Julian Rimmer 10:30

Good morning, aloha and greetings fellow market wizards.

Today Izzy is flying (I mean literally, not just in high spirits)

So this grizzled, battle-hardened, embittered veteran of some three decades in the trenches of the City, is rejoined by The Blind Spot’s geopolitical expert, Dario

The Boomer and the Zoomer will be escorting you on your daily perambulation through financial markets. Let everyman be thy guide. Come, walk beside us : solvitur ambulando

Hello all!

Julian Rimmer 10:32

I have a very suitable subject to illustrate our respective generational perspectives

Elon

or NapolElon

Elon>NapolElon

Julian Rimmer 10:34

TSLA dropped 5% after mkt after (another) 3Qmiss. Margins at 4yr-low.

TSLA is feeling the pinch from BYD’s $11,000 hatchback EV, the Seagull. Nomenclature that could only work in China. In Britain everyone hates seagulls. A Tesla may be more aesthetically pleasing to sit in but I could be three Seagulls, have family members drive them in convoy and still have change left over for a case of first-growth claret.

The seagull is defecating on Elon’s head?

Well, plenty of videos online continue to attest to the increasingly more well-known fact that Tesla’s build quality is poo-poo

Finnicky plastic bits, warped fittings, paint chips, and bad audio galore.

Julian Rimmer 10:36

I only discovered this morning BYD is an initialism for ‘build your dreams’ , which formulation is too cheesy for words.

The secret to its success lies in its original business – building batteries – which gives it a huge margin advantage of Tesla.

That’s super cool, actually

Julian Rimmer 10:37

You mean the battery advantage, not the name, I assume?

Indeed

Julian Rimmer 10:37

Massive govt tax breaks also help whereas given Elon’s incitement of Democrat politicians and the left generally would appear to have alienated them sufficiently to guarantee he’s never offered anything from a Biden administration or its putative successor.

Car sales are falling in China and now ‘Napolelon’ is having second thoughts about a new $5bn plant in Mexico. Countless people have gone bankrupt shorting TSLA shares in the past but it’s not a stock I’d want to own.

Welcome to the Karma café. There is no menu. You get what you deserve.

For the fullest experience of your favourite Karmaccino, head on over to WallStreetBets. The hilarity is guaranteed this morning

Countless “regards” (WSB lingo to avoid the PC police – swap the g with a t) had posted their absurd calls on Tesla prior to earnings

See this $12k call on TSLA at 260 and 275. poor guy

Julian Rimmer 10:39

Poor guy = idiot. has he never seen a TSLA earnings release before?

BUT some regards do have interesting things to contribute

Lots of commenters point out that TESLA is ‘LARPING’

This means ‘live action role play’ – or pretending to be something you’re not

Julian Rimmer 10:41

(reading this, I’m suddenly struck by what my grandad meant when near the end of his life, I asked if he would like me to read him the newspaper and he shook his head: ‘It’s not my world anymore, son’)

LOL

Especially considering Elon’s recent comments on how the new Tesla series is essentially a new type of ‘artificial general intelligence’

See here – which company seems like it is larping as a tech company. $5 to the right guesser

Online commenters have wondered what the ‘secret’ to Tesla’s supposedly outsized margins on other car manufacturers are. Firstly – they’re not that outsized. But secondly- many have wondered whether it’s because they have great savings on avoiding Quality Control

(Or because they apparently quantify R&D costs as a separate line item)

But a great piece on Seeking Alpha this January identified some of the troubles that Tesla currently seems to be facing

The author outlined how Tesla’s Covid and post-Covid boom was due to supply shortages that squeezed traditional carmakers’ margins and predicted that once these eased out, Tesla’s advantage would significantly shorten.

Which it did!

Julian Rimmer 10:44

People sitting on ytd gains (the stock has more than doubled from $100 January lows to ~$250) may want to book profits before being run over by a cybertruck filled with contrarians. That’s one cybertruck that may be delivered.

Cathie Wood’s Ark owns 7% of the company, $900mill. She likes the robotaxi and thinks each time ‘Elon faces turmoil like this, the intensity of his brain cells takes him to new answers’. I thought of the intensity of my brain cells this morning but it took me to exactly the same answers.

I don’t know whom I’m less likely to invest in: Elon Or Cathie

Just like wallstreet bets, if you wanna make money, you ‘inverse’ Cathie Woods

Julian Rimmer 10:45

Cards on the table: I cannot abide Elon Musk, life support machine for a rectum.

and moving swiftly along now

BUT my inner (though wavering) Elonite has at least one good piece of news for him

Qatar Airways is now using SpaceX’s Starlink to provide complimentary high-speed WiFi to passengers

Always thought Starlink was pretty cool. Definitely cooler than TSLA

And it really works!

Julian Rimmer 10:47

Onto oil…

The behaviour of oil in the last 24hrs is instructive. The reaction of Brent to events in the ME has been roughly: am I bovvered?

Irrespective of the actual causes of the explosion at the hospital in Gaza, the reality is that as soon as it happens, respective propaganda machines kick into action to ‘flood the zone with shit’ in Bannon’s memorable phrase. (It’s a tactic the Russians originated) No single narrative prevails. ‘Lies are halfway across the world before truth and his boots etc’

Julian Rimmer 10:49

thx for that

The uninformed will be convinced and polarised and the spectre of regional escalation by inflamed Muslim nations nearby looms. Retributive acts of violence will be perpetrated anywhere. The focus remains squarely on Gaza and the tension elevated, precluding any hiatus in the bloodshed which might allow negotiations to take place.

However, the price action in Brent suggests markets also think this crisis will be contained and moreover that given the delicate nay parlous condition of the consumer across the world right now, any jump in the oil price will cause demand destruction, and therefore prove short-lived.

To underline this point:

The Iranian foreign minister calls for an oil embargo against Israel by all muslim countries.

Eurasia Group’s Ian Bremmer response? “ it’s meaningless: 1) countries won’t join 2) israel imports are tiny (200,000bpd) 3) easy for israel to get oil elsewhere”

On the topic of Israel – another cute blind spot

Israel seems to be shipping weaponry to Azerbaijan using the classic Silk Way Airlines – a company with a history of transporting arms shipments to Azerbaijan

Four flights have ocurred over the past 2 months

And to follow on from our last comments on Azerbaijan – their military vehicles have been seen sporting a new identification.

Julian Rimmer 10:52

(@Izabella – someone needs to tell Elon that for a fifty-year-old bloke with moobs, a tight, black t-shirt is not appealing. Whoever told him it was was not a sincere friend)

Which is often a key tell-tale sign of an upcoming invasion. But who knows

Julian Rimmer 10:53

Last night, UST30YR yields jumped >5% for a while

The bottom line is that this is only going to support USD strength

FX commentator Stephen Flanagan ‘The US Dollar benefited from the faster move higher in rates. After some profit taking and technical correcting ahead of us I look for the US Dollar to continue its rise. The EuroZone/UK rates will decline at a faster rate due to growing economic uncertainties. FX volatility will remain and grow further in the months ahead.

The catalyst for yesterday’s move was that retail sales print, far stronger than expected. +0.6% on the month, against an expectation of 0.1% was the biggest surprise of the year.

Where that print came from, I don’t know

Speaking of USD world dominance, or its impending (or already occurring) decline

There has been some news this week regarding China’s Belt and Road initiative.

Like Charles Bradley’s classic – it’s “going through changes”

China declared that its investments would pivot away from new gigantic infrastructure investments, and towards “smaller, greener, and leaner” developments

Julian Rimmer 10:57

https://abcnews.go.com/Business/wireStory/chinas-belt-road-initiative-changing-after-decade-big-104028838 China’s BRI is now on par with the World Bank with over 3000 projects and galvanising ~$1tn in investments

It seems impressive. Often, too impressive for Western readers – who seem to want to poke a hole into the whole affair.

Julian Rimmer 10:58

I would number myself among those Western readers

Debt trap diplomacy is something the West is keenly aware of. We seem a bit miffed that someone else is doing it better

Julian Rimmer 10:58

I am miffed

I just finished “Confessions of an economic hit man.” An interesting book that went on about how china’s debt traps are just as noxious, if not more so, than Western World-Bank/IMF types.

But I would beg to differ

I joined my friends “overlanding” trip through southern Africa this year – they were going from Cape Town to Lagos.

I joined them for a trip around Namibia

Julian Rimmer 10:59

(or Nambia as Donald Trump calls it)

Lol. And what did the locals have to say about Chinese ‘debt trap’ diplomacy? Terrible things? The Chinese are racist?

Julian Rimmer 10:59

Yes

Absolutely not.

Julian Rimmer 10:59

Oh

“They’re amazing” was the consistent take

Julian Rimmer 11:00

are they propaganda victims?

Perhaps. But my friends who travelled upwards through Angola, and the Congos, all told much the same stories. People down there are having a love affair with China

Locals derided American and Western support as “white money for white people”. And the Chinese hire their own, of course, but according to the locals I spoke with, they seem far more open to hiring locals than the Western firms.

And Namibia is one in particular to watch – landing at Windhoek airport, the tiny tarmac was taken over by a gigantic American C-17′

Little did I know, Total Energies has been developing a ‘record-breaking’ oil discovery in Namibia

And so, I did my favourite foreign city activity – trying to find the American embassy

Julian Rimmer 11:02

Please tell me it’s a more appealing destination than the one in Lebanon

Well, it’s certainly far cuter. here’s an official picture:

Julian Rimmer 11:02

Looks like a game lodge.

Just like China’s local sprawling complex, this American embassy is equitably massive.

One way or another, China’s Belt and Road is not one to underestimate – its charm offensive IS working – and Namibia is certainly one to watch.

Julian Rimmer 11:03

Does it have a good economy? is there a way to invest easily?

Well, this is the interesting thing. Namibia’s economy – as told by the locals – stood out precisely because it was quite ‘meh’

No outsized resources, no insane energy reserves (until now, at least)

Which has led to a very peaceable society.

One of the least densely populated lands on earth, a large portion of the economy is rural – mostly husbandry – and some mining

Julian Rimmer 11:04

And tourism, I assume?

Indeed.

Julian Rimmer 11:04

Surprising, because I’d expect it to be a commodity economy on steroids like Kazakhstan.

Well – considering the new discoveries – this is precisely what the locals fear

A man who was waiting for a masseuse at the hostel I was staying at kept talking about the resource curse – and how Namibia had been blessed with so few. “But maybe that will change now…” he said glumly

Julian Rimmer 11:06

Maybe he felt happier after his massage ended

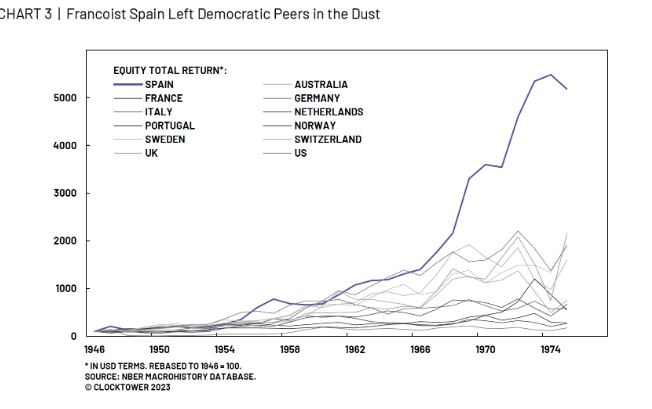

On the point about China and investing, there’s an interesting piece from John Authers at Bloomberg who looked at the performance of democratically-inclined Emerging Markets and those characterised by varying degrees of authoritarianism.

Fascinating, Mark. And yes – the production quality of contracted Chinese firms is certainly the biggest downside to Chinese loan assistance. This is also something Confessions of an Economic Hitman points out.

Julian Rimmer 11:08

The outperformance is as clear as the nose on your face and particularly pronounced since the end of 2021 when China’s crackdown on business saw it excluded entirely from FRDM ETF

There’s an ETF for everything it seems. The FRDM ETF has outperformed MSCI EM over the past five years too, not by much, but as a shareholder, you’ll feel better about yourself.

For many years, my fortunes were entirely dependent on the relative performance of the Russian and Turkish stockmarkets and I always felt a little grubby. This would have absolved me of much of that Catholic guilt.

Freer countries are more sustainable and recover faster… “You can see that in the recovery after Covid. They used their capital more efficiently, both human and financial.”

Of course, there’s an exception which disproves the rule and that was the Francoist regime in Spain which leveraged its significance during the Cold War era to attract huge grants and aid from America.

Love me some Franco. Most people from his generation (who weren’t killed, expelled or imprisoned) have great things to say about him.

Julian Rimmer 11:10

Our little economic miracle

Julian Rimmer 11:11

Well, I would say it was largely engineered by the US but Franco played his cards well, and almost uniquely for a dictator he died peacefully in office.

Hopefully, Putin won’t make the same quietus.

His successor, Luis Carrero Blanco, had the privilege of being Spain’s first astronaut

Albeit unofficially, and unwillingly

When his car was blown into the sky by ETA

Julian Rimmer 11:12

That’s much more satisfying

It was their first big ‘kill’. Netflix should have a new special on it.

And speaking of

This summer has seen bearish after bearish news on Netflix

Much grumbles about the ban on password sharing…

But it seemed to have worked out!

Yesterday saw Netflix announce a record swelling 247 million subscribers and matched analysts’ top estimate of earning $8.54 billion in revenue this summer

On the back of this news, Netflix also announced a price increase in their packages – from $9.99 and $19.99 to $11.99 and $22.00.

BUT

We found some nice scepticism online, as usual

Many wondered whether this large jump couldn’t just be a one-off effect: dedicated Netflix customers who stole their now-defunct ex-girlfriends passwords and were then forced to purchase a subscription can only do this once, unfortunately.

Julian Rimmer 11:15

I rarely find anything worth watching on Netflix so unless it’s free… there’s my scepticism

Mark – with more unemployment, it’s only gonna get worse.

But there is another tastier – and more speculative – morsel

This has to do with Netflix’s new ‘budget’ tier of subscription – which includes advertising.

Netflix admitted that the ‘full effects’ of their ad business hadn’t yet been felt

But many speculated the price hikes may be ass-patching measures for when shareholders realise that Netlfix ads (and their relatively high cost compared to YouTube, for instance) are simply not paying off

Could these price hikes be related to ass-covering measures, and is Netflix passing on the cost increases to the consumer wholesale? Who knows

Julian Rimmer 11:17

A friend sent me this yesterday

IBP was shuttered owing to concerns about the way it conducts its business, including about client money protection at the firm.

What happened?!

Julian Rimmer 11:20

my friend asked (rhetorically, I assume) How many more are there like this out there?’ My reply was, ‘All of them’.

Maybe most of them would be fair.

Now that I’m longer a dues-paying member of the Investment Bankers union, it’s open season as far as I’m concerned

The last thing the City wants but what I suspect the City gets is even more vigilance and surveillance from the FCA. Look at this, for example

Hum!

Julian Rimmer 11:22

It’s quite a remarkable state of affairs that the SEC is now contemplating a further crackdown and enhanced surveillance of financial firms which will include video recording of zoom-calls and meetings. There have been restrictions on mobile phone usage and whatsapp for a long period but this latest initiative to prevent what are euphemised as ‘potential compliance failures’ seems to be going a bit too far.

You’d be right 99.9% of the time

But at my old job, we had one client who had been defrauded by a group impersonating an investment group to disclose some shady dealings

Once this group’s report (likely financed by a competitor) was published their stock price fell by a few bn.

It was only the compliance measures of one of their subsidiaries (which took pictures of unsuspecting group meetings) that allowed us to have the faces of the perpetrators, and moved this investigation to the next stage.

Sometimes they work for their intended purpose!

Julian Rimmer 11:25

Dario: you have me wrong if you think I’m a man whose prejudices can be corrected by things like facts

Don’t worry I don’t

Julian Rimmer 11:26

To paraphrase Keynes’ dictum: when the facts change I change my mind. What do you do, sir? Well, I just double down.

Following this logic to its inevitable conclusion, the only way to ensure full compliance is for the SEC (and eventually the FCA because the former goes, the latter meekly follows) is to adopt the Big Brother strategy of 1984 with market participants being monitored round-the-clock.

They call this a ‘classic boomer move’

Julian Rimmer 11:26

One could avoid any obvious transgression during a meeting and then hand over a takeover tip to your client as you get into the elevator. Or as you stand beside him at the urinal.

Funny, but very true!

Julian Rimmer 11:27

(I interrupt this dialogue momentarily to tell you Izzy is almost airborne)

Things have come a very long way since I started on the Salomon Brothers trading floor in 1989. I didn’t realise what a sheltered life I’d led until then as having never seen one in my life hitherto, I’d witnessed three strip-o-grams on the trading floor, up close and personal, in my first six months.

It’s essentially a compliance game of hot potato.

What’s a strip-o-gram?

Julian Rimmer 11:28

Oh my lord, boomer v zoomer. This is like me asking you what ‘larping’ means.

A strip-o-gram was a woman who would visit your celebratory event and disrobe decorously for your delectation

Woah – that certainly won’t happen today

I was born in the wrong era…

Julian Rimmer 11:29

I think I was

This final last-minute anecdote to squeeze in before I morph into a wine merchant for the afternoon…

Here’s an incoming email yesterday from a potential customer:

“Do you sell non-alcoholic communion wine at your shop ? If so what is the price per bottle?”

I told her I was a raging alcoholic and a devout atheist. She got short shrift.

Hahahahaha

Julian Rimmer 11:31

And on that spondee of despair, it’s goodbye from me

Ciao everyone!