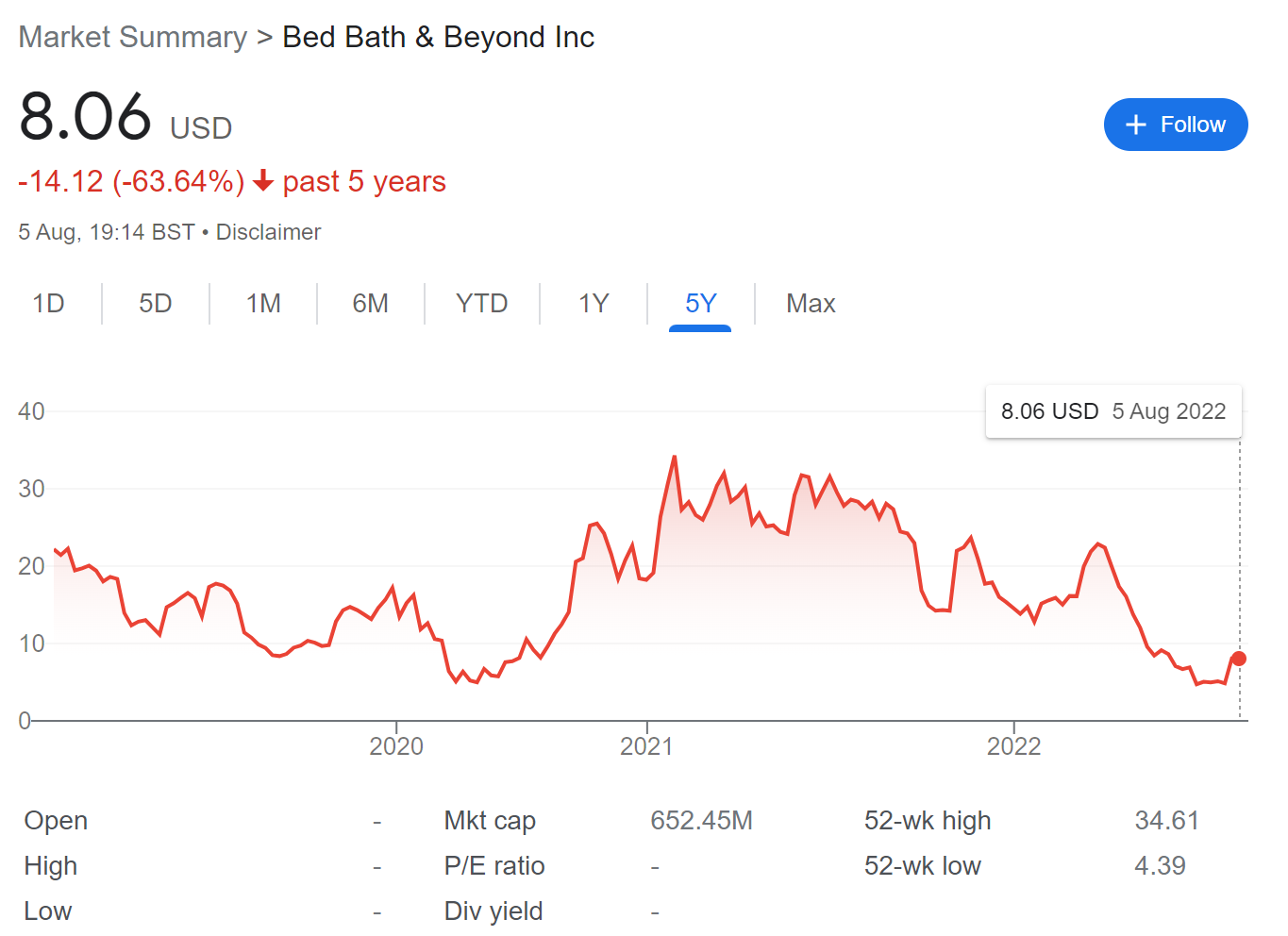

Well, my typical research buckets seem to have been crowded by the hype surrounding Bed Bath and Beyond (BBBY)

Izabella Kaminska 11:14

Izabella Kaminska 11:14BBBY is an American retail staple, right?

Exactly

Izabella Kaminska 11:14

Izabella Kaminska 11:14Not so much known here in Europe.

But what’s happening?

Shares for the American retailer bounced by 22% from Thursday through to Friday last week, buoyed by meming sentiment and speculation on behalf of a few YOLOers on Wall Street Bets, your Reddit go-to place for the worst type of financial advice.

BBBY is also listed on the Frankfurt exchange and is currently up by almost 13% today.

Izabella Kaminska 11:14

Izabella Kaminska 11:14Remind me what’s a YOLOer??

people who ‘invest’ (read: bet) with the philosophy of; You Only Live Once

Izabella Kaminska 11:15

Izabella Kaminska 11:15haha

didn’t know that

Izabella Kaminska 11:16

Izabella Kaminska 11:16Yikes. So what’s the rationale for buying it?

are there evil short sellers involved?

Remarkably narrative-light from what I can tell, compared to WSB’s quite politicised takes on the GME (and AMC) positions through 2021.

However, it is related to the previous meme stock pumps

Izabella Kaminska 11:16

Izabella Kaminska 11:16So they just like bathroom stuff.

haha

Well, they could definitely do with some more hygiene I’m sure.

This post, allegedly by one of the original BBBY hypers, claimed his purchase of BBBY stock was due to the interest that Ryan Cohen, the Chairman of Gamestop who acquired 10% of BBBY in March 2022, may be considering a full takeover of the company.

Izabella Kaminska 11:17

Izabella Kaminska 11:17But it’s been in the memestock universe for a while now, right?

It’s lurked in the background, but then again, so has practically every other stock that wasn’t GME or AMC

Izabella Kaminska 11:17

Izabella Kaminska 11:17I wonder how shorted it is

me too

but I think the real question here is what this says about the backroom question

Izabella Kaminska 11:18

Izabella Kaminska 11:18By which you mean?

Like with many of these meme pumps, the situation was likely engineered in dark private discord back-rooms for the benefit of a privileged few with the handles on the ‘hype’ mechanisms of Reddit’s WSB.

The hype appears to have begun in earnest over this weekend with a post by user u/TheDude0007, whose post showed his YOLO calls on BBBY have turned $ 45,000 into $ 500,000.

In a typical sus move, the post gained around 30+ awards within less than half an hour of its posting – which for all you non-Redditors in the chat, absolutely reeks of manipulation.

This isn’t the first time we see suspicious moves on this forum

Indeed, few noticed that the original GME pump, which famously began with u/TheRoaringKitty, also appeared to have been supported by individuals with insider knowledge of GME corporate announcements who formed part of private investing groups

we may write about these intriguingly forgotten posts in the future. 🙂

Izabella Kaminska 11:20

Izabella Kaminska 11:20Worth noting that Robinhood, like Hargreaves is also feeling the pinch. But more so to do with the crypto fallout.

That was from last week

Trading platform Robinhood is cutting nearly a quarter of its staff due to high inflation and the falling cryptocurrency market.

The company said the economic climate had reduced trading activity, which had boomed at the height of the pandemic.

The move comes after the firm reported quarterly revenues of $318m (£260m), 44% down on $565m a year earlier

A quarter! wow

Izabella Kaminska 11:21

Izabella Kaminska 11:21Meanwhile, Coinbase itself has had a bit of a rescue from a new deal with Blackrock

The Daily Hodl are very bullish on the deal

(Clearly not an objective outlet)

The FT meanwhile reports that Coinbase will be connecting to Aladdin.

Hopefully the magic carpet doesn’t run on ETH

Izabella Kaminska 11:22

Izabella Kaminska 11:22For those who don’t know about Aladdin, it’s one of Blackrock’s top risk management systems.

People sometimes misunderstand it though

A good primer on Aladdin is in this little Adam Curtis snippet from hypernormalisation

Go to 1.18 for the AC spin on it

But those who actually work in finance … didn’t like that account very much.

They say Aladdin isn’t a giant forecasting machine

Here’s how it was explained to me by people in the know

Aladin is a portfolio managment system used by many, many firms. Aladin and its competitors do not make investing decisions. They have functionality that helps you keep portfolio correctly balanced etc, It is not the Borg

So it aids portfolio management, and being able to plug into something like Coinbase means that all the portfolio managers who use Aladdin will be able to input and manage — almost like with APIs — their trades and positions seamlessly through the system.

Does this function as a market indicator of what BlackRock thinks of the crypto crash?

Izabella Kaminska 11:27

Izabella Kaminska 11:27Here’s the actual announcement from Coinbase btw: https://blog.coinbase.com/coinbase-selected-by-blackrock-provide-aladdin-clients-access-to-crypto-trading-and-custody-via-b9e7144f313d

So what is Coinbase principal trading? That is a great question.

If you look at their results in detail, you will note there is an entry that allows for Principal positions

I wrote about it here;

Other revenue includes the sale of crypto assets when we are the principal in the transaction. Periodically, as an accommodation to customers, we may fulfill customer transactions using our own crypto assets.

As to why Coinbase and not Binance, having investigated some matters in the crypto world, I could just say that some of the allegations I heard would rock most crypto nerds’ pants

And not in the good way.

Regarding Binance, I mean.

Izabella Kaminska 11:31

Izabella Kaminska 11:31That is a mental image I hadn’t accounted for

But generally speaking, Coinbase Prime is where I suspect a lot of “institutional learning” is going on. And I’m surprised that Blackrock would be ready to partner up. I heard on the grapevine that the regulatory cbank world was not too impressed by the entry of Ruffer into bitcoin.

They didn’t get fined or anything, but word on the street is that they were told; the next time you want to do this, please run it by us. And the likes of Blackrock were very much watching from the sidelines to see how that all went down.

Of course, crypto’s winter is ongoing for now. Last I checked the market cap is now at about $1trillion vs a peak of I think about $3trillion

But in case you missed it, Michael Saylor – formerly the CEO of Microstrategy — is now the executive chairman.

And this role change has absolutely nothing to do with the oversized bitcoin losses the company has generated… according to Saylor

Here’s that story

Anyway can’t find it now, but definitely read that he was denying the move was related. Which seems a bit of a stretch.

What about Tesla and its Bitcoin holdings?

Tesla is down almost 7% today in pre-market

Friday’s smaller losses on the stock forced Tesla CEO Elon Musk to deny reports he was planning to build a private airport for the company

What’s going on?

Izabella Kaminska 11:39

Izabella Kaminska 11:39So Tesla also took a bitcoin loss – $170m worth in the first six months of the year. It still has about $222bn.

That’s despite getting rid of about 75%

here’s The Street on it on July 25:

In a Securities and Exchange Commission filing published Monday, Tesla said the value of its digital assets — including bitcoin and dogecoin — were set at $222 billion as of June 30. Tesla took an impairment charge of $170 million on its bitcoin holdings for the first six months of the year, while recording a $64 million gain from converting its bitcoin into fiat currency. Musk also indicated the company continues to hold the digital dogecoin, but did not indicate its value or amount.

Amazing really

but the other bad news stalking Tesla is the fact the costs of the Cybertruck are going up as well as many of its actual non-vapourware cars too.

Which is a good pivot point to….

The Inflation Reduction Act!

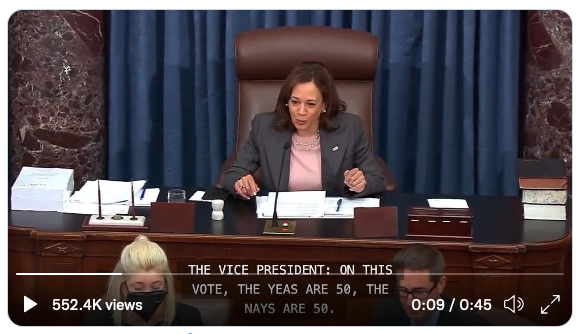

The big news over the weekend is that the Senate has passed Biden’s Inflation Reduction Act, which allocates $738bn for healthcare and fighting climate change.

Here’s the moment Kamala passed the act with her deciding vote:

Not sure how positive of an outlook it is to have such a key bill passed with the VP’s deciding vote

I wonder how it will perform in the House

Izabella Kaminska 11:43

Izabella Kaminska 11:43The run-of-the-mill commentary is that this is a win for the ESG megatrend.

Here’s some commentary from Nigel Green, CEO and founder of deVere Group, an independent financial advisory group:

“The legislation, which is designed to reduce carbon emissions and move consumers to cleaner energy, amongst other factors such as cutting prescription drug costs for the elderly, will shift the world’s largest economy forever towards a greener future.

“Global ESG assets are on track to exceed $53 trillion by 2025, according to Bloomberg Intelligence, representing more than a third of all assets under management.

“Now, due to the momentum that will be created from this landmark bill, we expect ESG assets to take an even greater proportion of the $140.5 trillion in projected total assets under management.”

Before the start of the new decade, according to Nigel Green, most investors considered ESG investors as ‘woke’ but this has now changed.

“These investments cannot any longer be dismissed as woke or whimsical.

“In fact, I believe that every investment portfolio should have exposure to ESG if the investor is serious about building long-term wealth.”

But personally, I’m a little baffled by why this is called the Inflation Reduction Act.

The idea this is going to be good for inflation seems silly. Though… I did a little research about the etymology.

And it turns out the name is somewhat comically misrepresentative

According to the Hill:

…the projected increases in tax revenue are larger than the projected increases in spending, the legislation would (eventually) reduce the government’s budget deficits. This deficit reduction is being touted as anti-inflationary. Additionally, the bill would allow Medicare to negotiate drug prices, which is supposed to reduce health care costs, and the energy investments are intended to slow energy price increases.

So why is the “Inflation Reduction Act” such a problematic name? Even if all of these policies work just as intended, Congress has already delegated price stabilization to the Federal Reserve. Central bank independence requires that the Fed be allowed to pursue its price stability mandate — which it interprets as 2 percent annual PCE inflation — regardless of what Congress and the president do. In other words, no matter the stance of fiscal policy, the Federal Reserve is expected to use monetary policy to keep inflation near its target over the longer run. Central bank independence is a valuable norm that is intended to promote macroeconomic stability by keeping politics out of monetary policy.

So it has very little to do with current inflation — and is a bit of misdirection as far as I see.

[Post script – Worth noting that Larry Summers has since tweeted that he thinks it will be anti-deflationary.]

so Inflation Reduction Act coming from the US Govt is a contradiction in terms

And the latest news from Tesla is indicative of that contradiction, no?

Izabella Kaminska 11:47

Izabella Kaminska 11:47Exactly. Just because it’s green doesn’t mean it’s anti-inflationary. In fact, it is possibly quite the opposite.

See the price story at Tesla

Tesla has recently raised prices (again) for its non-vaporware lineup of EVs — except for the Model 3. And the company caught a bit of good news when it was revealed that the new climate deal put forward by Senate Democrats, if passed, would eliminate the cap of 200,000 vehicles sold to trigger a phaseout of the $7,500 tax credit. Tesla was the first automaker to sell 200,000 EVs, triggering the phaseout back in 2018.

Also, related but unrelated… I recently came across what lithium Leach fields look like.

have you ever seen those?

no!

That’s from Euronews.

It’s oddly beautiful in a blade runner, dystopian kind of way

Izabella Kaminska 11:49

Izabella Kaminska 11:49

It’s an amazing fabric of brightly coloured dystopic chemical-looking fields. And it really reminded me of the landscape I saw in post soviet Azerbaijan, where travelling around Baku you would encounter these amazing fluorescent pools of sludge and god knows what. Bright green and pink. And this was typical of the environmental pollution from that era. So I, as a blind spot type person, am always worried about externalities. And the IRA is only going to put more pressure on the lithium market.

Here’s a good Bloomberg story about the run for lithium. Not a new story, but only going to get more important on the back of this legislation

Moving on…

Izabella Kaminska 11:54

Izabella Kaminska 11:54Let’s finish off with inflation; so last week we had a lot of inflation news…

The BoE obviously lifted rates last Thursday by 50 basis points, and we had an absolutely dire outlook from Andrew Bailey, the governor of the BoE.

Borrowing costs are now at 1.75% (though actually, the Bank Rate is a deposit rate, but that’s another story)

Soaring energy costs are behind the move. And the BoE thinks inflation will peak at 13.3% in October before falling to 2% by 2025.

Do we trust them? I don’t think so. The whole BoE balls up are on another level. One of the reasons I don’t think the reading is right is because I don’t think labour market tightness is normal labour market tightness. I think cbanks have been slow to factor in very structural changes in the working economy, among the rise of the gig economy, and the recent WFH phenomenon which has allowed lots of workers to generate huge savings by moving out from expensive rent/property areas.

Dario – how much money are you saving by not going into the office?

Too much!

Izabella Kaminska 11:56

Izabella Kaminska 11:56Hence I can afford you

😜

But seriously, Dario is a good example of someone who can take advantage of the WFH phenomenon to potentially transition into a more aligned or rewarding industry in his mind (I hope!) in a way that might not have been possible before WFH.

And there are lots of people like that

In my mind, its the one truest blessing to have come from the covid/lockdown fiasco

Izabella Kaminska 11:57

Izabella Kaminska 11:57That the labour market is tight doesn’t necessarily prevent a financial collapse or recession. For now, the capacity of wages to keep up with inflation remains muted, especially in the white-collar sector where pay reviews are annual. Real interest rates might still be negative but that doesn’t matter much if the capacity for earnings isn’t going up with it.

This is just very different. And I find it very weird that people are looking to precedents in western inflation history rather than precedents in other economic models or non-western examples.

You keep hearing, oh this is like the 1970s…

but what if it’s not a period comparison that matters, but a framework one?

What if the issue is precisely the wrong kind of tightness, a concentration of white-collar labour in unproductive, inefficient jobs and outside of the practical, problem-solving blue-collar world.

I have friends in top consulting firms, Bain, BCG, Mckinsey etc. and across the top of the white collar industry, I’m told of analysts either having to fight for work or putting their feet up on their desk and playing minesweeper.

Based on my anecdotal evidence, work appears to have started to dry up across the top of the white-collar consulting industry. I wonder what it’s like on the lower levels.

Izabella Kaminska 12:00

Izabella Kaminska 12:00Exactly, this is why I compare it more to the collapse of the USSR.

That was a high inflation supply-side (capital misallocation based) phenomenon, in the context of basically full employment.

Because everyone who wanted a job had a job in communism. But as David Graeber might have noted, loads of these jobs were merely bullshit jobs. Or worse, jobs devised solely to be gatekeeping rentier corruption bribe collecting jobs.

Which accurately contextualises the old Spanish joke, that it takes 50 Soviet workers to sweep a small kitchen.

Izabella Kaminska 12:01

Izabella Kaminska 12:01Exactly

lovely joke

This brings me to the reaction to the tighter-than-expected labour news from the US on Friday.

As Steven Englander at Stanchart recently pointed out the tight US labour market stats are doing little to support the dollar despite pushing yields higher.

The very strong July US labour-market data – a downside surprise to 3.5% (expected 3.6%) on the unemployment rate, and upside surprises on non-farm payroll (NFP) growth (528,000 versus 250,000 expected) and hourly earnings (0.5% m/m versus 0.3% m/m expected) produced the expected results in fixed income. Through 2PM ET, 2Y and 5Y UST yields rose 16bps and 10Y 14bps. US equity futures were down 0.7% in the aftermath of the release.

The bigger surprise was the tepid FX response. BBDXY was up about 0.5%, with the JPY the big loser. However, a fair number of high-beta G10 and EM currencies showed much more modest moves (Figure 1).

The puzzle of the limited FX market move is even deeper because almost all the fixed income move was in real yields. Inflation breakevens barely moved in response to the data; we normally think of real yields as being the most powerful driver of currencies. Similarly, the equity-market fall should have spurred bigger USD gains, in our view.

He suspects this is a signal of USD-buying fatigue. Although as noted above the trend doesn’t fit the usual pattern.

Related but unrelated, it’s interesting that last week Uber finally reported its first cash flow positive results.

Hubert Horan, who I have cooperated on extensive uber analysis with before, wasn’t sure how this was possible. His latest on the numbers can be found here.

Ironically, this is after possibly the worst year for Uber users ever, with insane price hikes, long waiting times, and other weird shenanigans.

Izabella Kaminska 12:06

Izabella Kaminska 12:06Here’s his latest take

What I did discover in the taxi home from the airport, is that according to new terms and conditions here in the UK, uber now doesn’t reveal the price it is charging to customers to its drivers. Many have shifted to other apps, because after being deemed full-time workers, Uber seems to be clawing back the costs to cover holiday pay and such the like from their margins. Which have collapsed. And the fact drivers can’t see what Uber is charging customers just adds salt to the wound. I have not confirmed this, to be clear. It’s just what I was told. But it does seem to support what’s going on the ground.

In London, it’s increasingly hard to source an Uber, so the increase in cashflow could simply be a result of higher margins, even if overall bookings are decelerating. (The recovery from Covid is possibly obscuring the deceleration).

One last point before we finish…

What’s that?

I can confirm; I noticed that recently when looking at my Uber driver’s phones and they were given other options for pickups at the end of my journey, the prompt did NOT disclose pricing (Spain and Portugal). Take that as you may.

Izabella Kaminska 12:10

Izabella Kaminska 12:10So sounds like the margins have shifted.

But the last point to finish off on…

I for one am still befuddled by how central bankers got inflation so wrong

but if you haven’t caught this it’s worth a read.

this is really worth a read

It explains how Mary Daly came across her damascene inflation moment

It happened when she was in Walgreens

Mary Daly, being a top Fed official…

FYI this was from December 2021

SAN FRANCISCO — Mary C. Daly was in line behind a woman in her neighborhood Walgreens in Oakland, Calif., this fall when she witnessed an upsetting consequence of inflation. The shopper, who was older, was shuffling uncomfortably as the clerk rang up her items.

“She starts ruffling in her pockets, and in her purse,” Ms. Daly said in an interview. “And she says: This is a lot more expensive than it usually is. I buy these things — these are my monthly purchases.”

The woman had to put something back — she chose potato chips — because she couldn’t afford everything in her basket.

I am revisiting this because I think one of the big problems with our communications systems these days is that journalists do not do on the ground reporting anymore.

This trend has been exacerbated by WFH, and Covid.

And while you occasionally get TV crews doing packages from high streets, they’re fairly spurious and sensationally oriented to coincide with government or cbank announcements.

This is why, here at the blind spot, we will start a high street series from all over the world.

Dario is on a bit of a world tour, so he is going to be popping into stores and asking retailers key questions from all over Europe (and maybe beyond) to get an accurate indication of the feeling on the ground. But also how retailers are planning to cope.

And if you want to be part of our “democratisation of shopping experiences to make benefit of inflationary realisations for Fed and other central banking officials” do get in touch.

hahaha!

Izabella Kaminska12:16

Izabella Kaminska12:16We will be posting a collection of shopping experiences and anecdotes.

But I may have to work on the name.

we are 16 minutes over!

So thank you for joining us.

thank you, everyone!

Izabella Kaminska12:17

Izabella Kaminska12:17We will see you next Monday

Take care

Comments

11:44 RR: It’s called the IRA to please Manchin, plain and simple

11:28 C: Hadn’t come across The Daily Hodl. Bewildering how many crypto publications there are. Good morning by the way.

11:28 RR: Why coinbase? Why not binance? Wonder what the terms of the deal are

11:26 RM: Blackrock is ok with Coinbase principal trading?

11:09 GH: All small businesses are more susceptible to people things, hopefully it is only at the beginning 🙂

11:07 RF: Congratulations

11:07 GH: Congratulations that’s great news!

10:59 GH: Hi Izzy, we are here keeping an eye on things

10:59 RF: Morning!

2 Responses