Dear Subscribers,

As usual, this week’s edition of the Blind Spot newsletter has been compiled by Izabella Kaminska and Dario Garcia Giner. But the big news this week is that this newsletter will be on a two-week hiatus as of next week so that I can take my first proper holiday since starting the Blind Spot in February 2022.

I value all of my subscribers immensely and feel bad for leaving you with no content for two weeks. I had hoped TBS would be a bigger operation by now, but alas, we remain a micro-venture, with typos and poor formatting, and inconsistent send outs. Oh my.

But, everyone needs a cognitive rest, and I promise the content will benefit from it in the long run.

In the meantime, I will continue to post highlights from Politico’s gated content and muse about newsy developments in the TBS Discord as well as on Twitter as usual.

I’m also putting Dario in charge of mailbox relations. So if you have any inquiries or news to share with us, please email [email protected].

I would also like to take this opportunity to update subscribers about Spot Markets Live. We suspended the service over June/July due to poor economic incentives and my need to pinch Anjuli Davies for a freelancing gig at Politico. But … I’ve since heard from Frances Coppola that she would happily partner up with Anjuli on a regular basis.

Would this be of interest to subscribers? What would make it more compelling and monetisable?

In the meantime, the Blind Spot’s investigative probe into the Tesla brand, which includes an exclusive interview with one of the partners of the group that owns the rights to the Tesla Brand (which Elon has to pay annually), is now available to basic level subscribers. If you like the story please do give us a shout-out on social media. It really does help.

Happy holidays to all, and I’ll see you on the other side of Europe’s mega heat wave.

Izzy

Economics, business, finance, and more:

- The Economist reviewed the rise of so-called student consulting clubs and their consequences. This phenomenon, typically occurring in elite universities in the Anglosphere, consists of students that band together and offer paid consulting services to companies for a fraction of the usual price.

. - Works In Progress questioned why Britain stopped building homes, with the author diving into Britain’s homebuilding history to outline how current house-building restrictions stemmed from Britain’s first house-building spree in the early 20th century.

.

- The Federal Reserve said it is set to introduce a new payment system to make payments in the U.S. banking system available immediately and 24/7. However, some analysts are concerned that “FedNow” could “destabilise banks’ reliance on customer cash, fanning the flames of deposit flight” that almost collapsed several regional banks this year.

. - The Saudi National Bank wanted to take its stake in Credit Suisse to 40 percent stake from 9.88 percent, injecting $5 billion in the process, but Swiss regulator FINMA blocked the petition.

While there’s no guarantee that even $5bn would have saved Credit Suisse, the message here is clear. We would rather see our banking system destabilised than give Saudi such a significant stake. — IK

- IFR highlighted the risks that the SEC’s planned move to halve the settlement cycle for US securities to T+1 from T+2 would create serious for foreign investors, which will negatively impact around $39bn of daily FX trades.

It wasn’t just IFR pointing this out. Minutes from the ECB’s June FX market contact group — a regular get-together the central bank has with market participants to probe their thoughts — reveal a similarly spirited discussion in which a few members highlighted that the shortening of the settlement cycle to t+1 could put pressure on “some regions with narrow time window with the US trading hours and for some types of FX market participants which do not settle through Continuous Linked Settlement (CLS).”

It was also noted that, “members felt that in order to manage increased operational risk, it was important to ensure that the timing of FX and US security trades align closely to minimize the risk of missing the CLS cut-off time for the related FX transaction. They also highlighted increased cost associated with new processes, e.g., pre-funding (increased need for liquidity where in some members‘ view custodians should play a bigger role), late payment fees, system enhancements, and higher likelihood of errors.”

Overall members felt that “shortening the US securities settlement to t+1 will be challenging and raises settlement risk.”

Though, not even ECB markets contact group can escape popular delusions about blockchain tech being the solution to any awkward problem (problems that usually stem from socio economic, cultural factors or time zones). One member allegedly piped up that: “with the use of latest technology one could achieve timely settlement without settlement risk by blocking trades simultaneously and in this way even eliminating the need for CLS.”Call us sceptical. The Blind Spot’s take on all this remains the same: be careful what you wish for. Instant clearing and settlement sounds nice in practice, but it takes us down the road of having to pre-fund every trade and/or depend on very powerful central go-betweens to guarantee trades. Much the way that Ebay has to guarantee sellers actually deliver to buyers.

As we’ve noted before in Bloomberg, 24-hour liquidity and settlement would force markets to create a price for intraday liquidity. Probably emulating a type of Uber surge pricing mechanism, which would likely be very volatile — especially if anyone took advantage of the new instant 24-hour infrastructure to trade large clips during illiquid hours. Not doing so would risk jamming the system. — IK

- Separately, the ECB’s FXCG meeting also discussed the growing stigma associated with tapping central bank foreign currency swap lines.

.

- Minutes from the ECB’s Money Market Contact Group revealed participants were worried about “hold-to-maturity” bonds being deemed ineligible for classification as high-quality liquid asset ost the collapse of Silicon Valley Bank. They also discussed what might be done to revive unsecured markets, in light of regulations that severely disincentivise their usage.

A few “such lines were still in place”, participants noted, but the market was significantly impeded by underdeveloped market infrastructure. This led to a discussion about initiatives that might support the revival of unsecured interbank lending, including one option which would see the ECB act “as central clearer on interbank unsecured trades.” Interesting, you might say, in light of the recent demise of Libor. — IK

- The SEC finalized another new slate of rules for money market funds with the hope of finally shoring up a corner of the investment world that has been bailed out by the Federal Reserve twice over the last 15 years.

The provisions, which passed on Wednesday, demand that funds hold more liquid assets and lose the right to temporarily stop redemptions, a practice that Chair Gary Gensler said may have exacerbated the so-called dash for cash in early 2020. But neither regulation proponents or the industry were happy about the outcome. Lobby group Better Markets told Politico that by not requiring required MMFs to carry capital buffers, and skipping on a controversial mandate known as ‘swing pricing’ — designed to shield investors from dilutions caused by a rush of redemptions — the SEC was not going far enough.

MMF providers, meanwhile, worried that the imposition of mandatory liquidity fees as an alternative to temporary redemption suspensions whenever a fund experiences daily net redemptions that exceed 5 percent of net assets (unless the fund’s liquidity costs are negligible) would be untenable. “There is no precedent for such a fee framework,” one industry player told Politico.

The Blind Spot, however, sees the new fee framework as another small market step towards introducing an intraday surge pricing mechanism for liquidity. You can just imagine the scenario. In a market panic, if you need to attract MMF liquidity, you’re going to have to pay over and above the redemption fee to make it an investor’s while. Again, this emulates how decentralised crypto finance markets have evolved.

The real market opportunity in the market at this point is building a intraday liquidity platform that can help price the market, and get the usual suspects in the rate markets to come and give it support. — IK

- The United Kingdom said it would scrap the EU-inherited rules that banned “naked” short selling in gilt markets. The Treasury claimed these restrictions on betting against sovereign debt have hurt liquidity.

This feels like a meaningful move by the UK to undercut the EU and leverage Brexit to draw market liquidity back to London (as well as risk). The u-turn will also allow market participants to by credit default swaps without owning the underlying bond again. We’re interested in reader thoughts about this move. Do get in touch if you have any strong opinions. — IK

- In a clear example of banks’ overzealous implementation of the FCA’s guidance on Politically Exposed Persons (PEP), challenger bank Monzo turned down Chancellor Jeremy Hunt for an account.

.

- BoE governor Andrew Bailey’s spoke to the annual Financial and Professional Services Dinner at Mansion House focusing on deteriorating growth rates, greater economic and financial fragmentation, and ever-present inflation risk but also “new prospects for money”.

Bailey, as is the central banker vogue these days, spent a good chunk of the speech waxing lyrical about the virtues of introducing a CBDC, which he argued was essential to preserve the “singleness of money”. This phrase, I should note, is currently being bandied around almost everywhere in the central banking community, as if it is a historic principle. And yet it doesn’t appear in the Financial Times archives until 2021.

Bailey nevertheless reassured listeners that the BoE’s intent was to maintain privacy no matter what and to maintain the cash option for society — a hint perhaps that those who think otherwise should be considered … “conspiracy theorists”. “To whoever painted ‘no to CBDC’ on a motorway bridge, “I can only apologise to the Cumbria Biodiversity Data Centre. Sorry,” Bailey said.

But as the PEP issues reveals, this is naive thinking.

There is still too little recognition that for CBDCs to be a truly universal preserve of the singleness of money, they would have to offer access to Vladimir Putin. Which they’re not going to do. This is an inherent contradiction, which will likely ensure the tools will be anything but private.

A meeting with a former copper now researching CBDCs this week, crystalized my thinking on this this week. The copper naturally felt inclined to believe that banning cash and forcing everyone onto a digital unit would help the job of the police immensely. But this is a totally naive mindset. First, as he himself acknowledged, it’s the intelligence services themselves that would be greatly disadvantaged, since they depend on anonymous transcations to mask their activities as much as the criminals.

Second, for as long as the main driver of illegal activity is demand led, parallel markets and a favour economy are always going to emerge. The problem isn’t the dirty money. The problem is the illegal activity that generates the dirty money and which has been far too normalised in polite society. Unless white collar workers in the City, and mysterious visitors to the White House with a habit of leaving cocaine around, stop demanding the underlying products generating all the dirty cash, all the KYC/AML in the world isn’t going to achieve anything.

All that will manifest is a two-tier economy, with secret surplus directed to those who profit from servicing the black markets. We know this is the case. It’s happened before. Many, many times. Just look at the former Soviet Union.— IK

- Ripple’s XRP token surged on Thursday after a judge in the Southern District of New York ruled that it’s “not necessarily a security on its face.”

This is an absolutely crazy decision which is set to empower a dubious organisation that provides little to nothing of substance technologically other than the sale of its long-ago pre-mined tokens. The decision will pave the way for a bunch of obscure opportunists to become excessively rich and influential on the global stage. Given the incentives and sums at hand, one has to wonder if the Judge arrived at the decision in sound mind and without external influence. — IK

- Semafor alleged that Goldman Sachs would report its worst quarterly earnings in several years next week, with CEO David Solomon facing “heat” from inside and outside the firm for its hasty retreat from its disappointing venture into consumer banking.

Another indicator that, contrary to popular opinion, retail consumer lending and banking may not be the gravy train most people think it is. And that banks might not be excessively gauging customers in this space after all. — IK

- Saudi Arabian oil production was set to fall below Russia’s as Saudi oil production cuts start to bite, putting upward pressure on oil markets.

.

- Bloomberg reported that Cargill was the player behind one of the biggest trades in the cocoa market in a decade this month, which rattled the London market. It’s the biggest since hedge fund manager Armajaro Asset Management LLP’s Anthony Ward tried to corner the market more than a decade ago, taking one of the largest-ever deliveries of cocoa in London.

- A major investigation by Bloomberg revealed the extent of JP Morgan’s Jess Staley’s relationship with convicted sex offender Jeffrey Epstein. As Bloomberg noted “the relationship between Staley and Epstein, which dates to the early 2000s, went beyond that of banker and client. The two formed a deep friendship that Staley in one email to Epstein called ‘profound.'”

. - Embattled former UK prime minister Liz Truss appeared more convinced than ever that her prognosis for the UK economy back in September would have done a better job of lifting the country out of its malaise than the efforts of Rishi Sunak and Jeremy Hunt thus. To prove the point she has convened a “growth commission” to offer a different take on global economic affairs and budgetary matters in a bid to boost growth.

The group of 13 economists hopes to measure the long-term impact of policy decisions on GDP per capita over five, ten and 20 years. It also aims to challenge the Office of Budget Responsibility — whose critical review of Truss’s own mini-budget helped sink her premiership — in assessing major fiscal developments.

And who funds the fiscal scrutinizers? It’s not clear. Since Truss herself plays no formal role in the group — the body operates via a private limited company set up in April — it’s not listed with the Electoral Commission, so it may not have to declare that information. We may never know. — IK

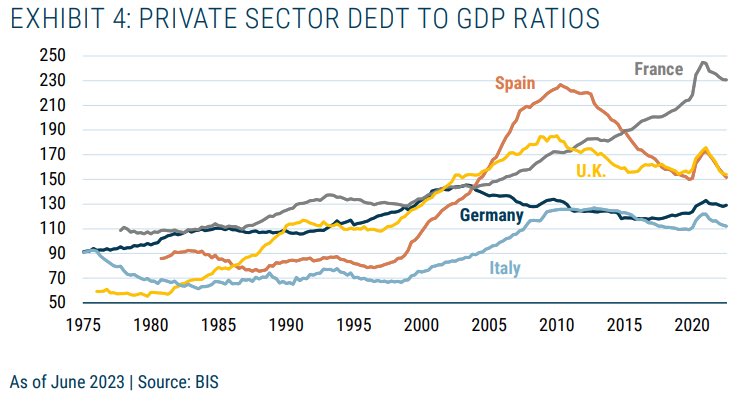

- James Montier of GMO’s latest paper entitled “Slow Burn Minsky Moments (and what to do about them)” revealed an explosion in French private sector debt to GDP ratios, which had climbed way its European peers in the last half-decade.

Military-Civil fusion, Western edition:

- NATO allies formally appointed an investment team to manage a billion euro ‘Deep Tech’ fund at this week’s meeting in Vilnius.

As my Politico colleagues on the Morning Tech newsletter explained, NATO’s so-called NATO Innovation Fund is a €1 billion venture capital fund aimed at investing in startups (or other enterprises) that are working on technology for the defence and security sector.

The fund was formally launched at last year’s NATO Summit in Madrid but the news this week is that the management team will serve as the “brains behind investment decisions.” The managing partner is little known manager Andrea Traversone, formally of U.K.-based venture capital firm Amadeus Capital. The fund also has a board of directors overseeing the activities, with early Spotify backer Klaus Hommels (of VC firm Lakestar) as the chair.

According to Politico the NATO Innovation Fund has purposefully branded itself as a “deep tech” fund, a term that is gaining traction as the go-to umbrella term for research-heavy technologies like quantum technology, AI or biotech. Despite being a NATO fund, it is going to be focused on Europe, with its headquarters in the Netherlands and “regional” offices in the U.K. and Poland. — IK

Curiosities:

- Eurostar’s rail operator placed its ski train to the Alps on review over concerns that Brexit border checks and the EU’s new entry system have damaged the efficiency of the service.

Geopolitical hot spots:

- Beijing angrily reacted to NATO’s declaration of China as a major challenge to the alliance’s interests and security. In response, China promised a “resolute response” to any potential NATO expansion in Asia.

.

- The White House announced “Operation Atlantic Resolve”, sending a clear signal it was mobilising for conflict in Europe with some top intelligence names highlighting the moves were also focusing on WMD preparedness.

. - Meanwhile, Insider, pointed out that secretive and highly paid submariners were behind some of Russia’s most worrying undersea operations.

.

- The Prigozhin saga continued. Retired American four-star General Robert Adams claimed “I doubt we’ll ever see Prigozhin ever again publicly”. He told ABC News that “I think he’ll either be put in hiding, or sent to prison, or dealt with some other way, but I doubt we’ll ever see him again.” More specifically, the General openly stated he believed Prigozhin had already been killed. But just today, a picture of Prigozhin sitting in a military tent emerged, ostensibly taken on June 12.

Is an old picture a suggestion that Prigozhin is dead, or is it that Prigozhin is still alive and kicking? Who knows. — DGG

- After Zelensky’s complaints on Twitter regarding the non-committed nature of NATO’s half-pledge for Ukraine this week, the US and the UK called for more “gratitude” from Kyiv, with the UK’s defence minister Ben Wallace revealing he had told Ukraine his country was “not Amazon”.

With war scepticism becoming increasingly acceptable in polite company, one can’t help but feel sympathy towards Zelensky’s current plight.

After all, the entire reason why Ukraine is still fighting this war was NATO’s seeming die hard commitment to its defence. Remember how Boris’ visit to Zelensky supposedly nipped a Russian peace deal in the bud?

All was well and good when it appeared that Ukrainians still had a shot at narrowing the capability gap. But as Ukraine’s floundering counter-offensive has shown, Ukraine’s problems are not so much their expertise or military capabilities, but simply a lack of manpower. It’s becoming increasingly obvious that NATO, while it remains more committed than some experts like John Mearsheimer had predicted, is unable or unwilling to commit enough to certainly put Ukraine on an even footing.

Thus, the complaints by the Americans and the British must be leaving a sour taste in Ukrainians mouths. They are ultimately fighting this conflict to the death with a superior adversary on Western guarantees. These guarantees weren’t necessarily wet paper. But they weren’t cast-iron either. Unfortunately, it seems that Ukraine may realise this too late — once they are entirely indebted to Western interests, and once their active military manpower may become depleted for at least a generation. — DGG

- The Office of Naval Intelligence warned that China’s increasing shipbuilding capacity is leading to a “shipbuilding gap” with the United States.

“Mr. President, we must not allow a mine-shaft gap!”

With these words, George C. Scott as General Turgidson in the brilliant Dr. Strangelove aplty parodied the panic that emerged over the original “missile gap” which had emerged between the Soviet Union and the United States. This “missile gap” was a fabricated (but seemingly real fear) of American defence experts which outlined that the USSR’s missile production capabilities would soon outstrip the United States in the 1950s and 60s. Later analyses found the original findings had been flawed — Americans had essentially bitten Soviet manufacturing propaganda, and the US would remain an unquestionably more powerful missile power than the Soviet Union until the Cold War’s close.

Is the same thing happening again with China?

A more specific and appropriate example to illustrate why this could be the case was the example of Germany in the early 20th century. This newly created Empire was causing an unprecedented Western arms build-up, particularly in Britain, especially as a result of greatly expanded facilities for shipbuilding. Indeed, Germany’s Kriegsmarine went from a puny force to apparently matching some of the Royal Navy’s ocean-going capabilities in a few short decades. This caused British shipbuilders to go into overdrive — producing far more heavy ships than had been produced before.

And what happened in the first world war? The shiny, brand-new Kriegsmarine’s battleships essentially cowered away in ports — most of its fighting actually being done by the remarkably efficient U-Boats. And the Royal Navy was left with oozes of battleships and other heavy cruisers designed for high-seas battleship warfare, when they should have prioritised anti-submarine capabilities, as well as a larger standing Army. The British Expeditionary Force, while outstandingly trained and equipped, was minuscule, and got wiped out in the first few months of the conflict and was quickly replaced with conscripts and reservists.

The Americans must not let these increased capabilities of the Chinese lead to a knee-jerk sunk cost into potentially obsolete marine equipment. — DGG

- The British Intelligence and Security Committee released a new report that revealed that China’s size, ambition and capability had enabled it to successfully penetrate every sector of the UK’s economy. This “serious failure” in its response to Chinese interference means the British government was too “slow” to develop policies that could protect key U.K. assets. The paper is available here.

Here are a few selected eye-brow-raising passages (with highlighted points of interest):“The fact that the Government does not want there to be any meaningful scrutiny of sensitive investment deals – and deliberately chose not to extend the ISC’s oversight remit to cover this at the outset of the new legislation – is of serious concern.”

“Chinese dominance of technology is driven and supported by the Chinese state. China uses regulation and state subsidies (***) to give its companies an advantage in the global marketplace, and uses its political weight to shape international standards to favour Chinese companies. China is aggressively acquiring technology and expertise through investment, and mergers and acquisitions, as well as by co-opting companies and Academia. Illicit acquisition of Intellectual Property also appears to be a major contributor to China’s rapid progress. The JIC Chair confirmed that “[China] is likely to want to access our science and technology base by legitimate and illegitimate means”.

“China uses some students to operate as non-traditional collectors of IP – particularly those involved in cutting-edge research and development ***. In some cases, these students obscure their military affiliations, including through the use of misleading historical names for their institutions or even the use of non-existent institutions.64 Once established in academic institutions in the UK, these students are in a position to identify and exfiltrate valuable IP and data.”

“The nature and scale of the Chinese Intelligence Services (ChIS) are – like many aspects of China’s government – hard to grasp for the outsider, due to the size of the bureaucracy, the blurring of lines of accountability between party and state officials, a partially decentralised system, and a lack of verifiable information.

“However, with severe pollution and environmental damage posing a possible threat to popular support for the Chinese Communist Party (CCP), it has also invested heavily in renewables (with the result that it now has a

quarter of the world’s solar panels, and a third of the world’s wind turbines).”“China now spends almost 20% more on domestic security than on external defence, and this appears to have led to an improvement in capability.”

“In terms of espionage, China’s human intelligence collection is prolific, using a vast network of individuals embedded in local society to access individuals of interest – often identified through social media. It is also clear from the evidence we have seen that China routinely targets current and former UK civil servants ***. While there is good awareness of the danger posed, it is vital that vigilance is maintained.”

“China’s behaviour since the start of the pandemic has also been under the microscope. Questions have been raised as to whether it may have accidentally or deliberately released the virus, and whether it may have exacerbated or exploited the situation for its own gain or to others’ detriment.”

Blind Spot Takeaway: Of note are the apparent tensions between the committee and the standing UK authorities. The whole thing reads, in many respects, like a Cassandra narrative. “Why didn’t you listen to us?” But there’s also a subtle insinuation that maybe those in power can’t be trusted, you know, because they’ve already been corrupted?

The sad lesson here, really, is that to meet the China challenge, the West is going to have to become more like China in the short term to eliminate its advantages. That means becoming more long-termist, while adopting many practices that aren’t in the DNA of capitalist democracies. This, however, explains the great subsidy push into high tech — which is a de facto to subsidy war with China. But it also explains the increased blurring on our own side of military and civil enterprise. The report’s call for unity among parties, and therefore a temporary aligned “one party” state of our own is also glaring.

As the report warns: “Even now, HMG is focusing on short-term or acute threats, and failing to think long term – unlike China – and China has historically been able to take advantage ofthis. The Government must adopt a longer-term planning cycle in regard to the future security of the UK if it is to face Chinese ambitions, which are not reset every political cycle. This will mean adopting policies that may well take years to stand up and require multi-year spending commitments – something that may well require Opposition support – but the danger posed by doing too little, too late, in this area is too significant to fall prey to party politics.”

The other thing to note are the paragraphs on Wuhan and Covid. While the report noted that “questions have been raised as to whether it may have accidentally or deliberately released the virus, and whether it may have exacerbated or exploited the situation for its own gain or to others’ detriment” it remained guarded and on the fence about the lab-leak hypothesis. Though there were a few intriguing sentences implying some members of the committee might think differently redacted.

Last, it’s absolutely fascinating to read about the frustrations being expressed about the normalisation of “work from home” in the intelligence sector and how this impedes performance.

“While it may have been reasonable for staff to work partially from home during the pandemic, it would obviously not be feasible for organisations that rely on secret material to carry out all their work over less secure systems. Yet even now, with the country having fully reopened, we continue to see the Intelligence Community working partially from home (some more than others).”

The report further notes “this has had – and continues to have – an impact on the Committee’s ability to scrutinise security and intelligence issues properly and in a timely fashion.”

Wow. — IK

Media matters:

- A House Judiciary Committee elaborated on a new report that described the FBI’s bungled effort to stop Russian disinformation online at the behest of a Ukrainian intelligence agency. The actions, which include the elimination of verified accounts on social media, instead ended up deleting authentic American accounts – including a verified Russian-language U.S. State Department account.

. - The increasingly notorious Russian prank duo struck again, this time tricking Henry Kisinger into admitting his belief that Ukraine had blown up the NordStream pipelines before the foreign policy expert clarified that “I do not mean this as a criticism.”

And these are just regular human imposters. Just wait until actual live deepfakes are let loose on some of these gullible elites. — IK

- American Congressman Matt Gaetz revealed a litany of security issues with Ring’s home security cameras. This included Ring employees observing women through bathroom-mounted cameras, or hackers using the camera’s two-way communication systems to physically intimidate families into paying a Bitcoin ransom.

. - In a de facto promo for Jack Dorsey’s latest Nostr platform, Max DeMarco reviewed the “broken” nature of today’s social media. The YouTuber asked the question: can we fix them?

DeMarco unintentionally highlighted the precise nature of our society’s addiction to social media — a naive hope that “this time it’ll be different”.

He introduced the problem by outlining current SM issues like censorship and the addictive nature of apps like YouTube, TikTok, and Instagram.

DeMarco then nostalgically recalled the early days of social media, when these companies were idealistic and focused on free, fair distribution of content. This “magical” time then became corrupted by time and money into the SM apps we love/hate today.

DeMarco’s solution? Another app. But fear not — this app will be run by idealistic entrepreneurs and be focused on free, fair distribution of content. And he’s now seeking funding for this revolutionary app. Oh wait.

The real solution? Turn off your phone. — DGG

Nothing Jaron Lanier hasn’t already said. — IK

- Elon Musk drew attention to the fact that Joe Biden’s FTC had pressured Ernst & Young to badmouth Twitter in their independent assessment of the social media company. Senior EY leaders feared that “if EY resigned as the independent assessor ‘the FTC would take exception to EY’s withdrawal and create other challenges for EY over time.”

. - Boris Johnson claimed he couldn’t hand over his WhatsApp messages because “he’s forgotten his passcode.”

. - A large section of this week’s British Intelligence and Security Committee report on China focused on the scale of CCP influence and interference in the UK media.

A couple of relevant bits:“The Chinese government looks to use the UK’s own media to its advantage. The Telegraph was reportedly paid £750,000 p.a. to carry the China Daily newspaper supplement (effectively a CCP mouthpiece), and it has been noted that since 2016 The Telegraph has carried twice the number of signed articles by the Chinese ambassador to the UK than the Daily Mail, The Guardian and the Financial Times put together.184 In April 2020, content from the China Daily disappeared from The Telegraph website: when Buzzfeed and The Guardian asked The Telegraph to comment on its removal, The Telegraph refused to do so. When we asked the JIC Chair whether he was concerned that the China Daily supplement was widely available in the UK, he told us that he was not convinced that it posed a significant threat:”

And:

“Chinese journalists operating in the UK have notably displayed behaviours not typically acceptable in the UK media. For example, in September 2018, a CGTN journalist was arrested at the Conservative Party conference after slapping a delegate in the course of an argument about Hong Kong (the journalist had disrupted an event being run by the UK- based NGO Hong Kong Watch and shouted, “You guys are trying to separate China”). In a public statement following the arrest (released on the Chinese embassy’s website), the television station said, “any attempt or action to divide China is futile and against the trend of history”, and “we urge the UK side to take concrete steps to protect our journalist’s legitimate rights and avoid such absurd incidents from happening again”. The Chinese embassy also raised the matter with the FCDO at a working level, and again later when the case came to court; the FCDO firmly refuted any suggestion that it could influence the investigation.The journalist was later convicted of assault.”

But given the report clarifies that among the five poisons that China views as key threats to national security is the Falun Gong movement, one does have to wonder about the Epoch Times and our own potential attempts at counter-influence. I’ve recounted on The Blind Spot before about how the Epoch Times’s own printed supplement found its way in very mysterious ways into doors of many Londoners over lockdown. In some cases, enveloped in other major publications such as … the Financial Times. — IK

Climate changes:

- Leon Simons, member of the Dutch Club of Rome, advanced a summary of the extreme marine heatwave in the Northern Atlantic last month. One of the surprising points was that decreased sulfur pollution in the northern hemisphere has a direct impact on these higher temperatures.

Is this going to open the door to popular discussions and advocacy for geoengineering the skies? It might do. There’s definitely been a step up in mainstream coverage of the ideas. — IK

- Europe’s recent heatwave was expected to halve the output of two key French nuclear power plants from July 13 to 16 as a result of regulations on using river water for reactor cooling.

Technological advances:

- An Artificial Intelligence model was trained to translate ancient Sumerian. Tests designed to estimate the quality of the translation showed the AI model scored surprisingly high scores in its cuneiform-to-English test and in the range of a high-quality translation by a linguistic expert.

. - India’s space agency said it was preparing for its first moon mission, as the South Asian power muscles onto the growing global space development industry.

. - A private Chinese rocket company successfully launched the world’s first methane-liquid oxygen rocket.

.

- Russian armoured vehicles continued to appear to use widely-mocked “cope-cages“, suggesting the idea has more practicality than was originally thought.

Russian “cope cages” first made an appearance as clumsy-looking and flimsy pieces of iron shoddily welded onto the top of tanks, which were routinely mocked on Western social media as evidently useless. But the continuing use of these cages amongs Russian (and Ukrainian) military equipment suggests they are anything but — and that the West seems intellectually (and erroneously) predisposed to dismiss cheap and disposable solutions to warfare that do the job.

Many modern anti-tank missiles like Western supplied American Javelins and British NLAWs are top-attack, meaning they pierce their target’s thinner top-side armour. Modern missiles often function by an explosive charge that shoots out a concentrated metal jet that penetrates armour. The cope cage concept is simple; it forces the detonation to occur too early and leads the metal jet to disperse and lose critical speed before being able to contact the vehicles’ armour. What invited the mockery was not the concept — or even the flimsy nature of many of these cages — but the knowledge that, most of the time, a well shot Javelin missile will easily crash through the cope cage and detonate on the armour just fine. And indeed — that is what seemed to be happening. But there’s more to the story.

As we highlighted two weeks ago, the Western military industrial complex seems too reliant on the overcomplication (and overpricing) of offensive and defensive equipment. Our military equipment may be the best in the world, in a peer-to-peer war, replaceability and cheapness wins over complication and quality. Or, “quantity has a quality all of its own,” to take a page from Stalin.

We believe the “cope cage” fiasco-that-wasn’t is a key example. Recent (and unverifiable) rumours that Javelins are piling high in warehouses because only expats or highly-trained NATO Ukrainian forces know how to operate them are a case-in-point. What’s more, examples of cope cages working abound. Here are some recently spotted on the Ukrainian side:

As you can see on the pictures above, these cope-cages succesfully entangle drones in their wire mesh before they detonate. This contrasts totally to Western military contractors methods — with a sole focus on expensive and sophisticated drone-defence equipment. The small size of drones does mean that any new anti-drone equipment has to be very precise and capable of dealing with swarms of cheap attack drones. Fair enough. And yet — a botched welding job and a cheap iron cage can do a good enough job.That is not to say these are foolproof methods. Pictures attesting to crumpled tanks under penetrated cope-cages abound online too. The critical issue with the West may be that our equipment is costed and sold with the implication of foolproofness — when it very much isn’t, simply because in war nothing is foolproof.

What cope-cage-gate has showed is that Western defence experts must start focusing on dumb, cheap, and sustainable approaches to war that work (just enough of the time) — alongside our increasingly expensive, tech-focused traditional Western mil-industrial complex. — DGG

Academic (dis)honesty:

- Harvard Business School Professor Francesca Gino had three of her behavioural science papers removed as fellow academics scrutinised her work. Gino’s speciality, which included behavioural science research into dishonesty, turns out to have also been academic fakery.

. - The Gino revelations reminded the internet about how Israeli-American behavioural science professor and author Dan Ariely, had faked data techniques to arrive at similar conclusions.

Covid collateral damage:

- A US House subcommittee found that scientists who dismissed the so-called “lab leak theory” and urged against conspiracy theories in a Nature Medicine article in 2020 were privately concerned about the “shitshow that would happen if China in particular” were deemed responsible for COVID escaping from their laboratories: “Given the shitshow that would happen if anyone serious accused the Chinese of even accidental release, my feeling is we should say that given there is no evidence of a specifically engineered virus, we cannot possibly distinguish between natural evolution and escape so we are content with ascribing it to natural process,” said one of the paper’s authors, Andrew Rambaut, a Professor of evolutionary biology from the University of Edinburgh, in a Slack message to fellow co-authors.

One Response