..

Izabella Kaminska10:59

Izabella Kaminska10:59Morning everyone

Morning everyone

Izabella Kaminska11:00

Izabella Kaminska11:00I’m here (a little bit in stealth mode) to learn what’s going on.

It seems like a nervous calm has swept through the market.

I started the week telling people never say never about Deutsche going down, but now it seems like the panic was a storm in a teacup based on the illiquidity of the CDS market..

Frances, did you see this from the FT about how the CDS market just isn’t what it used to be?

The European Central Bank’s top supervisor has claimed “opaque” trading in credit default swaps is harming banks’ share prices and could threaten a run on deposits. Andrea Enria, chair of the ECB supervisory board, called for a review of the market after sharp moves in the prices of CDS preceded a sudden drop in the shares of Deutsche Bank and other European lenders last Friday. “With a few million you can move the CDS spread of a trillion-euro-asset bank and contaminate of course stock prices and possibly also deposit outflows,” Enria told a conference in Frankfurt. “So that is something that concerned me a lot.”

I’m not sure the CDS market was ever much more than a betting shop

Izabella Kaminska11:01

Izabella Kaminska11:01So what’s different this time with CDS?

Why has the liquidity disappeared? Do we know?

FC: This report from Bloomberg makes the point even more strongly. https://www.bloomberg.com/news/articles/2023-03-28/a-single-bet-on-deutsche-bank-s-cds-is-seen-behind-friday-s-rout?sref=3roVJZZ4

Izabella Kaminska11:02

Izabella Kaminska11:02Crazy no?

It reminds me of the time Glencore CDS exploded randomly and nobody quite knew why. And I think even now we still don’t really know/

Of course, the CDS market did lose the great Blythe Masters for blockchain business, so maybe that’s the problem?

????

It’s hard to take seriously a market that can be moved that much by a single trade.

But it’s worrying for banks.

Izabella Kaminska11:04

Izabella Kaminska11:04Are there any rules about having to own the bond before you buy CDS? or can you still speculate? I remember that used to be a debating point.

Anyway, European markets are up on the back of all those lovely guarantees that are pushing the global liquidity situation comfortably above the lowest comfortable reserve threshold – even as cbanks continue to lift rates.

All green today

But there’s been some news on Unicredit

UniCredit gets ECB approval for 3.34 bln euro share buyback

Isn’t that supposed to make the share price go up?

I thought so, but everything is weird now

Izabella Kaminska11:07

Izabella Kaminska11:07Here’s the FT story

DB called a T2 bond early, which also should have made investors feel good, but instead they panicked

Izabella Kaminska11:08

Izabella Kaminska11:08The European Central Bank has approved UniCredit’s plan to significantly increase the amount it is returning to shareholders despite the banking sector’s recent turmoil. Italy’s second biggest bank said on Tuesday that the ECB had signed off on its €3.34bn share buyback programme for 2022. Together with a proposed dividend, UniCredit will distribute €5.25bn to investors, a 40 per cent increase on 2021’s levels. The approval is a significant boost for the bank just days ahead of its annual shareholder meeting, when investors will need to approve the planned dividend and the timing of the buyback programme.

The chart i really find fascinating with respect to the current mismatch between market valuations and actual bank performance is this one:

Eh @richard are you calling for the return of Glass-Steagall?

Izabella Kaminska11:10

Izabella Kaminska11:10Seems to me that inevitably there has to be mean reversion here? Either RoE is going to collapse or the Price to BV has to go back up.

So which one will it be?

It’s either a signal that there is mass asset deterioration and income collapse to come…

or it’s a signal that the market is underpricing bank stocks on a massive level.

I’m going to side with the former.

So am I

Izabella Kaminska11:11

Izabella Kaminska11:11And I guess what’s really spooking the market now is commercial real estate.

Frances, you’ve been looking at some broader indicators as well?

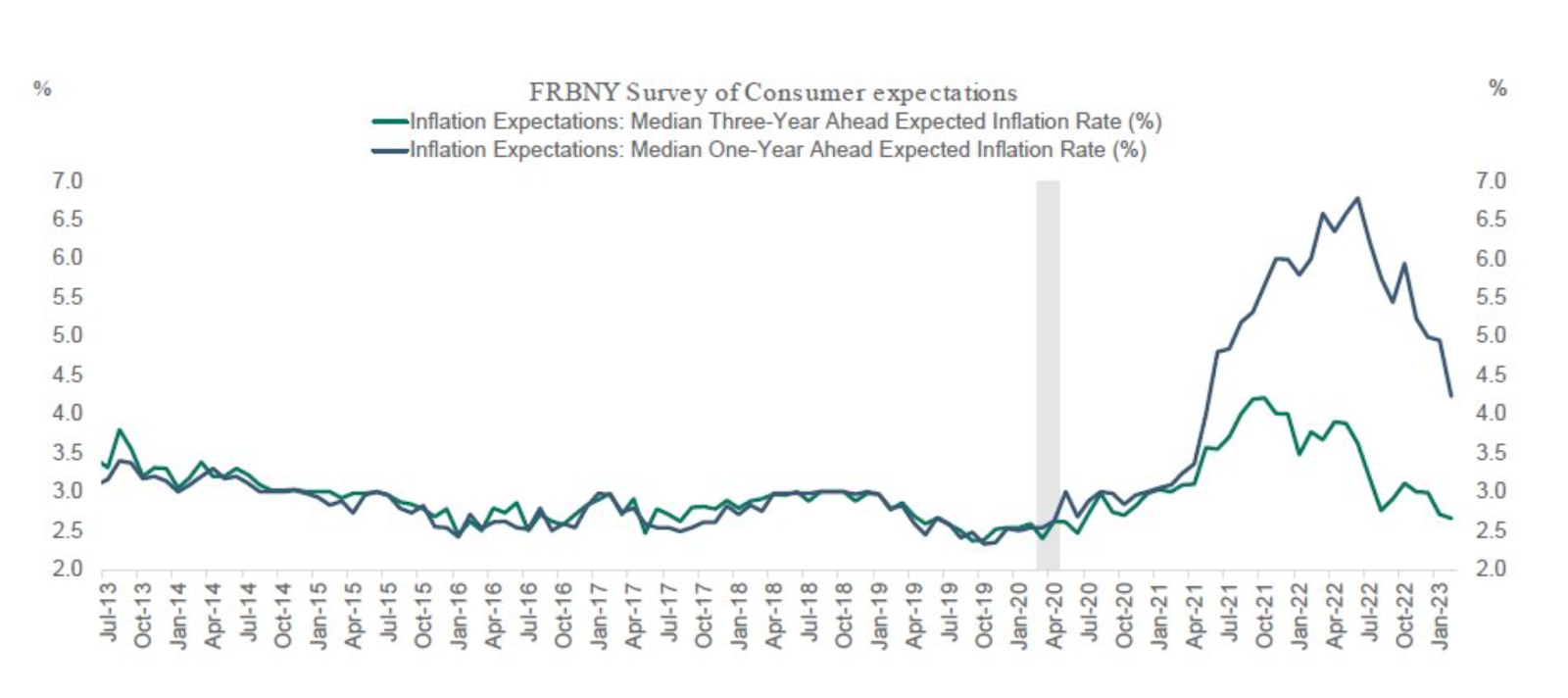

Federal Reserve Bank of New York published its survey of inflation expectations yesterday. Quite a sharp decline…

Fed rate hikes seem to be working, but this comes at a cost. The Philly Fed surveys I posted yesterday show manufacturing activity actually contracting and services growth slowing rapidly.

side note: falling business activity will feed through into falling CRE prices…

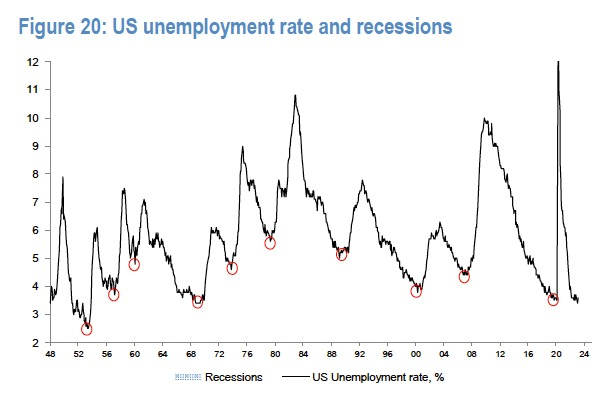

And also into higher unemployment. Unemployment is low by historical standards but that can change rapidly.

Claudia Sahm’s “rule” says that NBER recessions are always predicated by a sharp rise in unemployment.

(Claudia Sahm, former Fed economist)

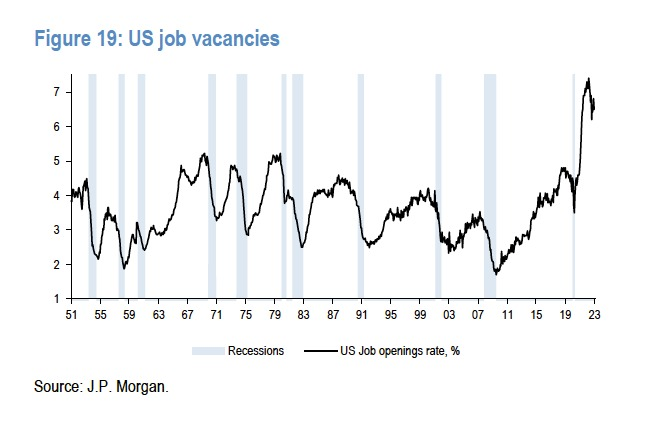

Job vacancies have been high but are now falling:

Izabella Kaminska11:16

Izabella Kaminska11:16also this is interesting:

ouch

Izabella Kaminska11:16

Izabella Kaminska11:16So fewer companies are hiring construction workers…

Which is a bad signal for commercial real estate, and housing generally.

And for the economy more generally

in the US, construction is a leading recession indicator

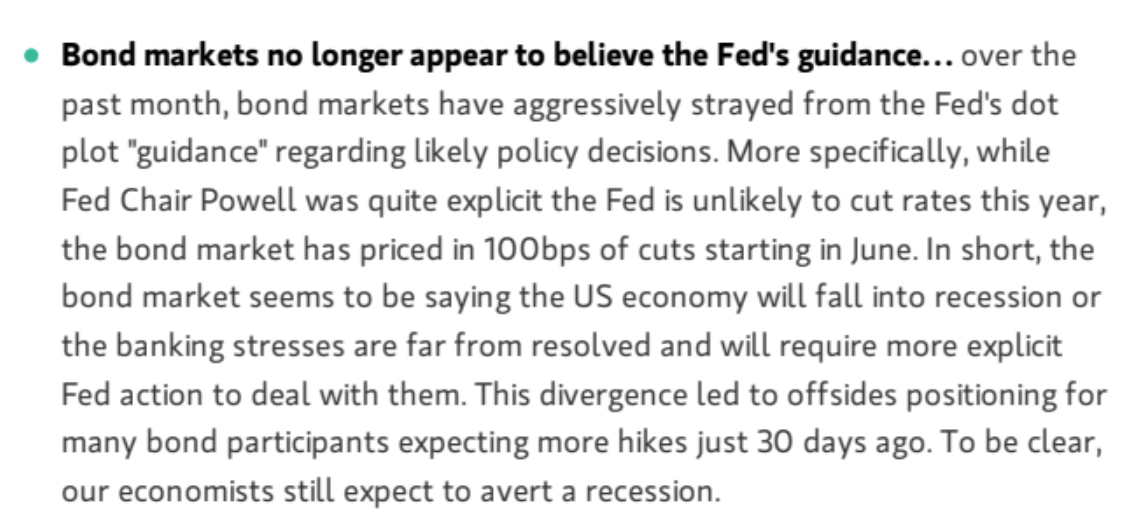

The Fed is signalling more rate rises to come, perhaps to prove that monetary policy is independent of banks and markets. But according to Morgan Stanley, bond markets are pricing in 100bps of cuts from June.

I think Morgan Stanley’s economists are a bit optimistic.

We’ve seen standoffs between bond markets and central banks before, and central banks rarely if ever win, though they usually claim their eventual climbdown was a deliberate policy change in the light of new evidence.

Izabella Kaminska11:19

Izabella Kaminska11:19***SOME MULTIPOLAR NEWS INCOMING***

Izabella Kaminska11:21

Izabella Kaminska11:21Looks like Rosneft is cosying up to India, and pushing for national currency payments. Does it matter?

Speaking of commodities and fuel, the situation in Kenya is also pretty interesting

A few days ago there was a speech that went a little bit viral by Kenya’s president William Ruto

Here’s the background:

President William Ruto signaled last week that the central bank and commercial lenders are working to remove distortions in the interbank market that have exacerbated a shortage of foreign exchange in East Africa’s largest economy. Currency trading between Kenyan banks dwindled in recent years because of central bank pressure on commercial lenders to prevent the shilling from weakening too quickly.

Some more wire news:

Izabella Kaminska11:25

Izabella Kaminska11:25Also we have some news from the BoE’s Financial Policy Committee

I’ll be very interested to see what that LDI guidance is. Like, “don’t”?

Izabella Kaminska11:27

Izabella Kaminska11:27If you ever wonder how this wire news comes out so quickly, it’s because they still do journalistic “lock-ins” (even in the modern digital age).

Where they invite you into a bunker, confiscate your phones, show you the news, let you prep it, and then.. RELEASE THE KRAKEN at exactly 10.30

End the practice of leveraging up to cover scheme deficits

I hope

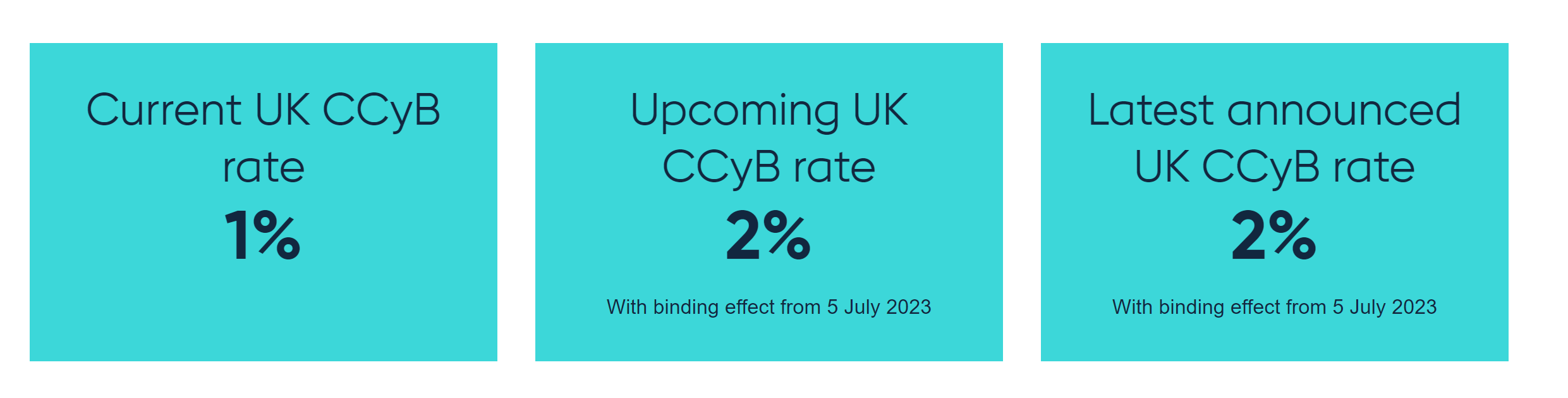

So sounds like pretty big news that the capital buffer is staying at2%

I think the idea was to close the stable door anyway just in case the horses came back, @helmholtz

Izabella Kaminska11:28

Izabella Kaminska11:28because Bailey indicated yesterday that if there was a real concern, the first thing they would do is RELEASE THE BUFFER

like they did during Covid

2% is no change, i take it?

If anyone knows otherwise, then speak now or forever hold your peace.

ahhhh…. !

Frances is making funny noises

Turns out it’s an increase

From July

Izabella Kaminska11:30

Izabella Kaminska11:30They are raising the countercyclical buffer?

This looks like a response to the banking stress

Izabella Kaminska11:31

Izabella Kaminska11:31I don’t understand. I thought in a crisis you lower the buffer? And release the capital ?

You raise the buffer when risks increase

Izabella Kaminska11:31

Izabella Kaminska11:31Ok, now i understand

it is making them reserve more on the assumption we are still in a period where you can do that ????

So it’s prelude to a crisis, rather than in a crisis.

Not reserve more. Making them de-risk

They either have to reduce their risk-weighted assets or raise more capital

Izabella Kaminska11:33

Izabella Kaminska11:33Ah, got it

so they have to de-risk – which presumably on this occasion means they have to hedge their interest-rate risk?

Or sell some stuff

Izabella Kaminska11:34

Izabella Kaminska11:34right

Here’s a question for the rabble, if you are a German financial institution with a lot of negative-yielding debt on your H2M portfolios, how exactly do you hedge a negative yielding bond?

Because you can’t really swap fixed-for-floating can you? Or can you?

It makes my head hurt

While I await enlightenment, just a note to say ECB’s Lane has been speaking (via POLITICO):

FRANKFURT – The eurozone is unlikely to see a major accident on financial markets, European Central Bank chief economist Philip Lane said in an interview published today, adding that interest rates will likely continue to go up.

“Of course, we are monitoring developments closely and are vigilant, but we do not believe that the same situation as in the US or Switzerland is the most likely scenario here in the eurozone,” Lane said in an interview with Germany’s Die Zeit. “We have no reason to believe that a major problem will arise.”

Should this be the situation, the ECB will continue to lift rates, Lane said.

“In our base case, further rate hikes are needed to ensure inflation falls to 2 percent,” he said. “If the financial stress we’re seeing, while not zero, is proving to be fairly contained, interest rates need to go even higher.”

Again, personally, as an ancient historian, i would never be so confident as to say such things, as the gods tend to frown on such overconfidence and reward with hubris.

But there’s also some news from Brussels (also via POLITICO):

The European Commission will bring forward changes to the rules for mid-size bank failures on April 18, according to the latest agenda for the College of Commissioners.

The plans were pulled at short notice in March amid tensions with EU capitals over national fears of being on the hook for losses in another country.

But the banking crisis may have reignited the impetus for the reforms following a series of bank failures in the U.S., including tech lender Silicon Valley Bank, and the demise of Credit Suisse.

The EU’s reforms aim to bring more mid-size banks into the resolution framework, so that shareholders and creditors rather than taxpayers bear losses in a collapse.

This is following them dropping the whole banking union thing from their agenda just before the crisis

@helmholtz – that’s what i thought! So it’s all very well them urging banks to derisk, but there’s nothing you can do if you’ve acquired negative yielding bonds and can’t sell them in the market now.

So you’re trapped materialising losses either way

@graham halliday – yes a negative yielding bond

I want to cast some shade at the BoE

That countercyclical buffer increase looks like a nothingburger to me

Because it doesn’t address the problem that the US banks encountered

The US banks had enormous quantities of zero-risk-weighted government securities, mostly in HTM portfolios.

So they had massive Tier 1 capital ratios – Silvergate’s was over 50% when it failed

But if you sell or pledge securities to raise money to meet your obligations, the maximum you can raise is the market value of the bond, not the face value

So they couldn’t raise enough money from those bonds to finance the catastrophic runs they suffered

Tweaking capital ratios doesn’t solve a liquidity problem caused by fair value losses on HTM securities

when those securities are zero-risk weighted anyway

So I’m not sure what risk the Bank of England is trying to head off by raising the CCyB

Izabella Kaminska11:44

Izabella Kaminska11:44I always thought that negative rates were going to end up doing very weird and awful things to the financial system. When they were first implemented there was a little bit of concern about whether bank spreadsheets could handle the negative numbers, but when they did everyone forgot about it all and went on their way as if it was totally normal to pay people to borrow money from you. But really, as with QE, the real risk with all these things was at the exit point, when inflation is back and rates have to rise again. So now we have how much negative-yielding debt out there in the system?

How much negative yielding paper is out there in the system and being held to maturity? And what was the longest duration of negative paper?

I would have thought it needed to look at the LCR and the composition of HQLA

Izabella Kaminska11:44

Izabella Kaminska11:44yes, and that’s what Sam Woods hinted at yesterday. Saying the LCR should be reviewed.

But really this gets us back to the point that the system itself seems to be crying out for full-reserve.

Izabella Kaminska11:45

Izabella Kaminska11:45this is absoltuely amazing really

we have a banking crisis of solvent banks

Even bailey said yesterday that Credit Suisse was likely solvent.

Helmholtz has it. It’s the LDI issue. Sudden liquidity demand when your assets consist mainly of safe long-term illiquid securities

Izabella Kaminska11:46

Izabella Kaminska11:46But on a much wider basis than what we saw in the UK

securities that are inadequately hedged – or not hedged at all – because they are “held-to-maturity”

Izabella Kaminska11:48

Izabella Kaminska11:48Speaking of SVB and american banks

On the First republic story, someone pinged me that it’s worth checking out who their clients are.

And if that’s why there’s been a rush to rescue them.

Here’s one indicator

Facebook founder Mark Zuckerberg obtained a First Republic 30-year mortgage of $5.95 million on a Palo Alto, California home at an interest rate starting at 1.05%, according to a 2012 Bloomberg article. Other customers have included Instacart founder Apoorva Mehta, investor Chamath Palihapitiya and real estate developer Stephen M. Ross, according to bank promotional materials.”

@graham MBS problem speaks to stress in the mortgage market – another indicator that the outlook is worsening

Speaking of American bank failures, the crypto people are up in arms about the seizure of Signature Bank NY

They are claiming it is all part of a federal conspiracy to choke off access to banking for crypto companies and traders

They call it Operation Chokepoint 2.0

They say SBNY was a solvent bank which the NYDFS closed down and put into FDIC receivership opportunistically following the failures of SIlvergate and SVB

Izabella Kaminska11:54

Izabella Kaminska11:54Operation Chokepoint 2.0. is such hilarious branding

Law firm Cooper & Kirk have written an entire paper alleging the Fed, FDIC, OCC and other regulators have acted unlawfully in closing down SBNY and refusing master accounts to various state chartered crypto-friendly banks

Paper is here

Izabella Kaminska11:56 (Stole the below from the internet, but surprised there isn’t better memagery )

Izabella Kaminska11:56 (Stole the below from the internet, but surprised there isn’t better memagery )Operation Chokepoint 1.0 was the Obama administration’s deliberate closedown of bank access for payday lenders

Izabella Kaminska11:57

Izabella Kaminska11:57do you think it’s true?

i do think there is a bit of a coordinated clampdown to be honest

I think since the FTX crash

Regulators realised that retail depositors were at risk and there was growing risk to financial stability too

So I do think there is a coordinated clampdown going on

Izabella Kaminska12:00

Izabella Kaminska12:00We are out of time sadly, but speaking of chokepoints

I did want to flag the following

Apparently, according to the Telegraph the net zero ban on petrol cars is in “CHAOS” because the Germans managed to achieve an e-fuel carve otu

Poland was the only country that voted against.

Here’s the Telegraph:

But I especially loved Politico’s story which reminded everyone about Hitler’s love of e-fuels:

That’s from their premium Pro site.

Hitler of course was also a lifelong vegetarian and friend to animals.

Izabella Kaminska12:02

Izabella Kaminska12:02I always loved that story about the synth fuel plants. I read about it first in Daniel Yergin’s the prize, and apparently, it was one of the reasons the Nazis were so intent on occupying Azerbaijan and the Baku oil fields. The allies kept bombing the plants.

Anyway, the subtle insinuation that the Germans have gone full nazi again is, err, provocative to say the least ????

Personally, I think it’s a bit wrong to imply the German car industry putting profits before people because of this e-fuel thing.

Electrification just doesn’t work for the vast majority of the world. If e-fuels can be cracked, they are going to have significant advantages over electrification, not least because all our fossil fuel cars are going to end up in emerging markets, where they’re not going to be electrifying anything any time soon.

At least not to the extent as the West.

While we are on the subject of e-vehicles, this heads-up on battery technology and the scramble for metals and minerals comes from Deutsche Bank’s Jim Reid:

“The US and Japan finally agreed yesterday to a trade deal involving rare earths and other critical minerals necessary for batteries in electric vehicles. The agreement removes restrictions on trading key minerals between the two countries and will make Japan’s automakers eligible for various tax incentives in the US.”

I imagine we will see quite a few more deals of this kind as the battle for control of the resources needed to meet net zero target heats up.

Izabella Kaminska12:04

Izabella Kaminska12:04On that cheery note, thank you again.

We are finishing up. Frances will be back tomorrow (Thursday) but then everyone is taking a break (unless banks go crazy again). From Thursday onwards, for now at least, we will be back to our normal Monday sessions with Anjuli and co-host only.

A domani, everyone.

Izabella Kaminska12:05

Izabella Kaminska12:05ciao

One Response