Hi everyone!

Today’s Spot Markets live session is with Neil Collins, the former City editor of the Telegraph, FT columnist and now co-host of ‘A long time in finance’ with Jonathan Ford.

Comments from Izabella and Neil that address audience questions have been put in bold

Spot Markets Live – 11/07/22

Izabella Kaminska 10:58

Izabella Kaminska 10:58Hello and welcome to Spot Markets Live, the real-time markets chat that takes you on a whirlwind tour of the markets.

Is anyone out there?

(My usual communing with the other side)

So our sessions are happening every Monday at 11am for now, with a limited controlled live audience until we get the tech up to scratch.

(Regarding Technical issues Graham from Coodash is probably watching – so do keep reporting)

But, soon enough, we will roll things out further. Do spread the word.

Those reading this in transcript form, if you fancy a login to help us expand the test over the weeks to come please email [email protected].

Today, the imitable Neil Collins is back with us. Neil is the former City editor of the Telegraph, FT columnist and now a co-host of the “A long time in finance” podcast with Jonathan Ford.

Hello Neil!

Neil Collins 11:01

Neil Collins 11:01Hello Izi

Izabella Kaminska 11:01

Izabella Kaminska 11:01Bonjour = [Responding to comment about how my Abba experience went] Neil was not at Abba with me yesterday. But I did end up going with Jemima Kelly, formerly of FTAV.

Feeling a little worse for wear.

but not too bad

mainly because my brain feels like it was hacked by a 70s pop sensation experience.

The Abbatars as they are called are really extremely effective. And this is the first time I have actually thought there might be some substance to this metaverse thing.

Neil Collins 11:02

Neil Collins 11:02They’ll be making Avatars of you next, Iz

Izabella Kaminska 11:02

Izabella Kaminska 11:02I am anticipating the technology to be used for political campaigning very shortly.

Yes ! It would be nice to live forever as your bestest self. Neil do you fancy being permanently uploaded into the Finance Hero Journalist Cloud?

Neil Collins 11:03

Neil Collins 11:03Better that than being permanently downloaded

Izabella Kaminska 11:03

Izabella Kaminska 11:03Well yeah.

But seriously, i do think this tech is coming. ALthough as Jemima said, it all felt a bit peak Post Capitalism.

Neil Collins 11:04

Neil Collins 11:04Post-capitalsm?

Izabella Kaminska 11:04

Izabella Kaminska 11:04Sort of the moment where the embarrassement de riches gets to the excessive point where Abba can charge money for a video experience

Neil Collins 11:04

Neil Collins 11:04Or when reality blurs into fantasy

Izabella Kaminska 11:04

Izabella Kaminska 11:04exactly

Last week we had Ben Harrington of Betaville with us. Betaville is a sort of Alphaville tribute band, albeit the Alphaville of old. [The Blind Spot of course is more like a spinoff, though hopefully more successful than when Paul McCartney left the Beatles to form the Wings.] Betaville has everything bar this live chat. So hopefully Ben will be cooperating with us in the future. He was kind enough to give us a little scoopette confirming the EDF nationalisation that came last week.

The latest on that, btw, is (nice dateline):

AIX-EN-PROVENCE, France, July 10 (Reuters) – The French

government is preparing for a total cutoff of Russian gas

supplies, which it sees as the most likely scenario in its

forward planning, French Finance Minister Bruno Le Maire said on

Sunday.

With about 17% of its supply coming from Russia, France is

less dependent on Russian gas than some of its neighbours, but

the government has been preparing contingency plans.

A cutoff is particularly problematic now because France’s

nuclear power generation would struggle to pick up the slack as

many reactors are currently down for maintenance.

Neil Collins 11:06

Neil Collins 11:06EDF was already a French government pensioner

Its business model for Hinkley Point is so successful that it has already been abandoned for Sizewell C

Izabella Kaminska 11:07

Izabella Kaminska 11:07Unsurprisingly, Markets are down today. FTSE is off about a percentage point at 7112. Dax is down 1.25 per cent. That’s on the back of a weak Hang Seng close.

Aveva, Reckitt, Coca-cola HBC and RELX are barely nudging their way into positive territory. Any ideas why?

Reckitt is embroiled in the baby food supply scandal in the US. But don’t know much more about it.

Top losers are the miners, Anglo American, Antofagasta [fears of more China slowdown] and then there’s ABRDN, Smurfit and IAG.

Neil Collins 11:08

Neil Collins 11:08I can’t help feeling that IAG’s problems are self-inflicted. Were John Kong still in charge at BA he would have knocked heads together

Izabella Kaminska 11:08

Izabella Kaminska 11:08Have you experienced airport woes yet?

Neil Collins 11:09

Neil Collins 11:09No. I’ve stayed on the ground, except go as far as Inverness

Izabella Kaminska 11:09

Izabella Kaminska 11:09Easyjet et al saying they will have resolved the issues by next summer

which is nice

Although, European markets are also down because of supply chain fears and Vlad the tank implying rationing is near for Europe.

Neil Collins 11:09

Neil Collins 11:09Stay at home and sweat!

Izabella Kaminska 11:09

Izabella Kaminska 11:09Possibly not a good time to visit Europe anyway, given the Summer of imminent Discontent

It does look like the rationing is nearing.

But let’s look at more entertaining M&A news

Neil Collins 11:10

Neil Collins 11:10We must be grateful to Elon Musk, providing us with with some fine distraction

Izabella Kaminska 11:10

Izabella Kaminska 11:10Matt Levine has been on it.

At the Blind Spot we are nice about giving credit where it’s due, and Matt Levine remains an utter must read

https://www.bloomberg.com/opinion/articles/2022-07-09/elon-s-out

Neil Collins 11:11

Neil Collins 11:11Twitter has appointed Watchell, Lipton Rosen & Katz to fight its corner

they go up against Crosby Stills Nash and Young

Izabella Kaminska 11:12

Izabella Kaminska 11:12Apparently, that’s a gag

Neil Collins 11:12

Neil Collins 11:12Oh, sorry Skadden Arps Slate Slate Meagher & Flum

Izabella Kaminska 11:12

Izabella Kaminska 11:12they’re a folk rock supergroup

who sound like an extended legal entity

Neil Collins 11:12

Neil Collins 11:12Oh dear, another failed gag

Izabella Kaminska 11:13

Izabella Kaminska 11:13oh dear, went over my head. I just know Abba

so what’s your take on Mr. Musk?

Because Levine just thinks for musk this is just an expensive hobby

Neil Collins 11:13

Neil Collins 11:13What fun the lawyers are going to have. Only $20bn at stake

Musk’s case to scrap the deal looks vanishingly thin

but with almost infinite funds he could go on fighting until the Delaware counts can’t take any more

Izabella Kaminska 11:15

Izabella Kaminska 11:15But there is some speculation that maybe Twitter won’t want to sue because if they do they won’t be able to pass discovery. I.e. if it emerges that they were indeed lying about their robot twitter users, then this could open a can of worms where other investors sue them for misleading them in corporate filings?

Neil Collins 11:15

Neil Collins 11:15He has provided no evidence that they were lying

and if they were, they’re in deep trouble filing false returns

Izabella Kaminska 11:17

Izabella Kaminska 11:17So Elon is facing off with them, hoping they won’t sue

Neil Collins 11:17

Neil Collins 11:17Why should they sue when the courts are surely likely to try and force Musk to complete the deal?

However, even if the judgment goes against him, I can’t see him paying up $20bn

Izabella Kaminska 11:18

Izabella Kaminska 11:18But that’s the point where they would sue him

so who really has the upper hand?

Neil Collins 11:18

Neil Collins 11:18Best of luck with that!

Roger: quite possibly!

Izabella Kaminska 11:19

Izabella Kaminska 11:19Oh no another major knowledge gap from me!

Neil Collins 11:19

Neil Collins 11:19Dickens’ Bleeak House

Izabella Kaminska 11:19

Izabella Kaminska 11:19Bleak house was never on my reading list

Neil Collins 11:19

Neil Collins 11:19That’s the trouble with today’s youth

Izabella Kaminska 11:19

Izabella Kaminska 11:19I can definitely give you a good rendition of Wuthering Heights

Neil Collins 11:19

Neil Collins 11:19I look forward to it

Izabella Kaminska 11:20

Izabella Kaminska 11:20But what does it mean Neil, when a billionaire like Musk just goes around pretending he wants to buy companies for the Lols. Do you think this is buyers’ remorse because of the market, or like Levine says, it was all about a overly indulgent billionaire hobby for Musk?

Neil Collins 11:20

Neil Collins 11:20Musk doesn’t believe that the usual rules apply to him

Does that remind you of somebody?

Izabella Kaminska 11:21

Izabella Kaminska 11:21hmmm

mr. BoJo maybe

before we go down the UK politics cesspit

What else has caught your eye today Neil?

Neil Collins11:22

Neil Collins11:22There’s always Wirecard, the gift that keeps on giving

Izabella Kaminska11:22

Izabella Kaminska11:22The story that refuses to die.

what’s the latest?

you spoke with Dan McCrum on your latest podcast right?

Neil Collins11:22

Neil Collins11:22Author of a fine book with a rather banal title

Izabella Kaminska11:22

Izabella Kaminska11:22doesn’t do it credit

lol get it

Credit

Neil Collins 11:23

Neil Collins 11:23It’s called Money Men, but it is much more than that. Its cast of thousands and the twists and turns make it read more like a detective story

The latest twist is an admission that some documents were just straight forgeries

Izabella Kaminska 11:24

Izabella Kaminska 11:24https://www.ft.com/content/996c3c9b-c095-42c9-baf9-d07b1b319c9d

Here’s the FT story

Neil Collins 11:24

Neil Collins 11:24To persuade Softbank to cough up in an equity raise

Izabella Kaminska 11:25

Izabella Kaminska 11:25Just audacious levels of lying.

Yeah, so i think the Wirecard story is indicative of what I call “The Entire Economy is Fyre Festival”

and it speaks to my Abba point

because in this day and age, deepfakes, fakes,.. everything is so easy to manufacture and present as real

And any one man band can present themselves like a 500-people plus op

Trust me i cover crypto

Neil Collins 11:26

Neil Collins 11:26Do you really exist, Izi?

Izabella Kaminska 11:26

Izabella Kaminska 11:26yes Neil I’m real

Neil Collins 11:27

Neil Collins 11:27I know. You left your glasses behind when you did a podcast for us.

Izabella Kaminska 11:27

Izabella Kaminska 11:27Yes, but what was embedded in those glasses?

spyware?

anyway, lets get back to base reality and the world of bricks and mortar — although yet, again, following in our theme what is really real and isn’t

Purple Bricks

Neil Collins 11:27

Neil Collins 11:27Ah yes, Purplebricks

Izabella Kaminska 11:27

Izabella Kaminska 11:27Neil you have some thoughts

Neil Collins 11:28

Neil Collins 11:28This business was always shy about breaking down where the revenue came from

Izabella Kaminska 11:28

Izabella Kaminska 11:28Purple Bricks for those who don’t know is a real estate agent that tried to flip the concept of real estate fees.

but it turns out there is a reason why the estate agents operate the way they do

Neil Collins 11:28

Neil Collins 11:28Now we know the answer. There was none. Or rather not enough

At the height of the buying frenazy of “a new model in estate agency” the shares touched £5

The price today? 15p

Izabella Kaminska 11:30

Izabella Kaminska 11:30

Neil Collins 11:30

Neil Collins 11:30Even that is not its lowest. It’s rallied a bit on news of an activist investor. Best of luck with that

Izabella Kaminska 11:30

Izabella Kaminska 11:30ha

well this is the thing with all the new-fangled disruptive “models” that were supposed to revolutionize everything from taxis to food delivery

when it cuts to the chase, they have failed to be resilient to core market forces

Uber is another one

as is deliveroo

As is German-based Gorillas

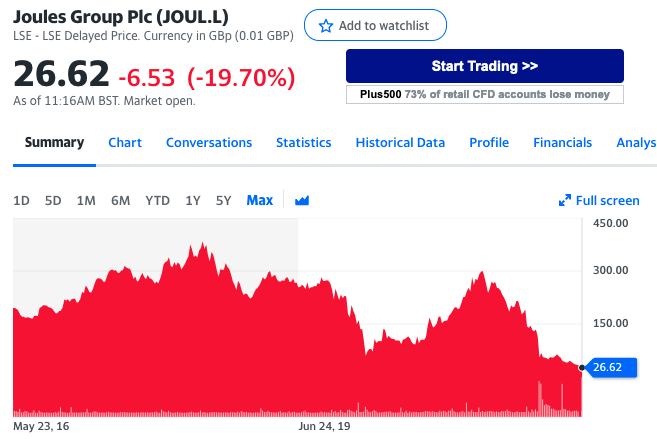

Neil Collins 11:32

Neil Collins 11:32It’s also reflected in the prices of whizzy internet-based clothes retailers

Joules is the latest casualty

Izabella Kaminska 11:32

Izabella Kaminska 11:32

Neil Collins 11:34

Neil Collins 11:34Meanwhile, the old store groups soldier on. ABF (Primark) Next, JD Sports and perhaps most surprising of all, Marks & Spencers

I wouldn’t say they were fashionable, but they have somehow scrambled back into the mainstream

Izabella Kaminska 11:35

Izabella Kaminska 11:35I spoke with Bruno Monteyne, senior analyst covering European food and household, personal care and cosmetics at Bernstein Research, a couple of weeks ago about how these instant online grocery competitors are likely to fare.

I also spoke to his colleague William Woods

They think that out of the incumbents, online has only got at best to a margin of 2-3 per cent. Which means overall it’s still margin dilutive.

But the instant companies, like Delivery Hero and Gorillas, are going to have even higher overheads and even worse unit economics.

Neil Collins 11:36

Neil Collins 11:36(Dario: I’ve never heard of Toshi….)

Izabella Kaminska 11:36

Izabella Kaminska 11:36He frankly doesn’t understand how they survive, and said it’s all “bananas” but he has learnt that stuff he has always thought was bananas, has somehow become normal. So hard to apply conventional logic in some cases.

Here’s a quote from my interview

from Bruno

“Grocery ecommerce from the old Ocado style point of view a high asset turn business. If you do it well, you can turn your capital three times better. But given that the industry never makes an excess return (it never makes an excess return because there’s no proper differentiation because you go from the nearest to the cheapest), if you’re lucky supermarkets makes 4-5 per cent Ebit margin and online makes 1-1.5 per cent. That might sound miserably low, but from a returns point of view it is as good or as bad as the old world. So that’s sort of the best to achieve. But this does assume you’re at scale.”

Basically, he also sees consolidation in the big supermarket names

only regulators really standing in the way

Neil Collins 11:37

Neil Collins 11:37(Ah, parent of LVMH. Deep pockets, then)

Izabella Kaminska 11:38

Izabella Kaminska 11:38One has to wonder whether we will all end up like Switzerland, where it’s basically a duopoly of Coop and Migros.

And funnily enough, having spoken to a bunch of Swiss finance types, they think that’s why Switzerland is handling inflation better, because the duopolists had a lot more margin to absorb.

Neil Collins 11:39

Neil Collins 11:39I doubt that. Even though half the industry is owned by private equity, there seems to be sufficient competition in the UK

Izabella Kaminska 11:39

Izabella Kaminska 11:39Yes, in the Uk, it’s razor-thin margins. But the question is for how long?

Neil Collins 11:40

Neil Collins 11:40And don’t forget that the competition authorities blocked the merger between Asda and Sainsbury. Completely!

Izabella Kaminska 11:41

Izabella Kaminska 11:41So, Neil you’re off to do a recording for ALTIF. Can you give us the scoop who you are speaking to?

Neil Collins 11:41

Neil Collins 11:41Podcast with Fergal Sharkey

Izabella Kaminska 11:41

Izabella Kaminska 11:41ooh. yes, I can see why you have to go and do some homework.

Neil Collins 11:41

Neil Collins 11:41Once a pop star, now a thorn in the side of the water industry

Izabella Kaminska 11:41

Izabella Kaminska 11:41Got to go read up so you have some good questions.

Neil Collins 11:42

Neil Collins 11:42Good to have been here. Bye

Izabella Kaminska 11:42

Izabella Kaminska 11:42But I’m still here so don’t go!

and do feel free to engage directly

I want to look at the political fallout in the UK

but from a markets POV

I’m most interested in the creeping nationalisation of so many strategic assets. EDF is obviously the big one. [Not directly related to Boris.]

As already noted, this is meaningful for us Brits because Hinkley Point is being developed by EDF and a minority Chinese partner. Can we trust a nationalised French company to run our nukes?

What do you think?

But also interesting to me is the subtle elevation of lots of military bods into positions of power.

It does feel a bit like some sort of military conservatorship is coming our way bit by bit.

Am I crazy?

At the moment, the UK leadership frontrunners are Rishi and Liz Truss depending on what newspaper you read.

But I have a feeling, there is a not-insignificant chance of Penny Mordaunt charging ahead flanked by Tom Tugendhat.

Penny is an active reservist as far as I understand. She’s got the backing of Allison Pearson at the Torygraph.

And Tom was in the actual army.

He’s definitely bigging up the army connection

Meanwhile, speaking of military control, a very interesting story is going on with the UK’s fertiliser market. You can go with the Telegraph,

Or you can go with Farmers Weekly.

This fits my “Uk is about to go into a state of military conservatorship” theory

Ince is one of only two fertiliser plants in the UK that are struggling to stay above water because of the increase in gas prices.

They produce carbon dioxide which is essential for meat processing.

The Ince plant is currently due to close in August because its parent company CF Industries doesn’t think it can operate in a viable way.

Ince employs about 300 people.

The government has been encouraging a buyer “and a markets solution” that can keep it operational, but supposedly none of the bids according to CF would be able to do that. Not quite sure why they care about whether the new owner can keep it operational. Surely better to get any money for a loss-making plant than none?

but regardless…

According to the Telegraph:

A spokesman for CF Industries said: “CF Industries has spoken with several parties. In the course of those discussions, at no point thus far have the parameters of any transaction – proposed or outlined – appeared likely to secure the long-term future of the Ince manufacturing facility and its employees.”

Anyway, security and agricultural lobby people are a bit worried this will leave the UK drastically over-exposed to CF Industries’ last remaining plant in Teeside. They’re not wrong.

The government gave CF a loan to maintain carbon dioxide supplies. But now it wants a market resolution.

And……

…..

Part of that resolution was what the Telegraph called an “audacious” bid by former army chief Lord Dannatt, who is apparently into agricultural affairs.

I mean, it’s always been a cliche that army folks go into the city after leaving the army. But the idea of Dannatt running a bid to secure the future of Ince does feel meaningful. For now the bid has failed.

But this note from Edward Burke in 2016 to the FT seems relevant:

Sir, The article “Generals caught in US election crossfire” (September 10/11) on ex-US military leaders meddling in US politics is newsworthy. Why does such interference not merit the same attention when it occurs in the UK? When General Sir Richard Dannatt attended a Conservative party conference in 2009 while still a serving military officer and criticised the Labour government, neither the FT nor other respected titles saw this as undermining British civil-military relations. Britain is not immune to such tensions; but they are rarely commented on.

[In response to comment] Like I said, I’m not a military expert, and it’s not like there hasn’t always been a revolving door between military service and city activity. But.. if Penny gets the job,… in a time of renewed Cold War anxiety, I think it’s all becoming a bit meaningful.

I met Penny at some point I think in 2019 or earlier. She was doing the local political rounds. She definitely has stature. But what do I know?

[In response to comment] 11:54 I don’t see the gas price coming down any soon, and the issue isn’t really resolvable with higher prices.

We are basically in a transition from a market economy to a war economy

A war economy can keep unviable assets going with things like rationing, a market economy can’t.

Productivity isn’t really the issue, and even if it was that’s not going to get us through the Summer of discontent, in my opinion.

which is likely to become the year of discontent by 2023

This isn’t the only supply chain shock coming our way btw:

Britain is on the edge of dairy shortages as a crippling lack of workers forces farmers to slash production, the country’s biggest milk and butter maker has warned.

Arla Foods, the company behind Lurpak butter and Cravendale milk, also predicted that dairy prices will surge even higher with grocery bills already rising at the fastest pace in 13 years.

Rationing is coming. I was a bit over zealous in calling this in Feb in terms of the timings, but i don’t think I was fundamentally wrong.

Germany has already started rationing hot water and dimming street lights

and this is THE SUMMER. [Wait till winter.]

On the tech front: Do keep letting us know about the trouble you may or may not be having

To finish off I will just remind everyone that US CPI is out this week.

It’s expected to reach a new high of 8.8 per cent year on year.

There’s this big Uber investigation out by the ICIJ

Leaked Uber docs reveal bare-knuckle expansion tactics:

investigation

– Leaked Uber files detail how politicians helped ride-sharing

giant’s global rise – Axios

But frankly, I think this is yesterday’s news and a bit overhyped. The formatting on the story is horrible too.

What is worth watching is that China’s State Administration for Market Regulation announced 28 cases involving merger deals that were not reported for antitrust reviews.

Offenders, which also include Bilibili and Weibo, have been fined nearly US$75,000 for each case, some dating back as early as a decade ago

And last and not least, I am going to start Nationalisation Watch.

Uniper (UN01.DE) flared on Saturday as its Finnish main shareholder rejected a call from a senior German minister for further help in bailing out the ailing company.

Uniper, Germany’s biggest importer and storer of gas, this week asked for a German government bailout, warning losses due to reduced supplies from Russia and soaring gas prices could reach 10 billion euros ($10 billion) this year. read more

It’s everything Jeremy Corbyn wanted but failed to get, but being driven by market economics not socialism.

12:04 Another thank you to Neil again, and just a quick housekeeping note.

I am taking a break next week (not in Germany). And since it is the summer rather than outsourcing this to a third party, what I might do is just shutter SML until my return in August. We have enough data on the problems, so this will give us a chance to optimise everything. And what I think will be a wise thing to do is keep the system on standby for emergency markets sessions if and when anything drastic and unexpected does happen over the rest of July.

If you’re reading this in transcript form and want access, you can sign up here for a Coodash login.

I’m hoping by September to recruit an experienced pro to operate this on a daily basis though.

On that note, I’m outta here. And do stay safe in these choppy waters.

thank you for joining again!

Comments

12:14 D: Yes that would work – you already have the Scroll button so once I’m back a few pages you can pop that up and then I’ll be able to hit that when I’m ready

12:11 GH: hanks for all the feedback

12:11 GH: Looking at that one D, because it is a live chat we obviously want it to update to the new message, we may be able to do something that stops that if you have scrolled a certain amount

12:09 GH: Will address copy line bug

12:09 D: there is a tricky UI issue in that if I want to scroll up and read prior messages it resets back to the bottom as soon are there is a new post

12:08 WS: but it doesn’t work for me 😉

12:07 GH: yes copy line button to the right

12:07 WS: oh – there is a copy this line button

12:06 WS: so i can’t follow Roger’s link below

12:06 WS: can’t copy paste text from the comments box

12:06 WS: one more bug?

12:06 DGG: thanks izzy!

12:05 WS: thanks Izzy – have a super holiday.

12:05 RF: Good story on Uniper’s problem

12:05 RF: https://news.sky.com/story/ukraine-war-pushes-uniper-one-of-europes-biggest-utility-companies-to-the-brink-12645640

12:03 D: Germany looks horribly exposed to energy shortages

12:01 DGG: What impact could that have?

11:58 DGG: that is crazy!

11:58 DGG: it’s affecting all of us, D. I’m doing the same

11:57 D: Is it just my browser or does the comment line get deleted when somebody posts, I’m using Notepad and then pasting here

11:57 WS: dairy prices been way too low forever imo

11:55 WS: so does gas price go up permanently so that productivity benefits of fertiliser aren’t cost effective?

11:53 WS: why is it non viable mediium long term? doesn’t gas price come down or fertisiliser price go up? hopefully we keep farming.

11:51 RF: I feel sure this is a second career for Dannatt, not a continuation of his first one

11:51 DGG: So it’s fascinating to see them coming out of the woodwork for this occasion

11:50 DGG: Indeed, the UK military has always been the quiet professional types. Great for low-keyness

11:47 DGG: wah!

11:46 RF: Or Flynn in the US

11:46 RF: Service is no guarantee of sanity …D Davies for example

11:46 DGG: interesting

11:45 WS: would be more worried about remote detonation of a nuclear power station!

11:45 D: Isn’t EDF on the hook contract wise?

11:44 WS: wouldn’t the power stations be taken over with force majeure?

11:44 DGG: When you say military bods, who do you mean?

11:43 DGG: When have we ever trusted the French

11:43 DGG: Re-nationalising the commanding heights

11:42 WS: thanks Neil.

11:42 DGG: Thank you Neil!

11:40 WS: i was sad to see Morrisons go to PE, as both investor and customer, but shops are holding up well for now imo

11:36 DGG: https://www.lvmh.com/news-documents/news/lvmh-announces-2022-innovation-award-prize-list-and-its-grand-winner-toshi-during-viva-technology/

11:36 DGG: It just won the 2022 LVMH Innovation Award

11:36 RF: Delivery services for humdrum good seem doom in a cost of living crisis… esp once the PE cash runs out

11:35 D: There is an element of last man standing with retailers isn’t there – high street is decimated

11:35 DGG: Some online clothes retailers are well positioned – those in the luxury sector. Check out Toshi. Bullish on their surivival as their margins, tight as all other online retailers, still benefit from a more significant markup as a result of their luxury delivery services.

11:28 WS: woodford fave right?

11:28 DGG: I had no idea about the Deutsche Bank thing. New to me, but not all that surprising considering the things DB gets up to these days…

11:28 DGG: What really gets me wondering with Wirecard, that was mentioned on ALTIF is, what if they could have just gotten away with it?

11:23 DGG: haaa

11:17 RF: jarndyce v jarndyce

11:16 JC: My bet remains that the case will still be ongoing long after Twitter exists as a platform

11:14 WS: as Levine says, what if he loses but refuses to pay?

11:13 RMC: missing s/t?

11:13 RF: Don’t put it past Elon

11:13 WS: i am still laughing

11:12 WS: lol @11:11

11:10 DGG: But I have noticed issues with catering for EasyJet, which suggests the problem goes deeper than staff cuts.

11:10 DGG: I have found the airport woes to be overstated – bar the sudden cancellations, all the airport’s I’ve been to this summer have been peacable and fine.

11:08 LP: Sorry for the inconvenience

11:07 LP: There does seem to be a probem with the text box clearing, working on a fix currently, a workaround would be to type your message elsewhere and then paste it here to send a comment without the box clearing.

11:07 RF: Fresh lockdowns looming in China

11:07 WS: text disappears from input box whenever a new topline comment is posted

11:07 WS: issue is intermittent

11:06 Izabella Kaminska: I’m on firefox and all well for me

11:06 DGG: (desktop chrome too)

11:06 WS: (on chrome on a desktop)

11:06 WS: Same issue in the typing box for me

11:05 DGG: And yes I remember Melenchon using the hologram in the penultimate elections!

11:05 DGG: I’m having the same issues as John actually, the text I type vanishes from time to time

11:04 LP: I see what you mean, looking in to the problem now

11:03 JC: The text entry box intermittently closes

11:03 JC: It’s like a race against time

11:03 JC: I am but on a tablet

11:02 JC: Thanks Luke

11:02 LP: Hi John, try using google chrome if you aren’t already, it’s the most reliable browser for using coodash

11:01 WS: hellos

11:01 RMC: hi

11:00 RR: Yep! All herr

11:00 DGG: Hello!

10:59 JC: Ok there we go. Rabble rabble. How was ABBA?

10:59 JC: Lose the typing box suddenly

10:59 JC: Probably me

10:59 JC: Problems