JR = Julian Rimmer (Resident Boomer and former EM markets pro, turned writer.)

DGG = Dario Garcia Giner (Resident Zoomer and former corporate investigations pro turned meme stock-watcher and in-house drone expert.)

ChatGPT Provided TLDR:

- Julian and Dario’s Market Banter: Julian Rimmer and Dario Garcia Giner engage in morning market banter, sharing their experiences and thoughts on topics ranging from wine deliveries and parking struggles to discussions on Macy’s buyout talks and the geopolitical landscape in the Middle East.

- Global Economic Overview: Julian provides insights into the challenging 1Q for US retailers, Dario recounts the UK’s economic struggles.

- Dario’s Geopolitical Analysis: Dario delves into geopolitical updates, covering Houthi attacks in the Red Sea, Israel’s warnings to Lebanon, and the complexities surrounding Hezbollah’s position in Southern Lebanon.

- Generational Perspectives on Housing: Julian and Dario discuss generational perspectives on housing, expressing skepticism about real estate investments and the overvaluation of properties in major cities.

- Financial Insights by Julian : Julian discusses market trends, including the performance of hedge funds and potential risks in the Japanese bond market. Dario raises hedge funds’ concerns about short-selling rules.

- Dario’s Villain Pick – Rheinmetall: Dario selects Western defense producer Rheinmetall as his villain, criticizing the ineffectiveness of their tanks in Ukraine and highlighting the challenges faced by Ukrainian crews.

- Julian’s Hero Pick – Sean Dyche: Julian applauds Everton manager Sean Dyche for steering the team clear of relegation and his resilient approach, drawing a humorous parallel between Everton and life’s struggles.

- Football Banter and Closing: Julian shares his top wine pick for 2023, and the conversation ends with banter about the football world, giving a lighthearted touch to the market and geopolitical discussions.

Welcome to spot mkts live and matutinal greetings are also extended tomy co-host, Dario down there in the land of sun and sangria

so if at some point I have to disappear, I’ve seen a motorcyclist in a hi-vis jacket

yes, the wine is still there but expect more typos than usual even because I have to keep a craft out for scrotes trying to pilfer some

£10 and I’ll post it

So for some general miscellany

Macy’s department store is in talks for a £5.8bn buyout from existing investors, notably Arkhouse Managemetn and Brigade Capital

Coming out of a tumultous 2020, where they cut 125 and jobs across the US, the company is still making strong profits – $1.2bn

Even if growth forecasts are naturally low, due to the state of American commercial real estate + mall foot traffic plumetting, the offer from Arkhouse and BRigade is at a 32% premium

Despite Macy’s incerase in stock price recently, its still valued below pre pandemic levels

some redditors are skeptical

“They’ll sell the properties owned, take profits to put Macys in a worse financial position and then declare bankruptcy to shift financial burdens onto taxpayers. “

“Middle-income UK households are 20% poorer than in Germany and 9% worse off than in France.

The picture is even bleaker for the low-income group: 27% worse off than in both countries.

Compared to a wider group including Australia, Canada, Germany, France and the Netherlands, the UK is on average 16% poorer.”

“And the main reason for this gap is low labor productivity, Brooker states.

During the 1990s and early 2000s, the UK was catching up with more productive countries such as France, Germany and the US. This came to a halt in the mid-2000s and has been reversing ever since.

Britain’s productivity grew by 0.4% a year in the 12 years following the global financial crisis, only half the rate of the 25 richest countries in the Organization for Economic Cooperation and Development.”

(the window looks the same to me)

the Scottish foreign ministry

Dave Cameron wrote to the Scottish First Minister Humza Yousaf after the latter met with President Erdogan without the FM’s approval

Fortunately, no crewmembers were injured – the Nor tanker was set for a stop in Israel next month

This is the fifth consecutive attack on international shipping since October, and came after the Houthis declared Saturday they would stop all ships heading to Israel if more food and medicine isn’t allowed into gaza

“Last week, Maersk said it would add an emergency risk surcharge of $50 per 20-foot container and $100 per 40-foot container for vessels discharging in Israel. The carrier said the added cost would cover insurance premiums that have risen more than 200% since October. Zim said Tuesday that it would also increase its fares “given to the continuous threats to the safe transit and global trade in the Arabian and Red Seas.”

The US fearful of additional escalation has warned Israel to mind its own business – well take it from here.

Instead, what these attacks are leading to is a growing NATO multinational shipping force

That will increasingly patrol the Red Sea straits

But that’s not the only thorn in Israel’s side

Israeli officials have just warned Lebanon that unless Hezbollah attacks on its north stopped, or the militant group retreated from positions closest to ISrael on Leb’s southern border, Israeli forces will be ‘forced’ to respond

“Hanegbi said Israel is demanding that Hezbollah remove its Radwan fighting force and retreat behind the United Nations-mandated cease-fire line demarcated by Lebanon’s Litani River, some 18 miles north of Lebanon’s border with Israel. He added that Israel aims to avoid a two-front war, implying that the timeline for resolution would be Israel’s winding down of hostilities with Hamas.”

Thats the head of Israel’s national security council

Though hezbollah hasn’t responded to the demands, the WSJ claimed the militia has internally rejected the ultimatum

Hezbollah is powerful enough that it has some degree of autonomy

They’re essentially masters of Lebanon, which is not inconsequential. It’s not an appendage like the Houthis or Hamas

It’s the worst fighting since 2006 but much has changed since then

Hezbollah was then a desperate and spent political force, stripped of legitimacy due to the Syrian pullback of 2005 in the aftermath of their assassination of Lebanese PM Hariri

Now Hezbollah is on top. Thye control the government – have widespread backing even amongst Christians

“We should be friends with those around us”, I was told matter-of-fact by a Christian Lebanese manufacturer who regularly sold goods to Hezbollah. I approved. The world is made up of real people not religious stripes

A less desperate, more poweful Hezbollah means they don’t need to prove themselves to supporters by starting a major conflict

And for Israel, fighting Hezbollah is a different species of fish – considering their difficulties fighting the rag-tag Hamas

I would therefore suspect (and HOPE!) the above gets fixed by some negotiator wrangling

Otherwise beautfiful southern lebanon will get an even greater battering.

Considering that Hezbollah advanced Lebanese gas claims on disputed fields by launching drones towards the gas extraction platforms

Currently, Israel only receives meager ‘compensation’ by any driller int he entire block as part of the landmark compromise reached last year between Lebanon and Israel

but maybe I’m getting ahead of myself

Julian – now that we’re out of miscellanies, how are markets?

dans les marchés…

despite all the argy-bargy in the ME, no one seems to have told the oil mkt about it…

oil making new lows, now -25% since Sept

S&P, DOW, NDX all up 5-6% in the last month

VIX 4yr low

you’ve got to hand it to the Fed, they have done an amazing job of lowering inflation and not destroying the equity mkt as a consequence

yesterday the 21-yr UST auction passed off successfully, UST10YR becalmed @ 4.2%.

the cpi data were benign and now mkts, Fedwatching as they do, are waiting on FOMC but Jerome Powell is going to stay and sound hawkish because he’d be a fool to say otherwise.

Speaking of the US – new research points to a woeful sitch for young things

“According to Creditnews Research’s latest report, Millennial and Gen Z homebuyers accounted for 45% of all home purchases in 2022, but that figure has since fallen to around 32% as of August 2023.”

When did you buy your first house julian?

I’m skepticla of a mortgage – especially an unaffordable one – as the road to sustainable wealth

And mortgages can be unaffordable in more ways than one

There’s a marvelous career fredom in renting. Yesterday, I lived in London, now I live in marbella, tomorrow I can move to Paris. The friends I was jealous of for purchasing a house all these years back are still working the same dead end corporate jobs because they can’t risk joblessness for a better life

I say new homeowners aint free

because in today’s market the most improtant for young people is flexibility – corporate growth is not what it used to be, you stay in a corporation if you don’t want a future

The death of housing supply, high interest rates, and post-covid real estate valuations means I still suspect most ‘cheap’ urban housing in major cities are dramatically overvalued

Especially considering the terrible safety record there

Who knows whether real estate valuations will crater and begin a wealth transfer as zoomers scoop up overvalued property from impulsive boomer buyers

DEspite sky high valuations for properties, the rate of sellers slahsing home prices is at a record

During the four weeks ending Oct. 29, a whopping 6.9% of all homes on the market underwent price cuts.

“High rates have forced some sellers to lower their asking price to make up for high interest rates on monthly payments,” Anderson added.

A lot of my Spanish friends are getting into buying RVs

Live with their rents, spend a few weeks off and weekends outirng the countryside and beach

Always thought RV touring was fun – especially with an S/O – bar the terrible showers and that everyone can hear your number 2’s sloshing about

Bear in mind, however, the current slump may be because everyone who wanted to own an RV would have purchased one in the post-pandemic years, which may explain the almost 50% loss in market for RV sales in 2023.

here’s another generational perspective…

last night the Argies devalued the peso by 54%

‘There’s no more money’ said the eco min, Caputo

by way of introuduction to the measure

the germans did colonise argentina after all huuh

(Reminds me of a labour minister after Gordon Brown’s govt was voted out of office in 2010)

he left a note for the incoming govt in his drawer saying ‘there’s no money left’

Caputo identified 10 steps to send about 20,000 volts through the Argentinian economy, not just the currency but taking the metaphorical chainsaw to govt spending – almost 3% of gdp.

The IMF welcomed the steps taken thus far

(they’re saying that now)

but whether the crawling peg regime, 2% monthly depreciation, will work is another matter.

Milei promised Argentinians ‘months of pain’ – and that’s one promise on which he may deliver.

will his plan work? the jury is out but the law of averages tells you Argentinian leaders fail invariably

how about this for a feelgood story?

a bit of instant karma for one of the Turkish AKP’s especially backward MP’s in parliament yesterday who one minute threatened that Israel would suffer the wrath of Allah

(Who he? He who?)

before suffering a cardiac arrest and keeling over.

Not saying it was used – just reminding people it has existed since the 70s

used by the CIA

Lotsa people from those hearings soon after died or went awol, btw (lolsers)

It was the last time the CIA was checked by elected members – leading to the Foreign Intelligence Surveillance Act of 1978.

Effectively checked, at least

and it’s the reason we know about mkultra!

sidetracked

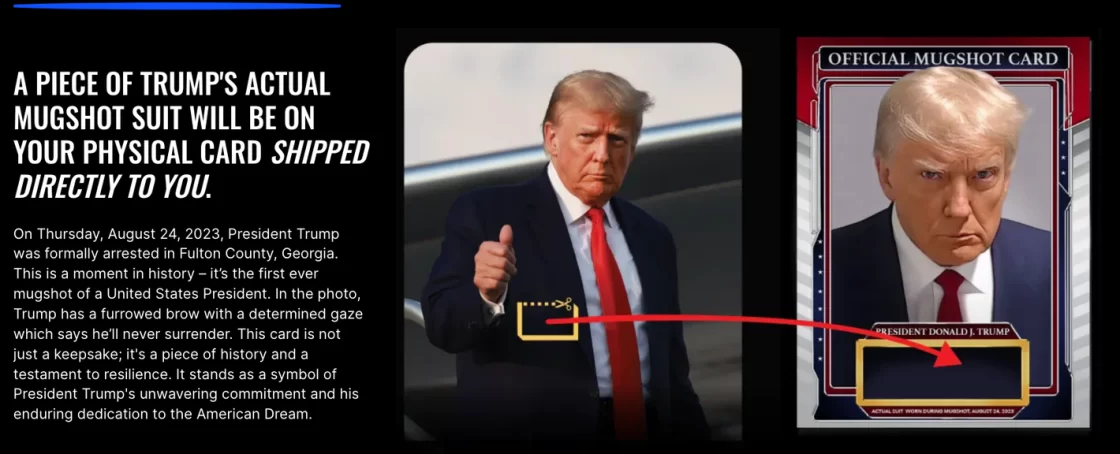

Donald Tramp, clearly running out of money and desperate to bleed his MAGA disciples of cash to pay his legal bills, is selling off bits of the suit he wore when he was booked and his mugshot was taken earlier this year

picking himself apart like hes some berlin wall

![Mario Eating Mushroom [GameBanana] [Sprays]](https://images.gamebanana.com/img/ico/sprays/530-90_mario_mushroom_preview.jpg)

(i think it was the good samaritan anyway. I have forrgotten a lot of my catholic indoctrination when i was young and exploitable

difficult year for hedge funds in America

where the average return was 4.35% at the end of Nov, although it might have crept up to 7% given the rally in Dec

Multimanager pod funds are doing better and are averaging 8.1% over 5 yrs, 2% above the regular long/short industry.

Citadel managed 15% and are returning about $25bn to investors, still leaving their multimanager platform in control of about $58bn of assets

“The reports are anonymized, but the funds argue the agency ignored how the rules interact and that they harm investors.

“Despite our best efforts, the SEC decided to ignore the interconnected nature of these two rulemakings and failed to apply a consistent approach or principle to regulating these related markets. The resulting rules are arbitrary and capricious,” said MFA President Bryan Corbett in a statement, arguing that the SEC “needs to go back to the drawing board.””

regarding short-selling rules

I saw somewhere yesterday a estimate that there is $500bn total in value yen/JGB carry trades

which is going to be extremely volatile in unwinding if Ueda doesn’t operate with the touch of a vascular surgeon.

While UST looks bulletproof at 4.2% with a soft landing consensus, the repatriation of domestic bond flows funded by selling UST (at a time of near record issuance) is a serious risk that, one can say with certainty, will rock UST mkts at some point in 1Q24

in this parish we have discussed US equity concentration at length recently

US concentration may dilute in 1Q2024 as a chart from GS I saw yesterday showed the first 2 mths of each year tends to favour small caps

so perhaps switching out of some SPX into RTY into YE23 makes sense

China, the mkt where money goes to die at present

vows to make industrial policy their top economic priority next year, a message likely to disappoint investors seeking big stimulus to boost growth.

The ruling Communist Party’s annual economic work conference stressed the use of “technological innovation to lead the construction of a modern industrial system,” and called for steps to “vigorously” develop the digital economy and artificial intelligence technologies (à consumer > resources)

This was a big opportunity for Xi to jumpstart an asset price recovery at his ‘ruling Communist Party’s annual economic work conference’ ( an invitation to that sends my heart spinning into a vortex of despair). Nor was there much discussion of the housing mkt and plans to revitalise it.

that sounds like the dullest thing to which you could be invited

anyway, Xi felt the same and left on the penultimate evening to visit Vietnam to stir up some apathy there.

He and the Vietnamese leader proposed a ‘community of shared future’ and we’ll drink to that if you persuade me it’s not tautologous.

Apparently they are buying a gob smacking about of Iranian oil

“China bought an average of roughly 1 million barrels per day of Iranian crude in October alone, according to UANI. The figure was slightly lower than the 1.2 million bpd and 1.7 million bpd that China purchased in September and August, respectively.”

In fact, most of the rise in Iranian exports this year was attributed to Chinese imports

spanish wine, now you’re excited, Adrio?

Colour of onion skin, 60% garnacho and 30% tempranillo, aged in oak for 4yrs (4yrs in oak for a rosé? Whatever will they think of next?)

and then a further 6yrs in barrel before release (6yrs for a rosé!)

but the result is a wine of amazing complexity and depth yet despite ten years of ageing, genuine freshness with a mouthful of grapefruit, satsuma, a bit of ginger and strawberry and…

…something I lack

… lots of tertiary sophistication

I have three bottles in bond but unfortunately my finances are in such disarray I can’t actually afford to take them out of storage so that’s why I don’t have a photo of it, refulgent on my desk

@richardh – bievenue

and so there they shall remain, the rosés, sleeping peacefully in the darkness of a bonded warehouse until my boat comes in.

Are western defence producers, which I hate

I particularly hate tank producers

And of these, I hate Rheinmetall in particular

Remember the hubbub about how the Challenger 2 and Leopards were supposed to be a game change rin Ukraine?

Never mind their huge profile, making them easy to spot, insane technical complexity, hard to maintain and train for, and insane weight, making them sink into ze mud

Unsurprisingly, Die Welt has recently reported they’ve essentially vanished from the frontline especially during the tricky fall/winter season where Ukrainian ‘chernozem’ soil becomes a tricky and almost impassable obstacle for Rheinmetall’s behemoths

But whats the point of survivability if the tanks are too complex to service and repair

You have lots of trained crews standing around as their Rheinmetall tanks are shipped WAY back to specialised units in Poland

Whereas most reapirs for Russian made tanks can actually be done just behind the frontlines

As for the much vaunted protectoin of these tanks – Ukrainian crews clearly felt it wasn’t enogh

As thye are sticking ERA panels and cope cages all over dem

For teasing us and failing to deliver (and forgetting the lessons of WW2’s eastern front) Rheinmetall is my villain today

Rather than Arsenal, who likes starting first and finishing last

He is a plain-spoken man who does not blame referees or his players for defeats nor does he crow unpleasantly when he wins

and since I left Liverpool behind me a long time ago, Everton is my umbilical cord to home and the emotional contact I have so it assumes a disproportionate importance in my life. Cheers Sean.

nunc tempus taciendi