The man with the shadow bullion bank

Theories about why Tether is piling into gold abound. But there’s no mystery. Basel III has constrained bullion banks, leaving ample opportunities for non-banks, especially as arbitrages open up.

The Blind Spot’s Xmas dinner debate

Join us to chat stablecoins, statecraft, and the future of money with finance author Felix Martin, stablecoin entrepreneur Tony McLaughlin, and fintech expert David Birch.

The Weekly Peg: Making seigniorage great again

Academics warn stablecoins will shift seigniorage from governments to private firms, plus banks get the go-ahead to hold crypto to fund gas fees for token operations.

The coming Substack reckoning

Why seigniorage, potentially stablecoin-derived, offers the most credible path to financing neutral public-interest journalism in the algorithmic age.

The Weekly Peg: An academical deluge

Eichengreen, Cecchetti, Garratt, Portes, Andolfatto, Uhlig, Wu all talk stablecoins.

The Weekly Peg: If the mountain won’t come to JPM, let JPM come to the mountain

As tokenized deposits rain on the stablecoin parade, the fintech life cycle nears completion. Fragmentation is becoming unsustainable. Plus, yen stablecoins come to the rescue of Takaichi.

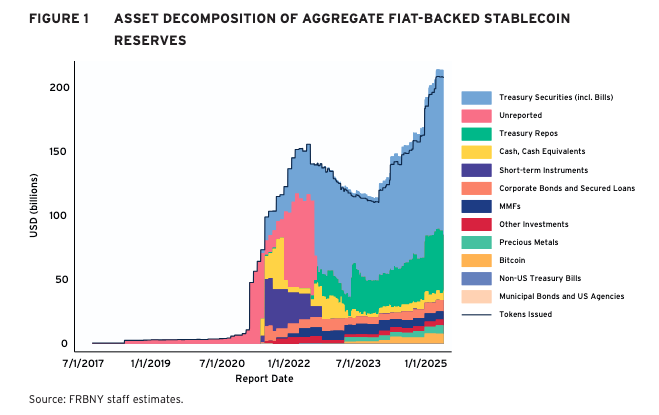

Chart of the day: What are stablecoins really made of?

Flagging one of the most interesting charts from CEPR’s latest Frontiers of Digital Finance report.

Stablecoin meet-up in London?

Dear Subscribers. Those of you who were around in the early days of crypto will remember how dynamic the London scene was in terms of crypto-themed debates, panels, and meet-ups. These weren’t the mega Token 2049 conferences we are familiar with now. They were small. Intimate. Dynamic. What they lacked in size, they made up […]

The most powerful US financial tool you’ve never heard of

Its opaque past, its contested present, and its high-stakes role in Argentina’s future. Welcome to the story of the Exchange Stabilization Fund.

The BoE’s mic drop moment

Who cares about stablecoin holding limits when you’ve got access to official liquidity support and exemptions?