A Tweet thread I posted yesterday about Liz Truss went semi-viral, and as can be expected responses have ranged from critical (yet informed) to totally feral.

Given its virality, I thought I would explain myself in longer form (since who really has the time to get into an endless tit-for-tat on the world’s least-nuanced social media platform).

First, a quick recap of my position.

- I am not and never have been a “fan” of Liz Truss. I wasn’t happy with any of the post-Boris choices to be honest. All of them seemed equivalent to what my four-year-old daughter would describe as “doogers” (a cussword she made up that allows her to safely slur people without them knowing that she is doing so).

.. - With Truss, I was most concerned about her war hawk tendencies.

.. - I had never read her book Britannia Unchained. And I knew little about Kwasi Kwarteng.

.. - When Truss was elected I was disappointed but I rationalised that it might not be all bad. I had no issue with a politician arguing for less tax, a reduction in regulation or a reduction in the size of the “bloated state”.

.. - While I’m definitely NOT a free-market radical, I do agree that on balance we are at the limits of what we can reasonably do with regulation, tax and bureaucracy, at least to the extent that they impose burdens on enterprises. The much bigger risk is for us now is slipping into a technocratic state powered by surveillance capitalism.

.. - When Liz Truss said she was prepared to be unpopular, I was actually encouraged. One of the key concerns I have is that the political world has become entirely captured by markets and social media. Since both markets and social media are international, that means UK policy is increasingly dictated by foreign players with money and troll bots rather than politicians elected by the people.

.. - I believe these forces underpin the push towards the worst of globalism and borderless capital flows.

.. - This would be fine if those power players had any concern about doing what’s right for the broad population of any country rather than what’s good for them. Or if they had any concerns about taking ownership and responsibility for the investments they get wrong. We know this never happens. In today’s globalised international market-capitalism system those who invest wisely take the winnings, and those who invest badly see the state take on their losses. Those who invest and create jobs locally, even if they don’t make losses, rely on states to subsidise what can often be entirely uneconomic and exploitative business models. Many of these would never work if they had to actually pay people a living wage. (And that’s not to mention the benefits they reap from riding on the innovation made possible by the state, without giving very much back – in line with Marianna Mazucatto’s longstanding argument about The Entrepreneurial State.)

The Liz Truss paradox

My assessment of the mini-budget and where we are now is as follows.

There’s an absolutely valid critique that the Tories have ended up becoming bigger uncosted spenders than Jeremy Corbyn ever hoped to be.

While this critique is not technically wrong it ignores important context.

There are three economic scenarios that allow for big (potentially uncosted) spending.

- During a deflationary crisis, to kick-start consumption and demand.

- In an emergency like Covid or war (ie when you know people will be prepared to absorb the losses later because the immediate threat is potentially existential).

- During a supply-side driven inflationary crisis, if you trust the government and are confident they know how to allocate investment into growth-generating industry.

The paradox at the heart of the Truss government that most people (and way too many economists) can’t get their heads around is how a small government free-market radical type can be happy to balloon the budget and state spending while still preaching tax cuts. It seems conflicting and nuts.

But, it might actually be better than the alternative.

The argument I was trying to make on Twitter is that the typical critique aired by the mainstream media is totally naive. It fails to consider the paradigm-shifting context of our time. Things are no longer what they used to be. The old investing patterns that worked for a globalised world are not going to work anymore. What is needed is a fundamental recalibration of how we measure economic success, not more plasters that keep the old model on life support.

Whatever happens, all of Europe – not just the UK – will be facing a bitter economic reality over the short to medium term. There are no good options on the table. Just like with Covid, there are only lesser or greater tradeoffs.

In that context, Kwasi Kwarteng and Liz Truss’ growth plan was to the economic challenge we are facing what Boris’ herd immunity plan was to the Covid challenge.

What the mainstream neglects to inform the populace is that the alternatives in both cases were and are no better.

Both options involve sacrifice.

The alternatives (lockdown in the case of Covid, and de facto austerity in the case of the mini-budget hysteria) are always favoured by those who prefer safety at any cost versus taking a small degree of risk that could deliver a silver lining if the fates align.

It’s therefore no surprise to me that it’s exactly the same people having hysterics about the trade-offs imposed by a risky but growth oriented plan for the economy.

None of this is good for democracy.

Those preferring to push “costed” austerity on the public are favouring the short-term over the long-term. They are preferring to side with international bond investors who care only about returns rather than those who have an interest in improving life in Britain rather than degrading it.

Britain’s Faustian Pact

“But, but …. you can’t renege on international bond investors and still expect to be a financial centre!!” (SAYS ALL THE MEDIA) “And this is all because of Brexit!! BRARR!”

First, I’m not even sure the gilt panic was as much about bond vigilantes having an issue with Britain’s credit risk as it was about boring technical factors related to settlement bottlenecks and operational issues. That it became a credit issue was, in my opinion, all down to the bad comms from government (for which Liz Truss and Kwasi Kwarteng are to blame) and the fact the media gaslit the world into thinking this was all the end of the world.

But even if it was a credit boycott, all that would have equated to is a reminder that those who sign a deal with the bond market devil, know what they are getting into. That means they must deliver their soul when it is called upon no matter what. “Don’t forget, the UK depends on the kindness of strangers to balance its budget!” say the likes of Mark Carney endlessly.

It matters not in their eyes that honouring those agreements can risk delivering the entire population into the sort of austerity one might actually expect in the depths of hell.

But here’s the thing. While the UK might indeed have signed a Faustian deal with bond investors, it is not the standard version in play here. It is, if anything, Goethe’s version. The one where all hope is not lost, because God intervenes on the basis that: “He who strives on and lives to strive / Can earn redemption still”.

Just like with Goethe’s Faust, Britain — because it is sovereign — has the potential for a last laugh versus the bond devil. It can flake on international bond investors by calling on the ultimate power: honouring redemptions through inflation. This is especially the case if it can support that inflation with a restructuring plan focused on a more productive life (less focused on rentierism or being a financial centre and much more focused on making the entire system work for all).

Unlike Ecuador or Russia or any other emerging state — indeed, even unlike every Eurozone country — the UK borrows in its own currency. That gives it options other countries do not have. Those who lend to Britain are supposed to understand that risk. Since they can’t do anything directly about it, if and when it looks like Britain is near going down the debasement route, they engage in hysterics.

But Britain can ignore those hysterics for as long as it has other variables in the economy to attract the goods, services and commodities it needs when the pound takes a beating.

Thankfully, it has many such variables. Chief among them is its highly educated English-speaking population that a cheap pound will only make an increasing bargain to hire. It also has a second-to-none further education system. Culture. Energy. History. Tourism. Connections with the Commonwealth. Most important of all it has immense spare labour capacity (albeit with the right incentives and conditions) to make reshoring all the remaining stuff it needs entirely conceivable and possible.

But it doesn’t even have to get to that. Britain already has the ability to stimulate domestic demand for any new bond issuance. As Russell Napier has eloquently explained, this can be done through regulatory capture (i.e. forcing UK pension funds to hold an ever larger amount of gilts). It can also be done by stimulating domestic investment demand, say by issuing a special series of Elizabeth bonds to the public as Neil Collins (occasionally of this parish) has also wonderfully explained.

Unlike what the propagandists would have you think, Britain is not a basket case.

Britain has real sovereignty. It just needs a leader with the cojones to leverage that sovereignty in the interests of its own population. If it can restructure itself, it can generate all the growth it needs.

Putin has mobilised his army, but Britain has the ability to mobilise its entrepreneurial classes. Putin needs salary to pay its soldiers. To energise the risk-takers in society who can see beyond just the next year, Britain only needs to share the proceeds they deliver fairly with them. Lowering taxes and regulatory hurdles on business is not bad in the context of growth.

If, on the other hand, Britain bows to the bond vigilantes it risks stifling the domestic economy forever.

Market Power Versus Political Power

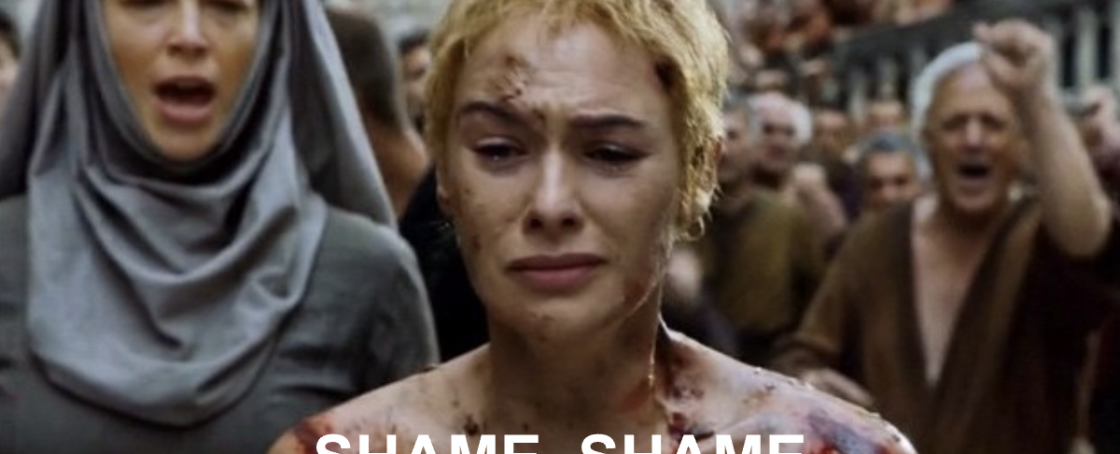

What we are facing right now is a major battle between market and political power. The markets have taken the first round. They are currently displaying the scalp of Liz Truss as a war trophy.

But I wouldn’t give up on political power just yet. It seems certain to me that a populist leader capable of leveraging the body politic to realise Britain’s sovereign power will arise eventually. The usual suspects will call this a descent into fascism.

Perhaps I would have too on first instinct. But what I have belatedly realised is that the turn to a nationally-oriented, domestically-focused war economy state needn’t be a bad thing. This is in fact a core feature of the Vitruvian Capitalism model that Tim Ferguson has been advocating in his Rationist letters here on the Blind Spot. This involves applying median-benchmarking on a country-by-country basis to promote domestic middle-class formation via positive-sum economic incentives.

As long as wider financial repression is seen as a genuine means to an end brought about by an emergency mindset, it can be better than the alternative. And as long as the leader chosen to deliver the repression can be trusted to invest wisely, preserve incentives for entrepreneurship, and return the state to as free an economy as possible asap (centred around the Bill of Rights) a temporary concord can be struck with the public.

That is why – ironically – it must be a candidate who is overly committed to liberalism and a free market ethos that takes the UK into such an extreme arrangement. It cannot be a dyed-in-the-wool socialist. Sorry. The risk of overspending on the wrong things opens the door to a permanently stagflationary mess, just as Russell Napier also warns.

None of this is ideal. But it is certainly better than the other option – a headless technocratic state where we are all subject to the unknown black-box forces of programming scripts and digital serfdom or career technocrats.

Once we are restructured, we can return to a healthy free-trade global system on a level playing field.

You might ask, how is that different to what we have now?

This is my opinion only. But I believe that for international capital markets to be truly “wealth generating”, everyone has to be a player in them. Since currently they are not, most of the world has no active voice in international capital allocation or what should and should not be invested in. They have as a result become takers rather than makers of policy. This is not just the antithesis of what democracy is supposed to be about, it is also the antithesis of liberalism.

In the current globalist paradigm, decisions are determined on the basis of who has access to capital. Surprise, surprise, then, that it’s those with pre-existing capital who favour mechanisms and policies that will help preserve or extend their already disproportional power irrespective of how those policies impact everyone else.

Until everyone has the chance to access capital or a stake in society, and be rewarded proportionately for what they do with it, a truly liberal free market system cannot flourish.

Everything else just opens the door to mass corruption.

Markets have had the first round. But fear not politics, just like Rocky Balboa, will be back soon.

4 Responses

A lyrical analysis, close to the reporting in the financial media. These describe the uk gilt and pension fund disruption as the markets Wile E. Coyote moment. They suddenly realise there are two options and they’re going to get one or the other. Austerity or stimulation. Truss and Kwarteng were courageous in attempting the growth option, but suffered the inability of political classes in not being able to do things gradually, by stealth if necessary.

Of more concern than market disturbance is the ongoing closure of energy dependent industry throughout Europe. Glass, base metal refining, steel, cement, many pharmaceuticals, fertilizer, … See the ft

“Will the energy crisis crush European industry?”

https://www.ft.com/content/75ed449d-e9fd-41de-96bd-c92d316651da

if this goes on we’re back in the nineteen thirties.

Thank you for a somewhat optimistic take. I have been getting increasingly downhearted that we are stuck on a technocratic doom-loop where lack of growth leads to ever more interventionist policies that reduce freedom and restrict growth even more, all reinforced with net zero and bio security fear mongering. I don’t see where the counter to this is going to come from, but I hope you are right that politics will deliver something…

It’s time for a complementary financial system that is run like a giant cooperative. With its own complementary currency, that turns ‘waste’ into wealth. The Stoke Model in other words. Yes, Stoke.