Good morning SMLers !

Another busy morning out there. Today Frances is back with us

Morning Frances

Morning everyone!

Anjuli Davies11:00

Anjuli Davies11:00Where do we start?

Is the panic over?

I suppose we should start with DB

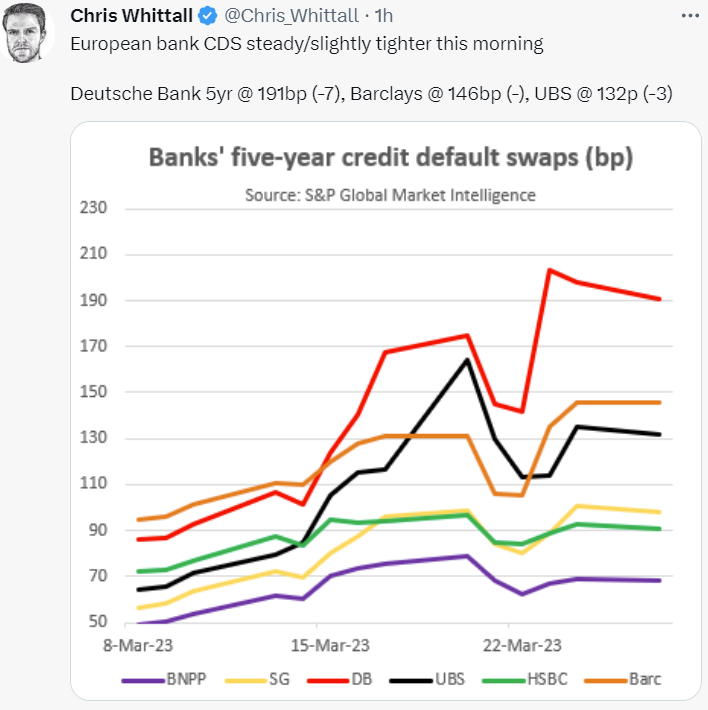

DB share price up this morning but CDS remain elevated

Anjuli Davies11:01

Anjuli Davies11:01

Who are these people betting against Barc?

Anjuli Davies11:03

Anjuli Davies11:03There seems to be a split crowd on Twitter. Half screaming CDS IS BLOWING OUT the other half trying to talk them back from the edge with BUT CDS IS SO ILLIQUID

I’m with the CDS ARE SO ILLIQUID crowd personally

Anjuli Davies11:03

Anjuli Davies11:03So, what’s the proxy we should really be looking at ?

And I wish people would stop calling them “insurance”. Actuarial risk management this is not.

I like share prices.

Anjuli Davies11:04

Anjuli Davies11:04

It seems the fixation with CDS is a hangover from the last crisis

but now it can be used to make some big moves

“Don’t insure your AT1s with CDSs” that’s adding fuel to the flames John!

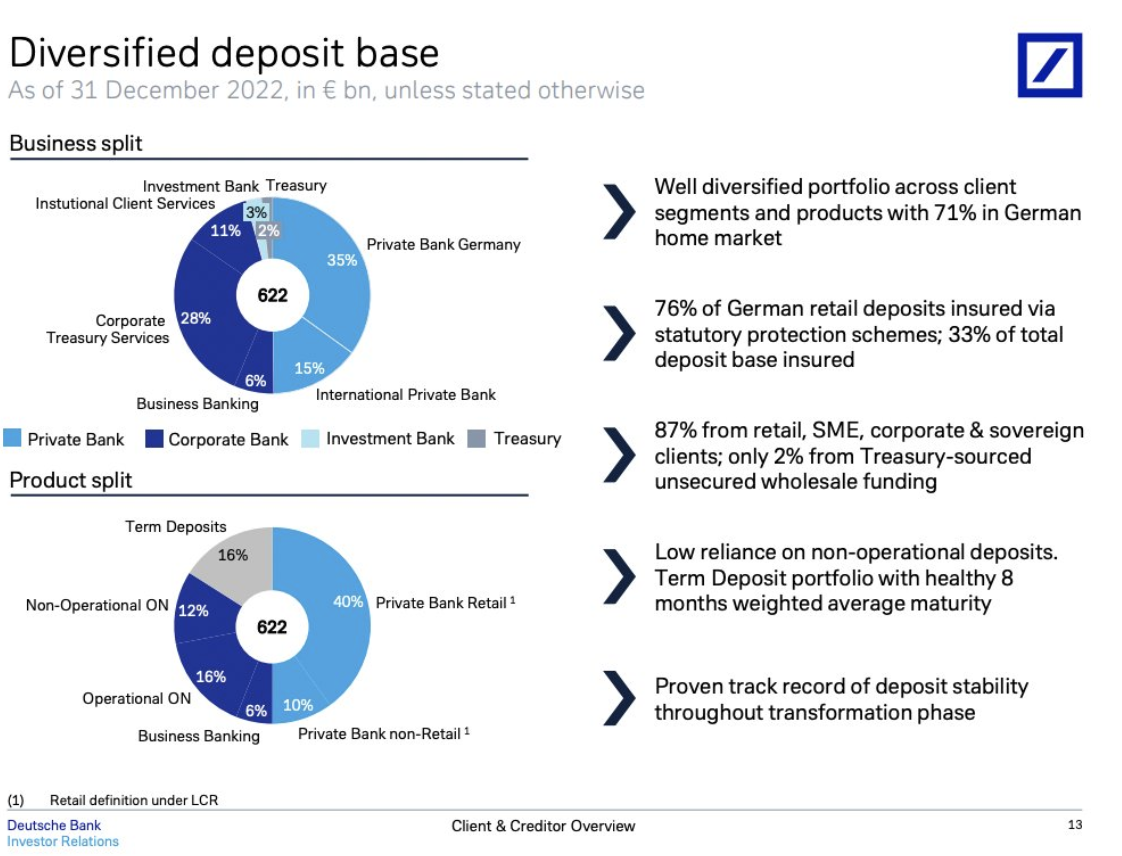

That deposit analysis shows how obsessed with the GFC banks and their regulators are

The current crisis isn’t about wholesale funding, it’s about uninsured corporate deposits

so “only 2% from Treasury-sourced unsecured wholesale funding” isn’t the reassuring statement they think it is

Anjuli Davies11:07

Anjuli Davies11:07Right…

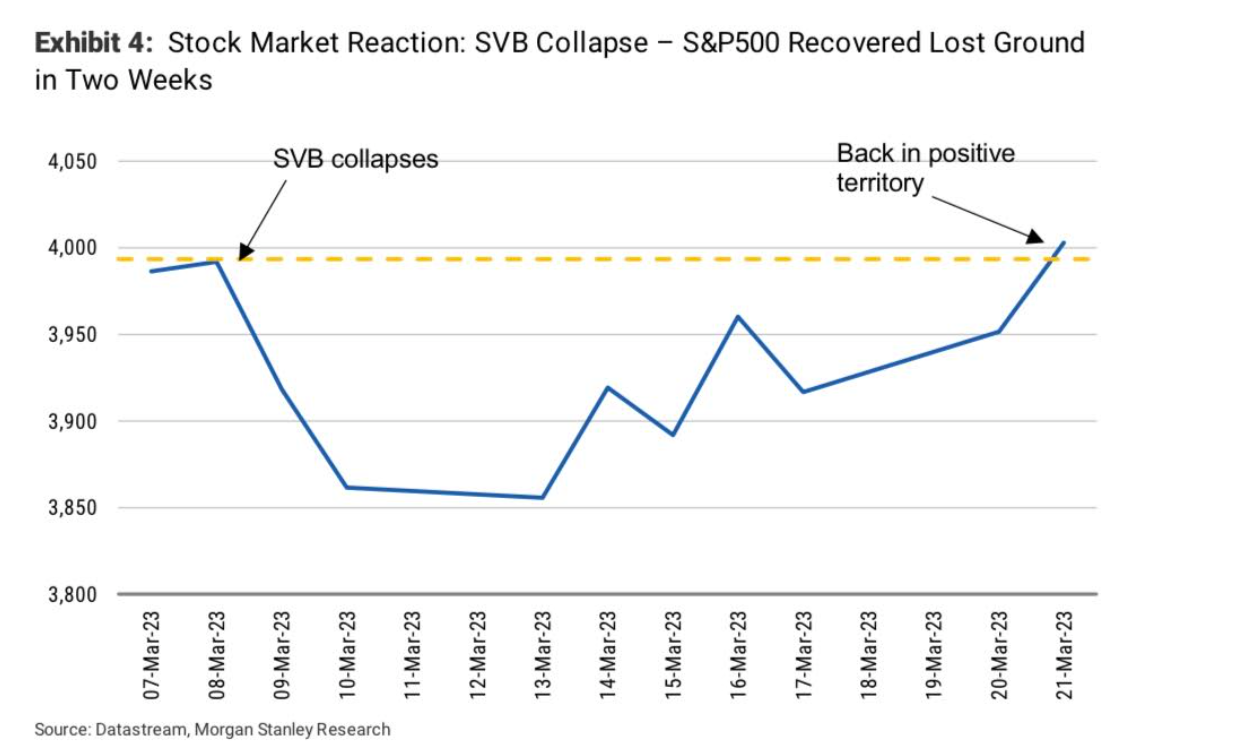

11:09Anyway, thinks have abated this morning at least

Markets are seeing green

SVB is getting rescued by First Citizens

Anjuli Davies11:11

Anjuli Davies11:11Is this good news Frances?

First Citizens has around $109 billion in assets and total deposits of $89.4 billion.

The FDIC said First Citizen’s purchase of about $72 billion of SVB’s assets came at a discount of $16.5 billion.

FDIC statement is here. https://www.fdic.gov/news/press-releases/2023/pr23023.html

Anjuli Davies11:12

Anjuli Davies11:12“The FDIC estimates the cost of the failure of Silicon Valley Bank to its Deposit Insurance Fund (DIF) to be approximately $20 billion. The exact cost will be determined when the FDIC terminates the receivership,” it said.

Approximately $90 billion in securities and other assets from SVB will remain in receivership for disposal, the regulator added.

so FDIC reckons $20 bln

This is a very large mouthful for First Citizens Bank.

11:14And it comes on top of a streak of acquisitions. First Citizens looks a tad aggressive to me.

Anjuli Davies11:14

Anjuli Davies11:14First Citizens merger with CIT at the start of last year

It’s grown very fast

11:15Fast growth through a series of distressed acquisitions doesn’t make for a strong and stable bank in my view

But maybe this time is different lol

Anjuli Davies11:16

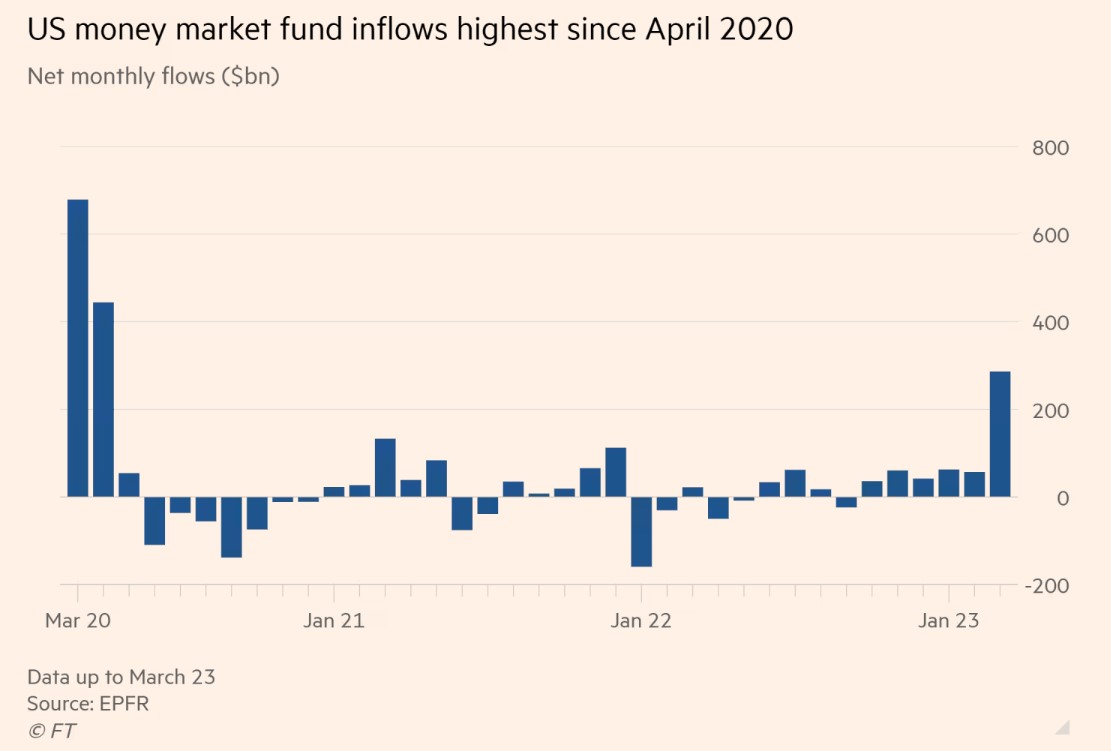

Anjuli Davies11:16Another topic that seems to be getting a lot of attention is the move to MMFs

This is interesting. The US banks that failed were all providing non-interest-bearing deposits to a particular customer segment that was very prone to runs. But the move to MMMFs is a wider, slower run affecting far more banks.

Anjuli Davies11:18

Anjuli Davies11:18Is this a search for yield story or something more?

It seems that quite a lot of the money parked in demand deposits while rates were low is washing into MMMFs in search of higher rates

I think it’s inflation avoidance, Anjuli

If I were a corporate treasurer right now, or even a household with loadsamoney (I’m not), I would be keeping minimum balances in demand deposits

I’d be actively moving money to easy access interest bearing accounts

Anjuli Davies11:20

Anjuli Davies11:20A family member of mine has moved all his ISAs into US Treasuries

ISAs are earning nothing right now. The tax break is eaten up by inflation.

11:22In the US, MMMFs are an obvious alternative to demand deposits, so it’s not really surprising that banks that aren’t passing on interest rate rises to demand depositors are losing deposits to MMMFs. The alternative in the UK and Europe is not so obvious, so I think deposits might be stickier here.

11:23@Darren it depends on the investment

@Graham MMMFs are supposed to be secure but it’s worth remembering that they can “break the buck”, unlike a bank which is obliged to redeem at par

imho this was what everyone forgot in the GFC, hence the panic when Reserve Primary broke the buck

Anjuli Davies11:24

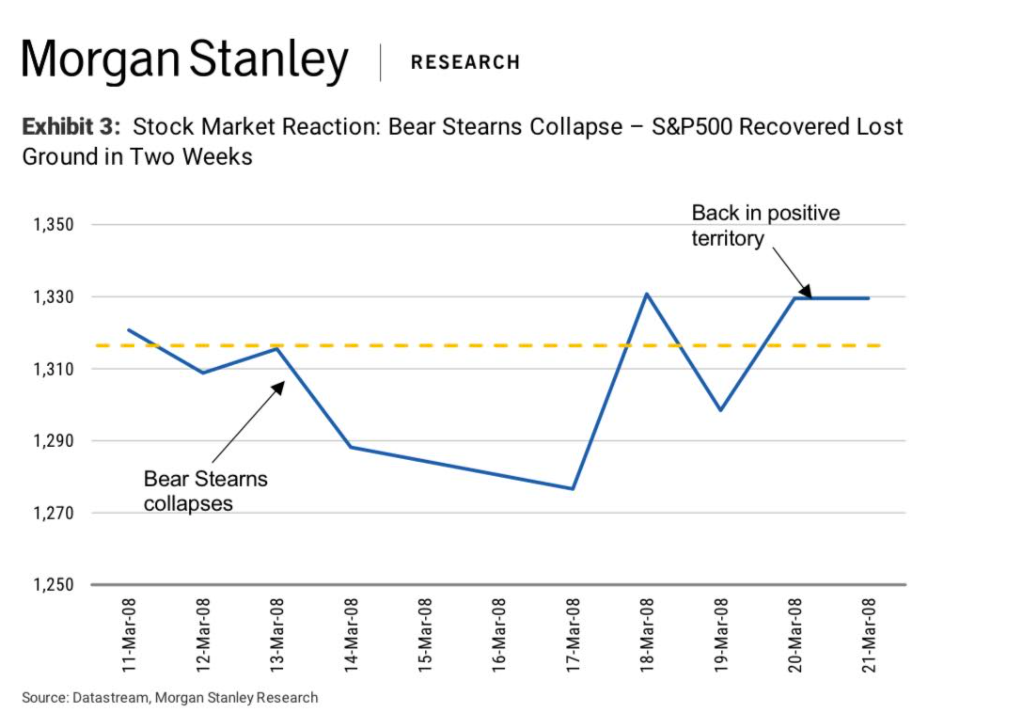

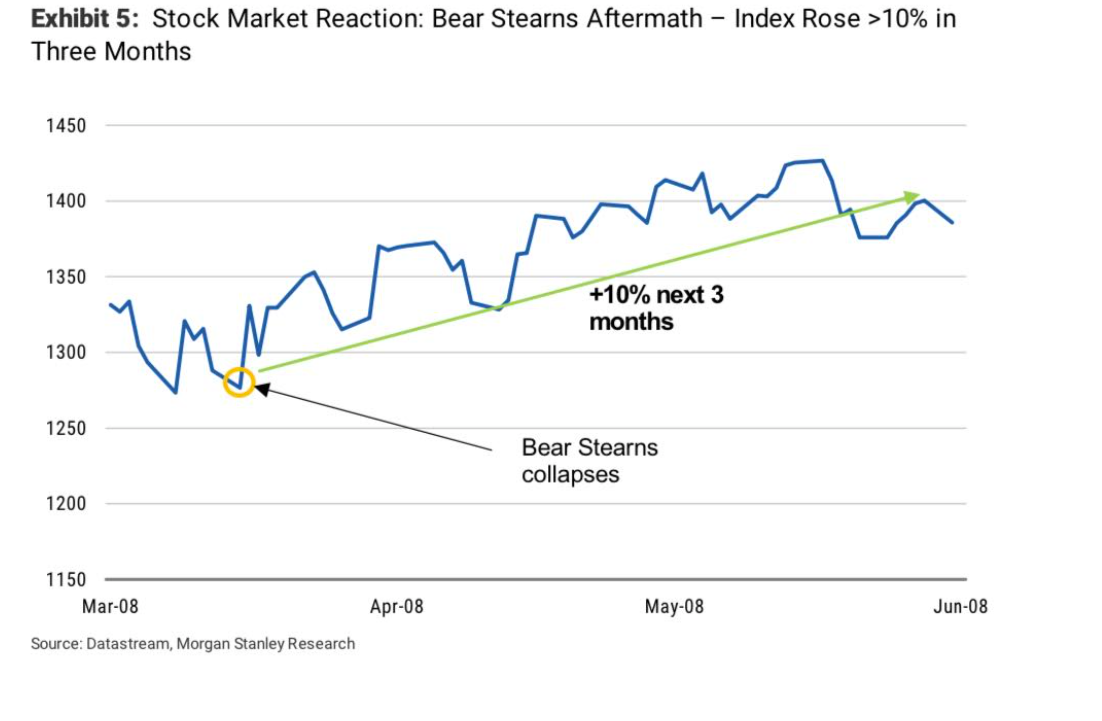

Anjuli Davies11:24Morgan Stanley have a note out this morning “Anatomy of a downcycle”

will get you some charts

Is it time to move back into equities

Morgan Stanley also compare this crisis to the Savings & Loan crisis, which I think is a better analogy than Bear Sterns

sharply rising interest rates catching out banks that haven’t hedged their interest rate bets

that would be more likely to be the case in smaller banks

Anjuli Davies11:29

Anjuli Davies11:291981 Precedent. Though it is the most fresh recession in recent memory, we are not convinced that the GFC is actually the best precedent. We believe that the 2020–22 Covid Cycle has parallels with other inflationary periods (1973-4, 1981), where supply chains had also become extended. For example, in 1981, inflation had surged to 11.3% in the aftermath of the Iranian Revolution of 1979. As a result, Fed Chairman Paul Volcker hiked rates from ~11% in 1979 to ~20% by mid- 1981, in an effort to quell inflation. See link to the Federal Reserve Archives here. Industrial Production was surprisingly resilient at first (eg. +5.5% in 3Q81), however by the end of the year, things took a turn for the worse. The Manufacturing PMI (ISM) fell to 37.2 by 2Q82, and remained deeply contractionary for six consecutive quarters. Industrial Production fell significantly each quarter from 4Q81 until 2Q83. Moreover, this recession also significantly exacerbated the Savings and Loan crisis. In simple terms, around 4,600 S&L institutions with total assets >$600bn began to record losses (an estimated ~$8.7bn) due to the unforeseen spike in rates. We suspect that the 2023 Great Unwind will eventually feel quite similar – an initial sense of resilience despite higher rates, followed by a protracted adjustment period.

I expect to see consolidation among the US’s mid-tier banks, and perhaps small banks too

11:31Interest rates don’t have to reach the dizzy heights of the 1980s for mid-tier and small banks to be in trouble. We’ve had nearly 15 years of near-zero interest rates. Interest rates were much higher in the 1970s.

11:33I think the deposit-rich “narrow banking” model with unhedged interest rate risk beloved of SVB et al is not viable in a higher interest rate paradigm.

11:34And neither is true full reserve banking, because it’s fundamentally unprofitable. The interest rate hikes of the 1970s killed off the UK’s Trustee Savings Banks, because they lost deposits to lending banks that could offer higher interest rates.

Anjuli Davies11:35

Anjuli Davies11:35Whilst we all remain focused on the banks, are we neglecting what’s going on in the shadow banking universe?

What’s happening to all the debt laden PE vehicles ?

if your only sources of income are the spread between your deposit rate and the central banks interest rate on reserves, plus whatever fees you can get out of people, you need scale. Deposit flight is fatal for full-reserve banks.

March 23 (Reuters) – Private equity firms that acquired companies since the banking crisis started on March 8 have funded the deals mostly with their own funds, a departure from traditional leveraged buyouts that reflects their struggle to secure cheap debt.

Four acquisitions of companies by private equity firms that were announced in the last two weeks were funded by debt that accounted for between 9% and 50% of the deal consideration, according to a Reuters review of regulatory filings. The remainder was equity checks by the private equity firms.

Wall Street’s Buyout Bankers Are Reaching Their Lending Limits

PE boom coming to an end?

Anjuli Davies11:39

Anjuli Davies11:39Market participants are talking about how securitisation markets in the US are effectively shut down

Implies that more companies will go to the wall rather than being bought out by PE

so we should see an increase in bankruptcies and ultimately a rise in unemployment

Anjuli Davies11:39

Anjuli Davies11:39What happens to all the debt they are holding ?

Haircut in accordance with creditor claims ranking through the bankruptcy process

so we also might see some PE firms going down

11:42In some sectors, PE pullback or failures might need government intervention. Care homes, for example.

@Darren both PE firms and PE backed firms

Anjuli Davies11:43

Anjuli Davies11:43Private capital is now so intricately linked to every facet of society

we are going to see a swathe of nationalisations I think

Anjuli Davies11:44

Anjuli Davies11:44The amount of money invested, or waiting to be invested, by private-equity funds has swelled from $1.3trn in 2009 to $4.6trn today. This was driven by a scramble for yield among pension funds, insurance companies and endowments during a decade of historically low interest rates in the aftermath of the global financial crisis of 2007-09. Many have more than doubled their allocations to private equity. Since 2015 the ten largest American public-sector pension funds have collectively committed in excess of $100bn to buy-out funds.

the numbers are staggering

consequences of QE, not just low interest rates. Silly money looking for a home.

11:47silly money that is now being withdrawn. The asset bubbles it blew up are all going to deflate.

Including real estate, which will upset people a lot. Unless central banks lose their nerve and reflate again “for the sake of financial stability”.

Anjuli Davies11:48

Anjuli Davies11:48Speaking of central banks, Unicredit put out in a note that there should be some coordinated signalling

Central banks’ dilemma – control inflation, or protect financial stability?

Anjuli Davies11:49

Anjuli Davies11:49

can you re-post that, Anjuli? error message says it is “gone”

11:50I think central banks are all sending a similar message: “we are not going to be bullied by banks into ending our rate hikes”

Anjuli Davies11:51

Anjuli Davies11:51

still can’t see it.

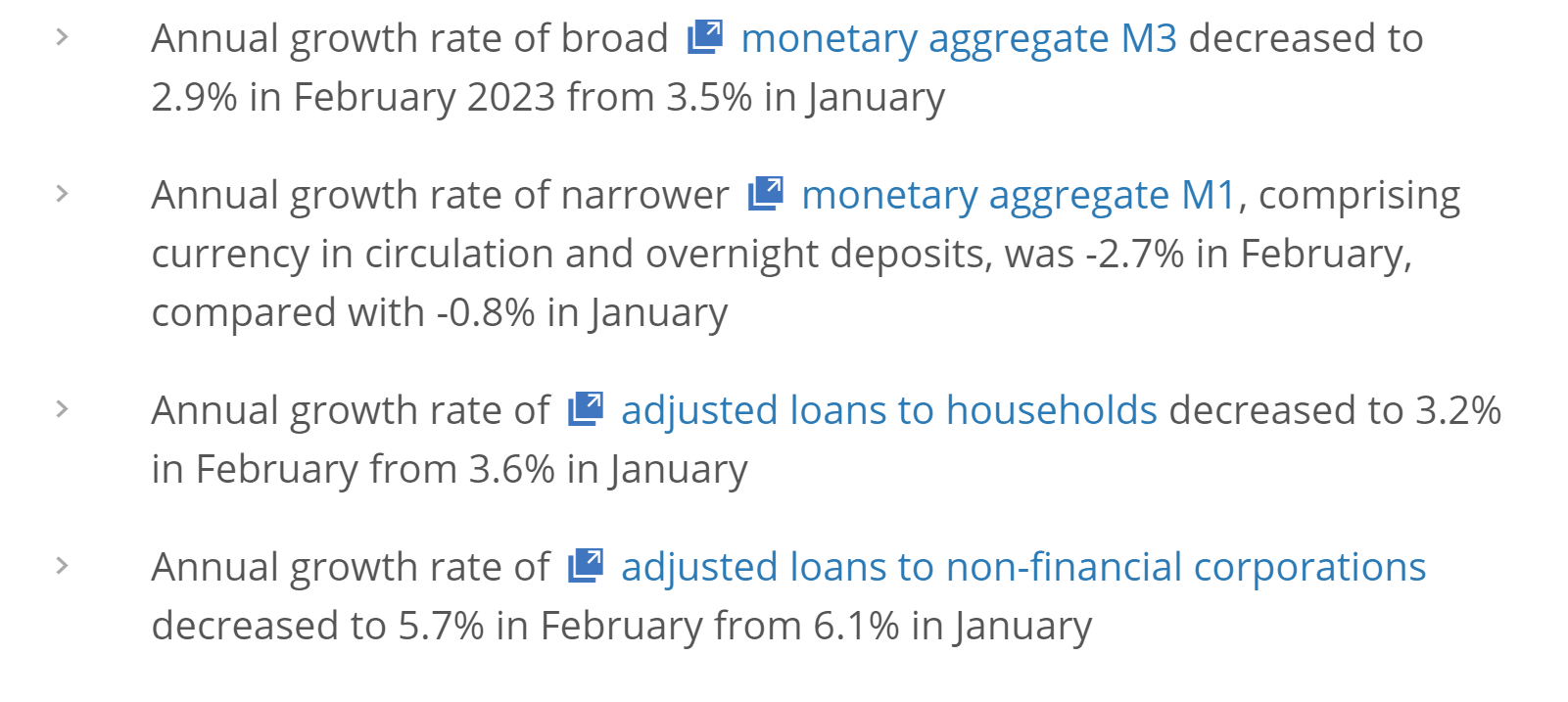

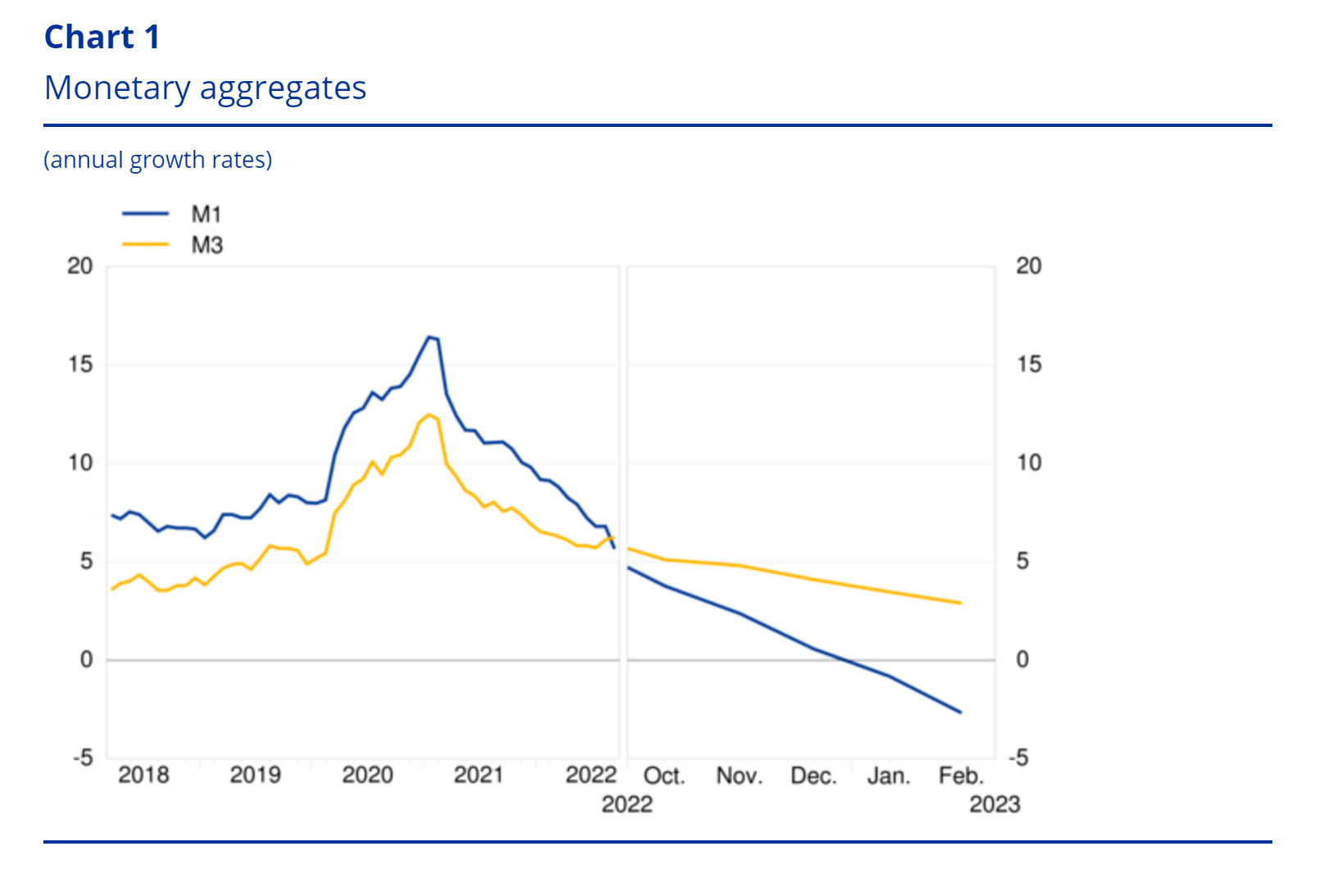

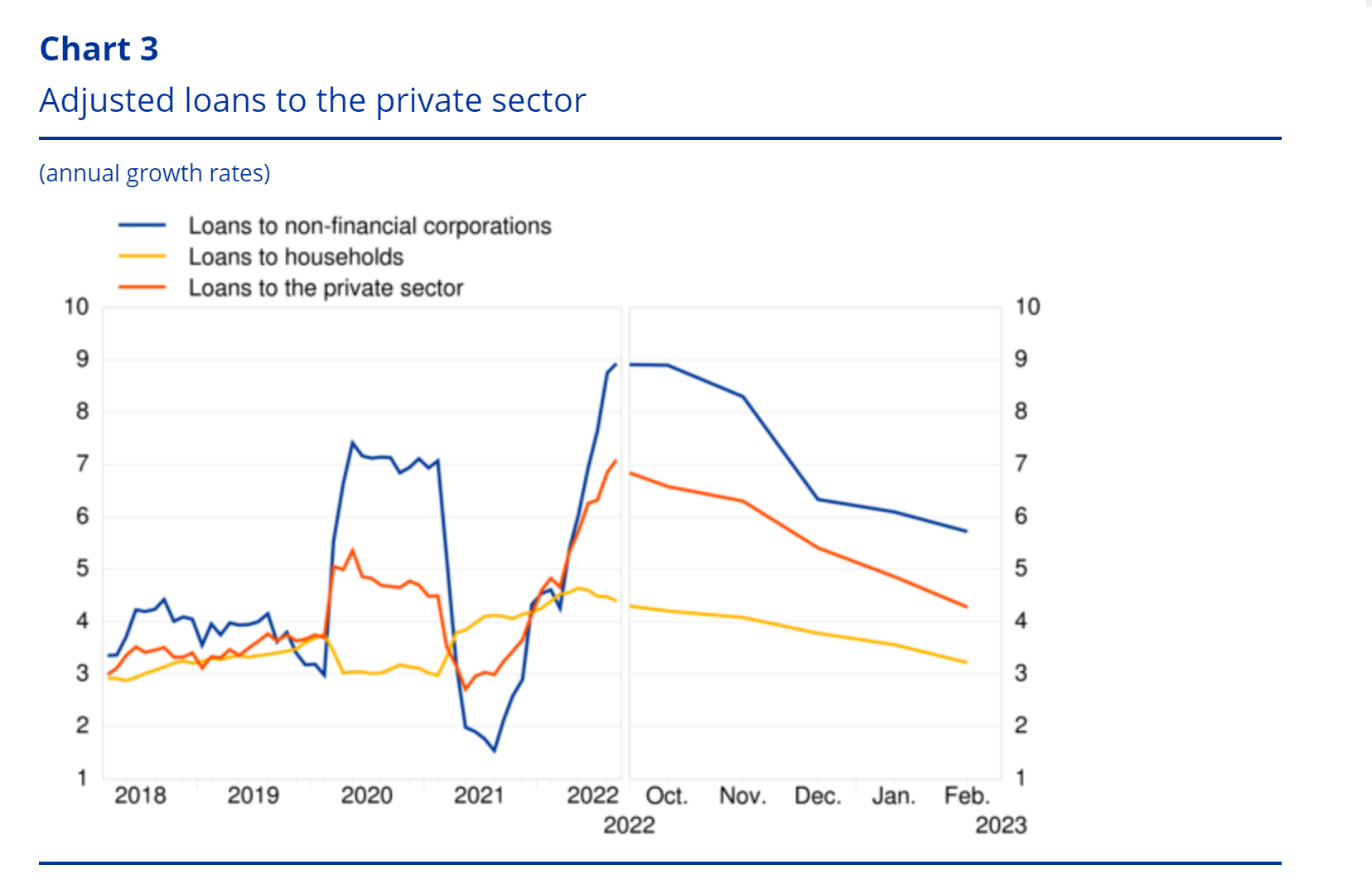

Speaking of central banks, ECB’s latest monetary developments report is grim

Anjuli Davies11:52

Anjuli Davies11:52Basically it says that major central banks should issue a joint statement that any further rate hikes are off the table

Ah, so it’s not coordinated signalling they want, it’s a coordinated pause in monetary tightening.

I don’t think they will get that at the moment. Not enough evidence of serious financial instability.

Anjuli Davies11:54

Anjuli Davies11:54true, well i guess both

ECB’s monetary developments

M1 falling

Anjuli Davies11:55

Anjuli Davies11:55That doesn’t look good

There’s lots of inflation data coming out this week

Over in Europe, all eyes will be on the preliminary inflation readings across the Eurozone. March data for Germany will be out on Thursday, followed by reports for the Eurozone and France on Friday, among others. In terms of forecasts, the team sees March headline at 7.1% (+1.1% MoM) and core at 5.8% (+1.4% MoM). As a reminder, the latest 5.6% core inflation reading is the highest on record. Our team don’t expect it to peak until the 6.0% they expect in July.

Apart from the inflation data, there will be an array of sentiment indicators across the bloc as well, with potential preliminary impact of the banking turmoil in focus. Among the gauges are the Ifo survey (today) and consumer confidence (Wednesday) in Germany, as well as manufacturing (tomorrow) and consumer confidence (Wednesday) in France.

This from DB economists

Also M3 lending growth has dropped quite a bit.

Anjuli Davies11:57

Anjuli Davies11:57We’ll have to wait until the end of the week for the most important datapoint and that’s the Fed’s preferred inflation gauge, the PCE, on Friday. Our economists see a +0.36% advance for the core PCE in February (+0.57% in January) and MoM declines for both income (-0.1% vs +0.6% in January) and consumption (-0.6% vs +1.8%). Earlier in the week, a pulse check on the US consumer will come from Conference Board’s consumer confidence measure on Wednesday (DB estimates 102.1 vs 102.9 in February).

I think this will be worse in March because of the banking turmoil. Credit conditions bound to tighten.

All of which adds up to significant disinflation

And therefore signals an end to rate hikes possibly sooner than expected

In other news: the Saudi National Bank’s chairman has resigned in the wake of Credit Suisse’s fall.

Anjuli Davies11:59

Anjuli Davies11:59And before we go, I wanted to mention that BoE’s Bailey testifies on Silicon Valley Bank tomorrow in from of the TSC

Finally, if I may, I need to issue a correction from last week… Block and The Block are not the same. There are Too Many Blocks. My apologies for getting this wrong and confusing everyone.

Anjuli Davies12:00

Anjuli Davies12:00Thanks Frances

And thanks for another great session

We will be back soon !

Indeed we will. Bye for now, everyone!