This is a bumper “retrospective” edition of the Blind Spot Wrap based on the fact Izzy has been on the road all of last week.

Econ, Business, Finance etc:

- The White House deleted a tweet related to social security increases after a community-led fact check by Twitter highlighted the increase was due to long-standing inflation adjustment measures.

- Hamza Lemssouguer, a former top credit trader at Credit Suisse, has seen the performance of his fund slump in the midst of market turmoil.

- Russian LNG exports rose in October by the largest amount since March, mostly destined to France, Japan and China – while pipeline flows to Europe plummeted.

- Staff at Wells Fargo’s mortgage team braced for firings after a 90 per cent decline in loan volumes.

- The Monetary Authority of Singapore announced a successful trial sale of Forex and government bond trades using DeFi protocols, executed by JP Morgan, DBS, and SBI Digital Assets.

- A good read about the miscarriage of justice that occurred with the sentencing of Libor traders.

- Glencore officials used private jets to deliver cash.

- It’s okay for the ECB to call for fiscal largesse without commensurate tax increases for the direct beneficiaries.

- Morgan Stanley to start lay offs.

- Airbnb stock fell over 10 per cent despite bumper earnings due to cautious guidance.

The cooling guidance echoes negative recent social media sentiment highlighting how much harder it is has become to make renting an AirBNB pay – DGG.

- The number of foreign-born people in England and Wales has increased by 2.5mn since 2011, reaching over 10 million in 2021.

Geeky Central Banking Matters:

- The ECB has “recalibrated” the way it conducts targeted lending operations to help restore price stability over the medium term. Says the recalibration of the TLTRO III terms and conditions will contribute to the normalisation of bank funding costs.

- The governor of the central bank of Brazil, Roberto Campost Neto told the Santander International Banking Conference he saw inflation coming when nobody else did, because it was obvious that supply-side issues and energy constraints would have a disproportional impact on the cost of production.

Here’s the quote (our emphasis):

“Our interpretation of the global inflation process was a bit different. When we started to see the huge coordination in terms of monetary and fiscal policy at the same time in an unprecedented way in terms of the money being put to work, we’re talking about 9 trillion on an 80 trillion dollar economy in a period of one year, we started to think that we need to watch to see what’s going to be the monetary implication of that and I think at that time the world was caught in an argument that we don’t have mobility and because you don’t have mobility you have disruption in supply, and if you have disruption in supply and the mobility is causing you to consume more goods and less services you’re going to go back into an equilibrium very soon.

We thought this was a bit different. What we saw happening was this huge amount of money being put to work with all the monetary stimulus was creating a dislocation in the demand so you had more money. People were at home and they were consuming more goods. But the dislocation in the demand for goods was much stronger than the effect of people consuming less services.

And the problem is when you dislocate the demand for goods and if you imagine a trend line in your head of goods and services, today, globally we’re still not back to the trend line. We had this huge shock in the consumption of goods and you know we are barely going lower if you look at the trend line for services we had a drop and now we’re approaching the trend line again. So what is the meaning of that? If you have a more permanent dislocation in the consumption for goods you also have a more permanent dislocation in the demand for energy because to produce goods takes much more energy than to produce services. So at that time we were beginning to see this will transform into an inflation that was more persistent because the dislocation of the demand for goods will take longer to go back to the trend line and also because we are having this new demand for energy.

And at the same time you’re having the new demand for energy you have the lowest capex in energy ever. Because the world was worried about the green transition we had less investment in fossil fuel and for the green transition the elements that are important for the green transition were going higher in price at a very fast pace and it was limiting the ability to to do the transition in a way that you can actually meet the demand for high energy. So when we put all that in the equation we thought the inflation will be more persistent and we need to act fast and that’s more or less one of the reasons.”

He also reminded everyone that Bolsonaro’s party won the majority of house seats, which means Lula will not have total control.

- Paul Tucker calls out the elephant in the room when it comes to quantitative tightening.

Paul Tucker is possibly one of the most under appreciated thinkers in central banking. In this piece for the Institute for Fiscal Studies, Tucker spells out beautifully what should have been bleeding obvious to central bankers all along. That until QE is unwound, you can’t effectively raise rates. Indeed, strange paradoxical effects are likely to be afoot for as long the balance sheet remains expanded.This all comes down to the fact that as interest rates increase, so do the interest payments on the expanded cash reserves sitting in the central banking thanks to QE. Since the UK government is ultimately on the line for any negative equity that manifests at the central bank thanks to unfunded/unsterilised money issuance, this has the effect of shifting a large fraction of UK government debt from fixed-rate borrowing to an open-ended floating rate. As Tucker argues, “the current set-up is not technically necessary to operate monetary policy effectively, and so the current predicament could – and arguably should – have been avoided. But as of now, there are no easy options or win–win reforms, with macroeconomic and microeconomic considerations pulling in different directions. The government and the Bank would need to balance several weighty, conflicting things before embarking upon any change.“

Of course, the BoE needn’t be obliged to pay interest on reserves. The history of how the Bank of England passes on its monetary policy and in what form, is quite interesting in that regard. As Tucker notes, the BoE never used to pay out interest on reserves. Nor did it set minimum reserve requirements of any sort. Unlike many other central banks, the BoE has instead depended on a system that allows banks to choose what non-zero balances they aim to hold each day at the Bank ever since the 1980s. This system however engendered hyperactivity in the Bank’s monetary operations and volatility in the overnight rate of interest in the money markets. As a result, the BoE undertook reforms in 2005-06 which introduced something called “voluntary reserves averaging”.Under the new regime, banks could still set their own target level of reserves, but the level would be averaged over the month between on monetary policy committee meeting and the next. This became known as the maintenance period. To ensure a healthy balance was maintained the BoE decided to offer to pay reserves generated in the period the Bank Rate. This is when the practice of remunerating reserves was sanctioned by the Treasury.

This contrasts to the Fed, which only started paying interest on reserves after the 2008 global financial crisis, in a bid to maintain a floor on rates in the open market. There seems, however, to have been little thought given to how this set up would impact public finances in a rising interest rate environment.

Tucker suggests one way to reduce the cost to the taxpayer is to introduce a system of tiered interest rates on banks’ reserves. Another way would be for the state to hedge its exposure to unexpected rises in Bank Rate by substituting two-year gilts for around two-thirds of banks’ reserves. Finally, the Bank could opt to drain QE reserves before attempting to raise rates at all. “In other words, there is an option of adjusting monetary policy primarily by unwinding QE rather than leading with increases in Bank Rate.” – IK

You can read the full piece here.

Spooky Matters:

- In an incredible coincidence, the co-founder of Balancer Labs was found drowned a day after publicly speculating he’d be framed by the ‘CIA and Mossad and pedo elite’ via a planted laptop.

- Leaked documents attest to the Department of Homeland Security’s influence operations with social media managers to police alleged misinformation and disinformation online.

- New Zealand’s security services have launched an initiative to identify potentially radicalised individuals online.

- MI5, mI6 and GCHQ are changing their nationality rules for new recruits.

- The Grayzone get cancelled from Web Summit, then discover First Lady Zelenska ordered the cancellation directly.

Geopolitical Pivots:

- Perhaps France is the true basket case of Europe?

- The BBC investigates the tragic events leading to the deaths of dozens of migrants and some police while attempting to cross the Spanish-Moroccan border in Spain’s north African city of Melilla.

It’s no secret that the brutality and underhanded tactics of both Spanish and Moroccan police often lead to tragic scenes.

But foreign observers should note the key role played by migrants in the exercise of political pressure. During this spring’s diplomatic confrontation between Spain and Morocco, Moroccan incentives to migrant crossings were effective in bringing Spain’s government to the deal table.

As long as Western media continue to frame this political debate in a simple tale of victimised migrants, the wider abuse of these desperate individuals by political actors on both sides will continue. – DGG

- Saudi Arabia and the United States are on high alert after the Saudi Kingdom warned their American partners that Tehran planned an attack on their territory to distract from local protests.

The art of invading to distract from social malaise is a well-known practice.

And Iran certainly seems keen to quench its current unease. Beyond Saudi Arabia, the United States has aired similar concerns about Iranian attacks on the Kurdistani region of Northern Iraq.

Iran has often accused its rivals of promoting the current unease rippling through its streets. But rumours of a military operation spread by Riyadh must be taken in the context of hardened US-Saudi relations, as a possible attempt to maintain American goodwill by tying them to their mutual geopolitical interests in the region. – DGG

Putting the Socialism into ESG:

- Greta Thunberg ups the ante; she now claims to seek the overthrow of the ‘whole capitalist system.’

Crypto and CBDCs:

- NFTs are so over.

- Russell Brand gives CBDCs the once over, again. And Jeffrey Sachs tells Russell all about US biolab activity and the role shock therapy played in destabilising Russia.

- Izzy tells the Santander International Banking Conference and all its respective central banking attendees that they should be listening to what Russell Brand has to say.

- Nigeria’s eNaira experiment has failed to gain traction with the public.

Space-ial Awareness

- NASA’s next mission set to explore a ‘Golden’ asteroid is estimated to be worth $10,000 quadrillion.

Covid Is Not Over (Yet)

- The Atlantic’s widely panned article to declare a ‘pandemic amnesty’ is rebutted in Michael Senger’s piece, calling for an inquiry into widespread abuse and failure of responsibility during the Covid-19 pandemic.

- The FT’s Tom Hale spends 10 days in a secret Chinese Covid detention centre.

- Did Ebola leak from a US biofacility?

Techno-geddon:

- Facebook parent Meta is preparing large-scale layoffs this week.

- Uber whistleblower tells Web Summit that the ride-hailing app’s business model is unsustainable.

- Stripe lays off 14 per cent of workers.

- Lyft to lay off about 700 employees.

- The fintech layoffs just keep on coming.

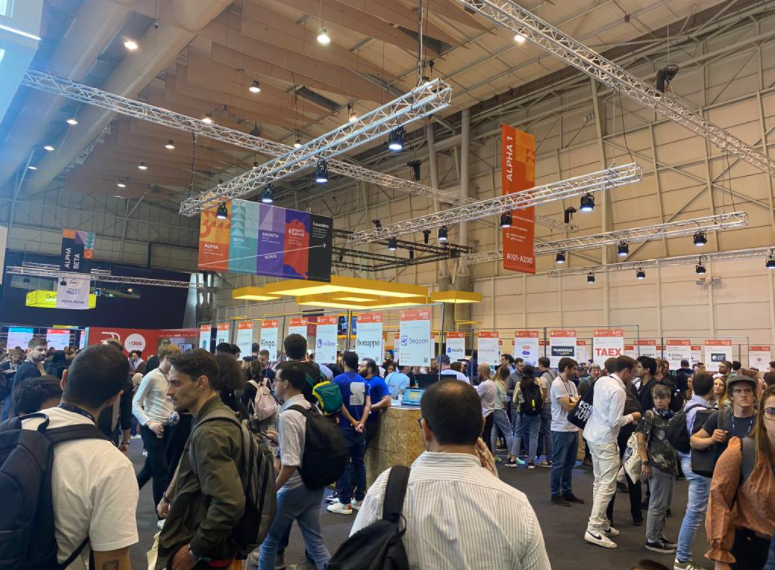

Strangely, the folks attending Web Summit last week didn’t seem too concerned. The whole conference was gripped by a mood of suspended economic reality and blissful ignorance. “Don’t ask about the economy and we won’t tell you about the effects.” “Flat rounds are the new up rounds!” “Every winter is followed by a summer!” And on, and on… I almost feel bad for them. They have no idea about what’s coming. – IK

Privatisation of the Memes of Production:

- How Elon is Gorbachev.

- And why Izzy’s Gosplan 2.0. thesis seems to be coming true.

- Izzy and Junseth are joined by Haya’s Frank Di Mauro in a bid to get to the bottom of what ails social media and journalism, and whether Elon can be trusted to put things back in the right direction.

- How social critic Lewis Mumford came up with a name to explain the way complex technological systems offer a share in their benefits in exchange for compliance. He called it “the magnificent bribe”.

- How the workforce is getting increasingly unproductive.

- Meanwhile, the US State Department is giving law enforcement and intelligence agencies unrestricted access to the personal data of more than 145 millions Americans.

- What happens when the subsidisation of tech salaries, funded by stock issuance and capital appreciation, has to stop?

Media matters:

- Naked Capitalism’s Yves Smith gets a tip that the Nikkei is not happy with the FT’s editorial line on Russian sanctions due to its impact on the Japanese economy and has intervened to ensure that editorial management soften their stance.

When Nikkei first bought the FT, there was a lot of concern about how the Japanese leadership would manage editorial independence. Many were concerned the group would be very interventionist. Throughout my entire time at the FT post the Nikkei takeover, however, the exact opposite seemed to be the case. Nikkei operated with an extremely light touch. But then, there was always speculation that this was just about buying currency and favour. Don’t intervene on the small things. Save it for the big things. This could finally be one of those big things. – IK

From the “Fake News” Zone:

- New Swedish Prime Minister announces refusal to abide by Agenda 2030.

- David Icke is banned from the Netherlands (and by extension to the whole of the EU) for unclear reasons.